Big Five Banks' Earnings Unveiled. Which Bank Stock Should be the Top Pick?

Canada's most prominent banks have just closed the books on their second-quarter earnings. Amidst concerns about high borrowing costs and a slowdown in economic growth, the Big Five— $Royal Bank of Canada(RY.CA$, $The Toronto-Dominion Bank(TD.CA$, $Bank of Nova Scotia(BNS.CA$, $Bank of Montreal(BMO.CA$, and $Canadian Imperial Bank of Commerce(CM.CA$ —have shown remarkable resilience.

The past year has been a rollercoaster for these financial giants, as they've bolstered their defenses by padding their loan loss reserves, known as provisions for credit losses, and grappling with increased expenses and regulatory capital requirements. Despite these challenges, the banks have demonstrated their financial acumen, with all but Bank of Montreal posting earnings that outpaced analyst expectations.

Bank Stocks Poised to Benefit from Rate Cut

With Canada's latest inflation data coming in softer than anticipated, the spotlight turns to the Bank of Canada with renewed hopes for a rate cut this June. Investors keenly awaited such a move, believing the BoC might lead the charge even before the U.S. Federal Reserve, especially considering the high debt levels of Canadian households and the country's tepid economic progress.

"What the rate cuts will mean for an economic outlook is much more positive,” Jefferies LLC analyst John Aiken said. "Given the Canadian banks are a beta play on the Canadian economy, anything that helps the Canadian economy will be beneficial to their bottom line.”

Aiken points out that a rate cut could relieve banks by reducing their borrowing costs. Even though loan rates may adjust downwards in response, they remain higher than they were two years ago, ensuring that banks still benefit from the rate differential.

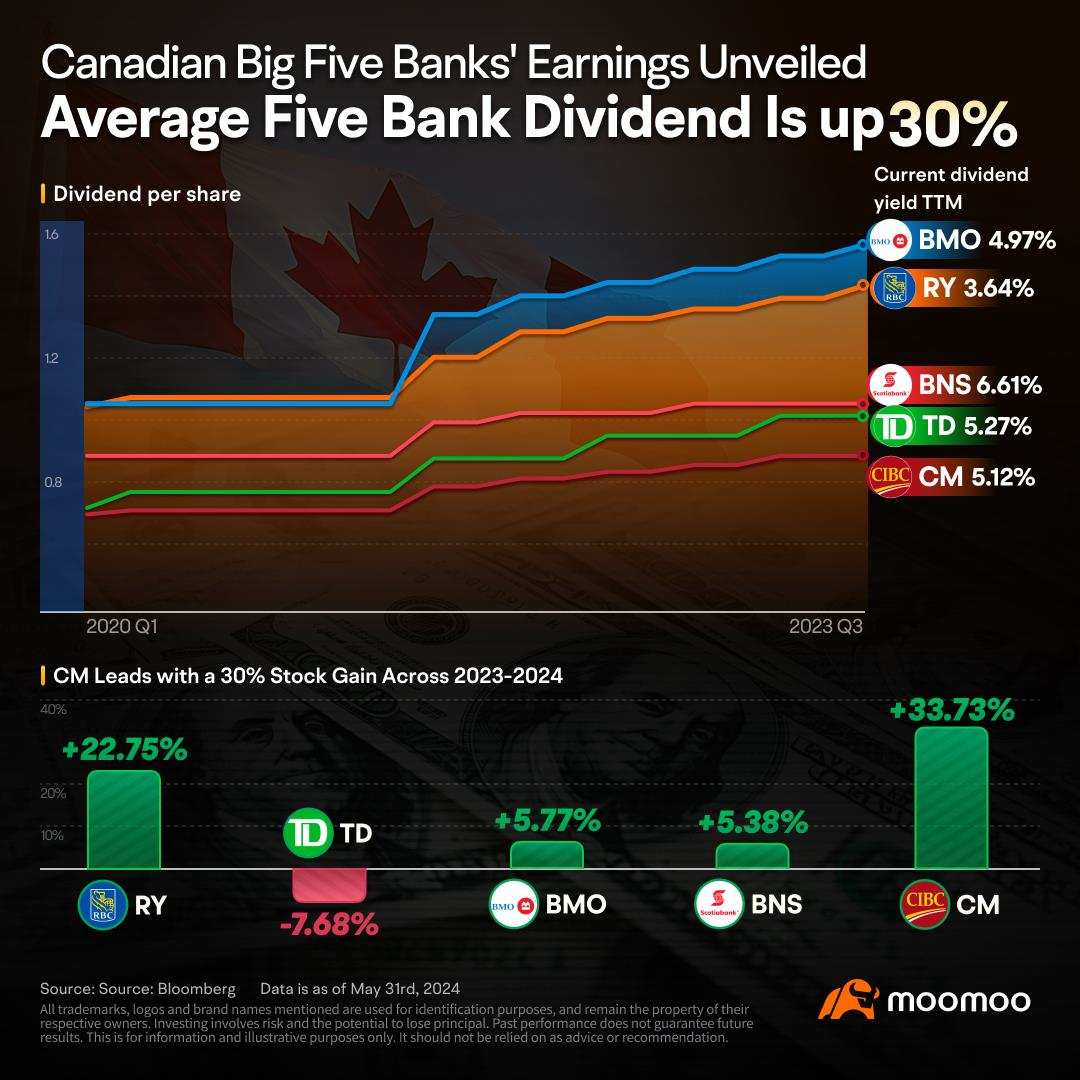

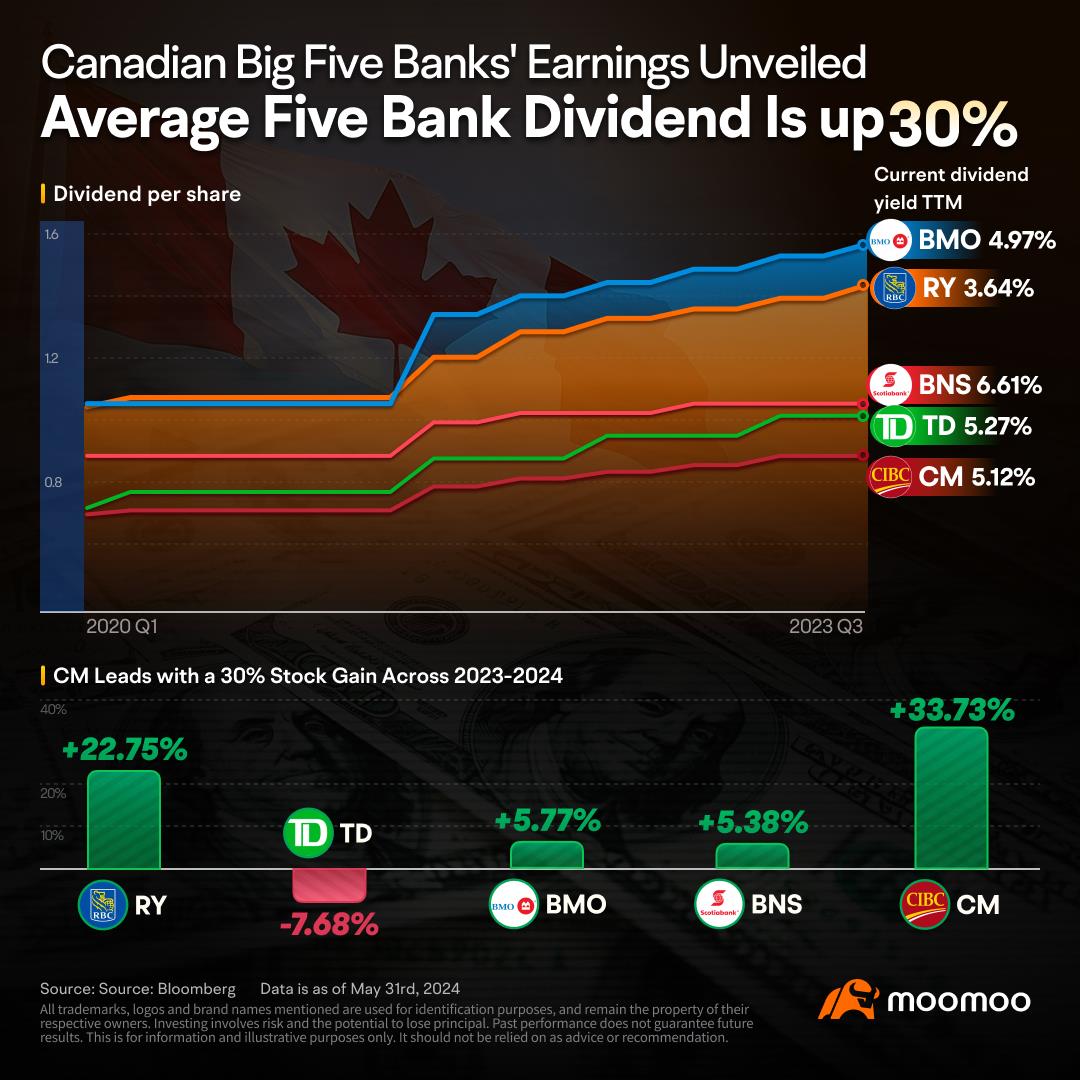

Moreover, with the Big Five flaunting an average dividend yield of 5%, a rate cut by the BoC that nudges the risk-free yield below this level could make bank stocks even more tantalizing for yield-seeking investors. This could provide a solid floor for bank stock prices. It's worth noting that since 2020, dividend growth among these banks has soared, with an average increase of 30%. Royal Bank and Bank of Montreal have accounced to raise their dividends by 4 cents per share, hinting at a robust trend in dividend growth that will likely continue.

Analysts' Take on the Banks

Royal Bank of Canada has seen its dividends and stock prices grow considerably, with a more than 20% increase in share value across 2023 and 2024. The bank's successful acquisition of HSBC Canada has further solidified its position, leaving it with robust capital reserves even after the $13.5 billion deal. It was a "strong quarter" for Royal Bank, Keefe, Bruyette & Woods analyst Mike Rizvanovic wrote in a note to clients, pointing to "an impressive top-line performance, manageable credit costs and a solid capital position following the close of the HSBC Canada acquisition."

CIBC emerges as a compelling choice for bank investors, boasting a 30% increase in stock price since the beginning of 2023 and a 5.12% dividend yield. Its second-quarter earnings have surpassed expectations, and the lender has seen positive trends, especially in its Canadian banking division. "In our view, this is a very constructive quarter as the bank continues to deliver on its guidance," Scotia Capital analyst Meny Grauman wrote in a note to clients.

Despite experiencing an 8% drop in its stock price since the start of 2023, Toronto-Dominion Bank has also outperformed earnings expectations for Q2. Analysts from Desjardins stress the need for patience with TD, noting pre-provision earnings that surpassed their forecasts. The bank's performance has been strong but remains under scrutiny due to U.S. regulatory concerns. Desjardins maintains a buy rating, though slightly reduced target price, while National Bank has taken a more cautious stance, downgrading TD and lowering its target price amid concerns that challenges may lie ahead.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment