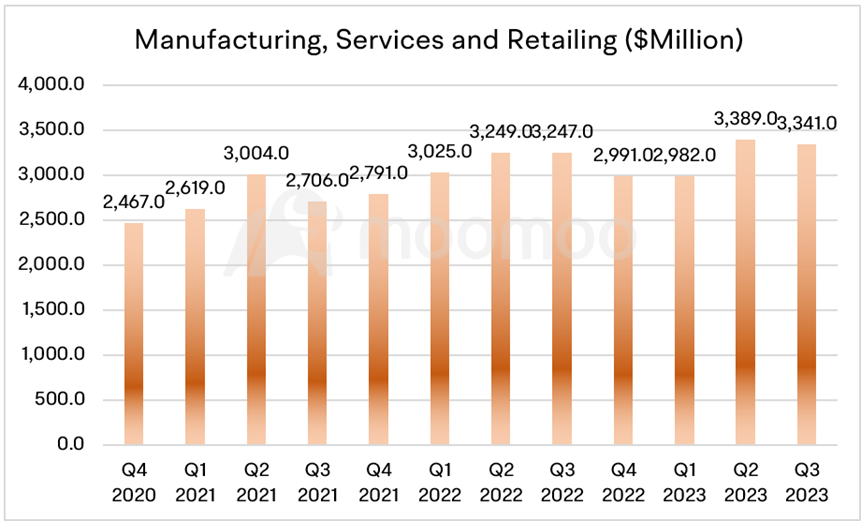

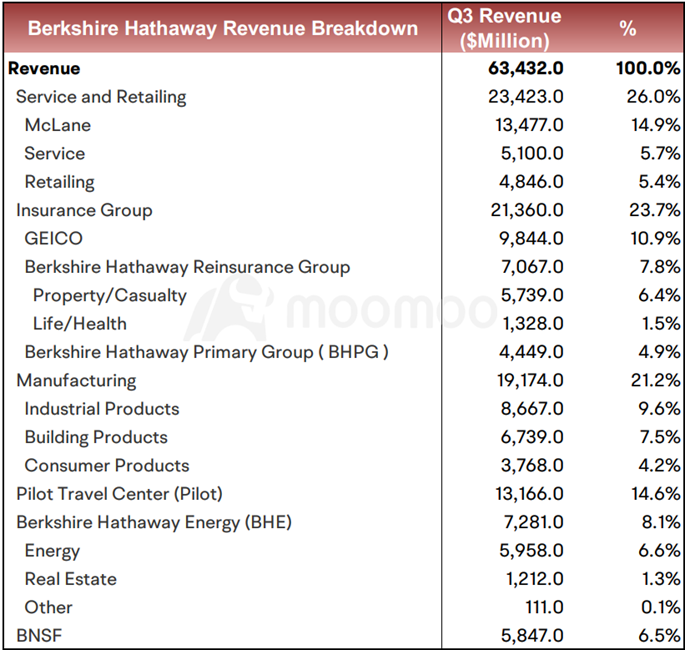

2) Manufacturing and retail segment: The sector includes many types of businesses, the largest of which is the supply chain management company McLane, that Warren Buffett acquired. McLean’s major clients include Walmart, 7-11, Yum Brands, etc. The company has more than 80 distribution centers across the United States and one of the largest transportation fleets in the United States. Buffett's acquisition of McLean was mainly based on the scalability, synergy and stability of its business.

Jalapenoterry65 : What a wallet.

Kosmic Ki : Thank you

纽约炒家 : Close your eyes

Derek Kiser : Well we are steel looking to Expand for chick A DEE'S, Super Proud of ALL, We have EVOLVED TOO![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)