BHP's half year profits miss expectations but it's the third firm in a week citing Chinese construction is turning around

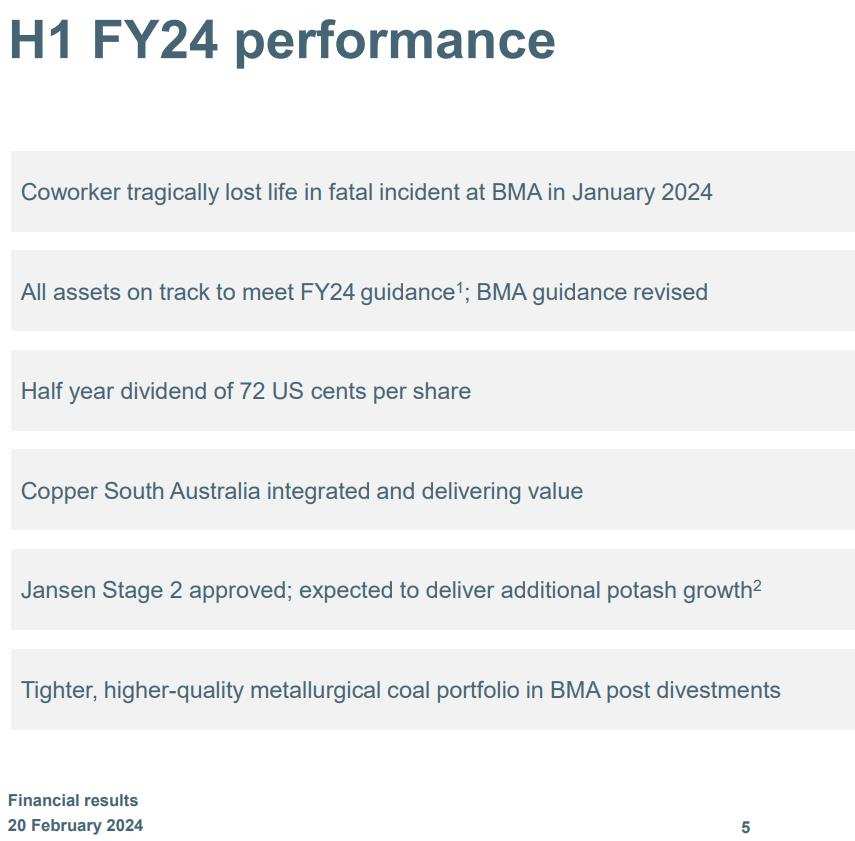

1- Half year profits miss expectations but it's the third firm in a week citing Chinese construction is turning around.

2-BHP sees momentum generated by construction awards boosting full year revenue for FY24 by 10%

3- It follows China's Mysteel saying sales are rising, while Minmetals Futures sees activity rising.

$BHP's numbers for the half year:

- Underlying profit-0.4% y/y to $6.57 billion, vs estimate $6.73 billion (Bloomberg Consensus). But in line with BHP's estimates amid "strong revenue generation" and cost control

- Interim dividend72c vs. 90.0c y/y, vs estimate 72c

- Underlying Ebitda+4.9% y/y to $13.88 billion, vs estimate $14.64 billion

-Net income-86% y/y to $927 million, vs estimate $6.61 billion

- Capital & exploration expenditure +57% y/y to $4.74 billion

-Revenue from continuing operations +5.9% y/y ($1.5 billion) to $27.23 billion (as a result of higher iron ore and copper prices

-Net debt $12.65 billion, +83% y/y

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Non Fungible Tak : As long as they can maintain the dividend, I’m happy. It’s 72c USD so converted to roughly 1.10 AUD plus last time they gave 1.25 AUD for their final dividend so the dividend rate for my average price 47 AUD per share equals to approximately 5 percent. Still better than putting into saving account?