In plain language, an example explanation of the biggest advantage of VCP👇

This is a recent tweet from Mark Minervini on Twitter👇

As the quarterly earnings report comes the day after the contraction, we have no way of knowing whether Mark traded this stock, but we can find some clues as to why Mark is interested in this stock based on $Blueprint Medicines (BPMC.US)$the charts.

First, look at IBD's chart, the recent two significant downturn consolidations have created a bullish deviation on the RS line👇

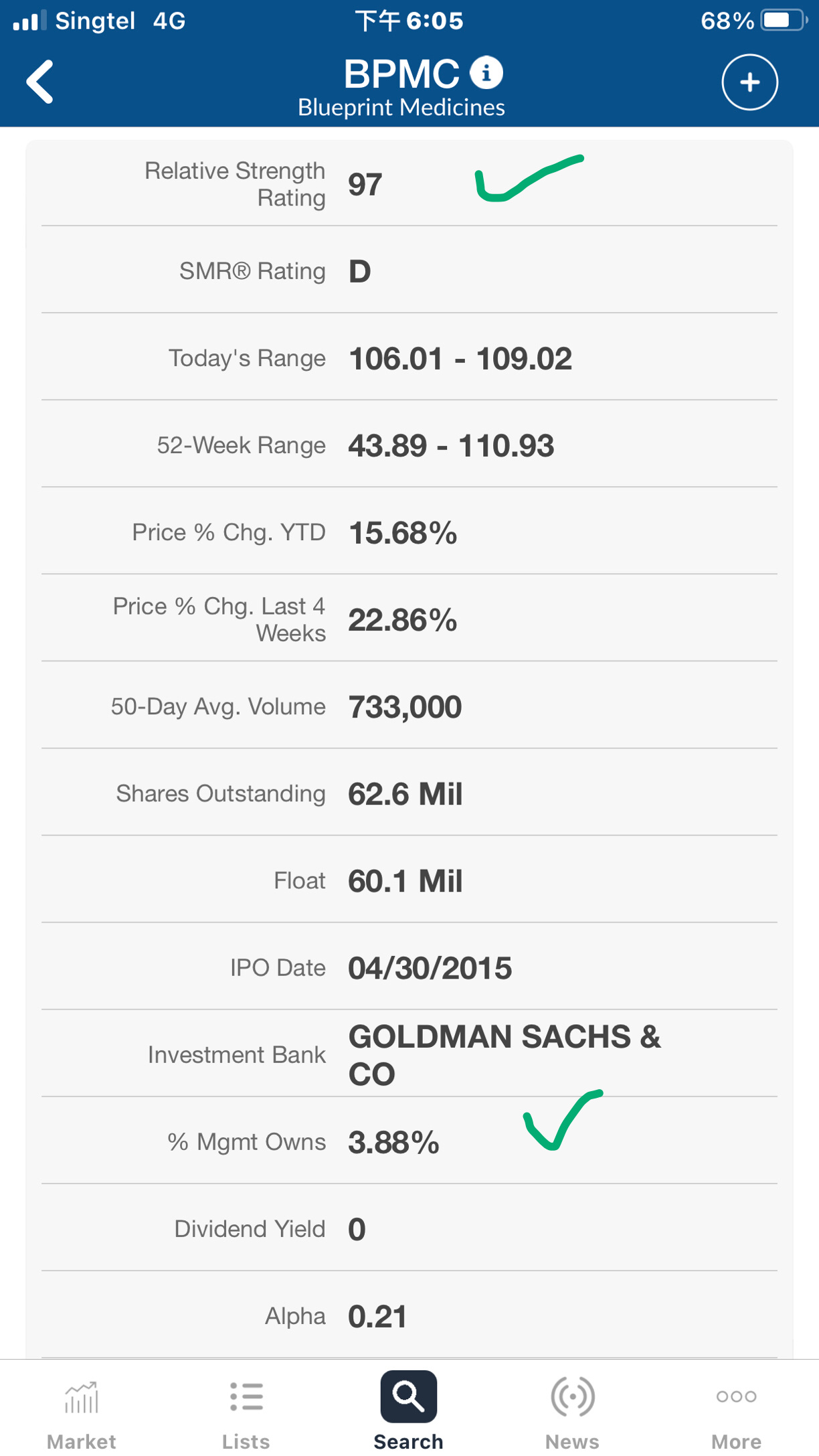

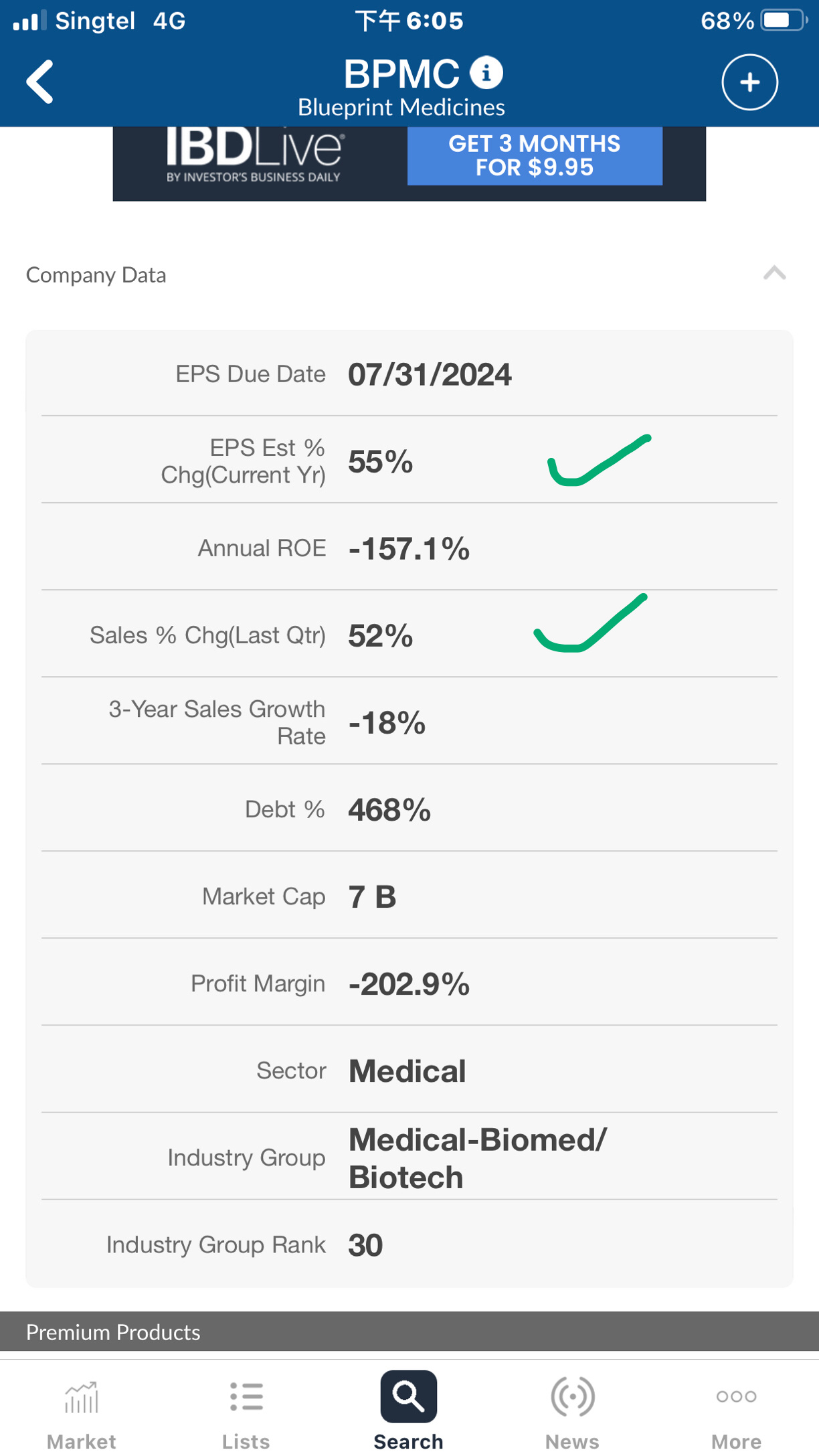

Some other important indicators👇

Returning to the MOOMOO chart:

In the chart, the high and low points of the consolidation area are connected by a purple line, which are:

101,84.81

97,84.33

94.67,88.46

94.98,90.745

Subtracting the previous value from the current value gives the difference:

16.19

12.67

6.21

4.235

Percentage difference between high and low:

16%

13.06%

6.56% (meets the condition)

4.46% (meets the condition)

The final breakout buy point is indicated by drawing a white line, and the recent low point is marked with a red line for stop loss.

Next, we take a $100,000.00 account as a model and the reasonable stop-loss range for swing trading corresponding to the account is 1% to 0.25% of the account.

A 1% account stop-loss = $1,000.00, corresponding to a price difference stop-loss of 4.235. This can buy 236 shares, with an amount used of $22,427.00, representing an approximate position ratio of 22.42%.

By analogy:

0.5% account stop loss = $500.00, corresponding to a price difference stop loss of 4.235, can buy 118 shares, amount used: $11,213.00, position ratio is about 11.21%

0.25% account stop loss = $250.00, corresponding to a price difference stop loss of 4.235, can buy 59 shares, amount used: $5,606.85, position ratio is about 5.6%

Using these three preset account stop loss percentages and the final price difference after the stock contracts, it is easy to calculate the corresponding position size that should be established.

Obviously, the core of VCP is contraction, and the main purpose of contraction is to reduce the price difference and reduce the stop loss percentage, so as to bear a larger position under the same risk management conditions and obtain more potential profit.

In short, under the premise of taking the risk of losing $1000, $20,000 obviously has more profit potential than $10,000. 🎁

Finally, let's talk about the setting of account stop loss percentage. There is no so-called correct answer. For swing trading on daily charts with a period of 2 weeks to 2 months, it is reasonable to control it between 0.25% and 1% according to personal style and habits. Of course, you can also adjust this percentage based on the market's corresponding situation and the excellent level set for the stock, so as to calculate the position to use each time.

Joke: In the eyes of swing traders, VCP is everywhere. 🤭👇

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment