Beyond Property Developers – TWL Holdings Bhd Poised to Benefit from Budget 2025

The Budget 2025, presented in Parliament on 18 October 2024, underscores the government's commitment to fiscal consolidation, focusing on reducing overall expenditure to address the national deficit.

While the spotlight has primarily been on property development companies, it's essential to delve into how these measures might specifically benefit key players like TWL Holdings Bhd, which operates across diverse segments of the property market.

One notable initiative from the budget is the newly introduced tax relief on housing loan interest, specifically targeting first-time homebuyers. Under this policy, individuals purchasing their first home are eligible for tax relief on housing loan interest for properties priced between RM500,000 and RM750,000.

This initiative directly aligns with TWL Holdings Bhd's strategic focus on developing affordable residential properties, especially for first-time homebuyers. By easing the financial burden on buyers, the measure is expected to increase demand for TWL's projects, further solidifying its market position.

Additionally, the policy aims to encourage the younger generation to prioritize homeownership over renting. This shift not only benefits individuals but also contributes to the broader macroeconomic goal of stimulating the property market. For TWL, this represents a timely opportunity to leverage its portfolio to cater to the growing demand, ensuring sustainable growth in a challenging economic landscape.

As TWL Holdings Bhd continues to innovate and expand, the measures outlined in Budget 2025 could serve as a catalyst for the company to achieve its long-term vision while contributing to Malaysia's property market resurgence.

TWL Holdings Bhd (KLSE: 7079), Potential and past performance of this beneficiary

TWL Holdings Bhd, a prominent player in Malaysia’s property development sector, is uniquely positioned to benefit from the first-home tax relief introduced in Budget 2025. This policy, aimed at easing the financial burden of homeownership for first-time buyers, perfectly aligns with TWL’s strategic focus on affordable housing projects.

Past Performance

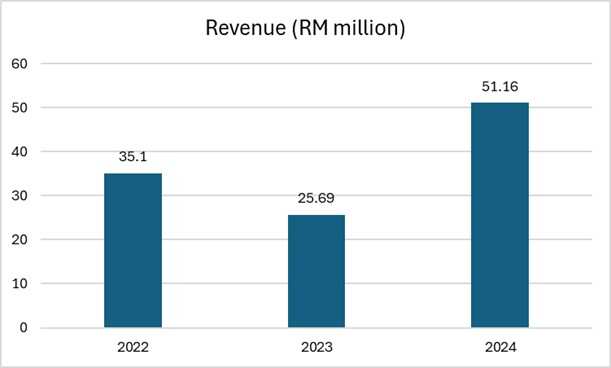

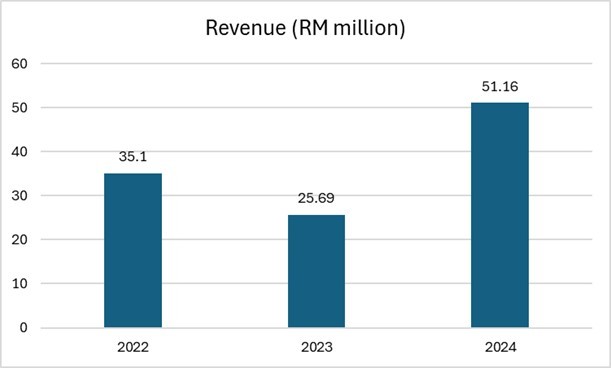

TWL Holdings has demonstrated resilience in the face of economic uncertainties. Key highlights of its financial performance include:

TWL Holdings has demonstrated resilience in the face of economic uncertainties. Key highlights of its financial performance include:

Despite setbacks caused by the COVID-19 pandemic, TWL’s management showcased adaptability, ensuring the company remained on a solid recovery path. These efforts have laid a strong foundation for future growth.

Future Potential

This initiative is likely to encourage the younger generation and middle-income earners to prioritize homeownership, boosting demand for TWL’s projects. Additionally, the company’s focus on affordable housing aligns with broader macroeconomic goals, making it a key participant in the government’s agenda to promote homeownership.

Apart from that, one of TWL's key strengths lies in its own concrete-mixed batching plant to produce and supply innovative, highly technical and customize concrete mix and other concrete related products. This strategic integration allows the company to control costs, ensure supply chain efficiency, and maintain high-quality standards across its projects.

This initiative is likely to encourage the younger generation and middle-income earners to prioritize homeownership, boosting demand for TWL’s projects. Additionally, the company’s focus on affordable housing aligns with broader macroeconomic goals, making it a key participant in the government’s agenda to promote homeownership.

Apart from that, one of TWL's key strengths lies in its own concrete-mixed batching plant to produce and supply innovative, highly technical and customize concrete mix and other concrete related products. This strategic integration allows the company to control costs, ensure supply chain efficiency, and maintain high-quality standards across its projects.

By leveraging in-house resources, TWL can significantly reduce reliance on external suppliers, enabling the company to achieve competitive pricing while preserving healthy profit margins. This capability is particularly advantageous in a cost-sensitive segment like affordable housing, where margin management is critical to profitability.

The synergy between its development projects and supply chain operations positions TWL Holdings to not only meet the growing demand but also deliver robust financial results. With strong demand drivers and operational efficiency, the company is well-equipped to capitalize on the opportunities presented by Budget 2025.

Conclusion

TWL Holdings Bhd stands out as both a beneficiary of the favourable measures in Budget 2025 and a company with a proven track record of navigating challenging times. Its focus on delivering affordable housing, coupled with strong past performance, positions it as an attractive opportunity for investors looking to capitalize on the momentum in Malaysia’s property market.

TWL Holdings Bhd stands out as both a beneficiary of the favourable measures in Budget 2025 and a company with a proven track record of navigating challenging times. Its focus on delivering affordable housing, coupled with strong past performance, positions it as an attractive opportunity for investors looking to capitalize on the momentum in Malaysia’s property market.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment