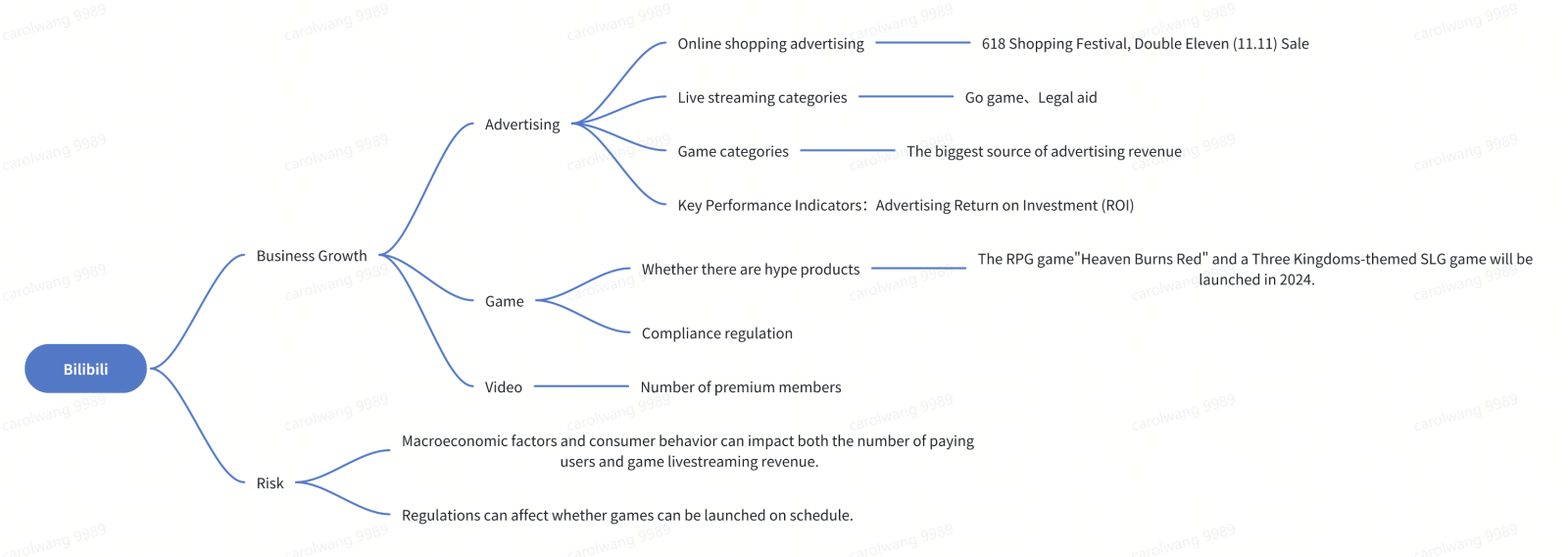

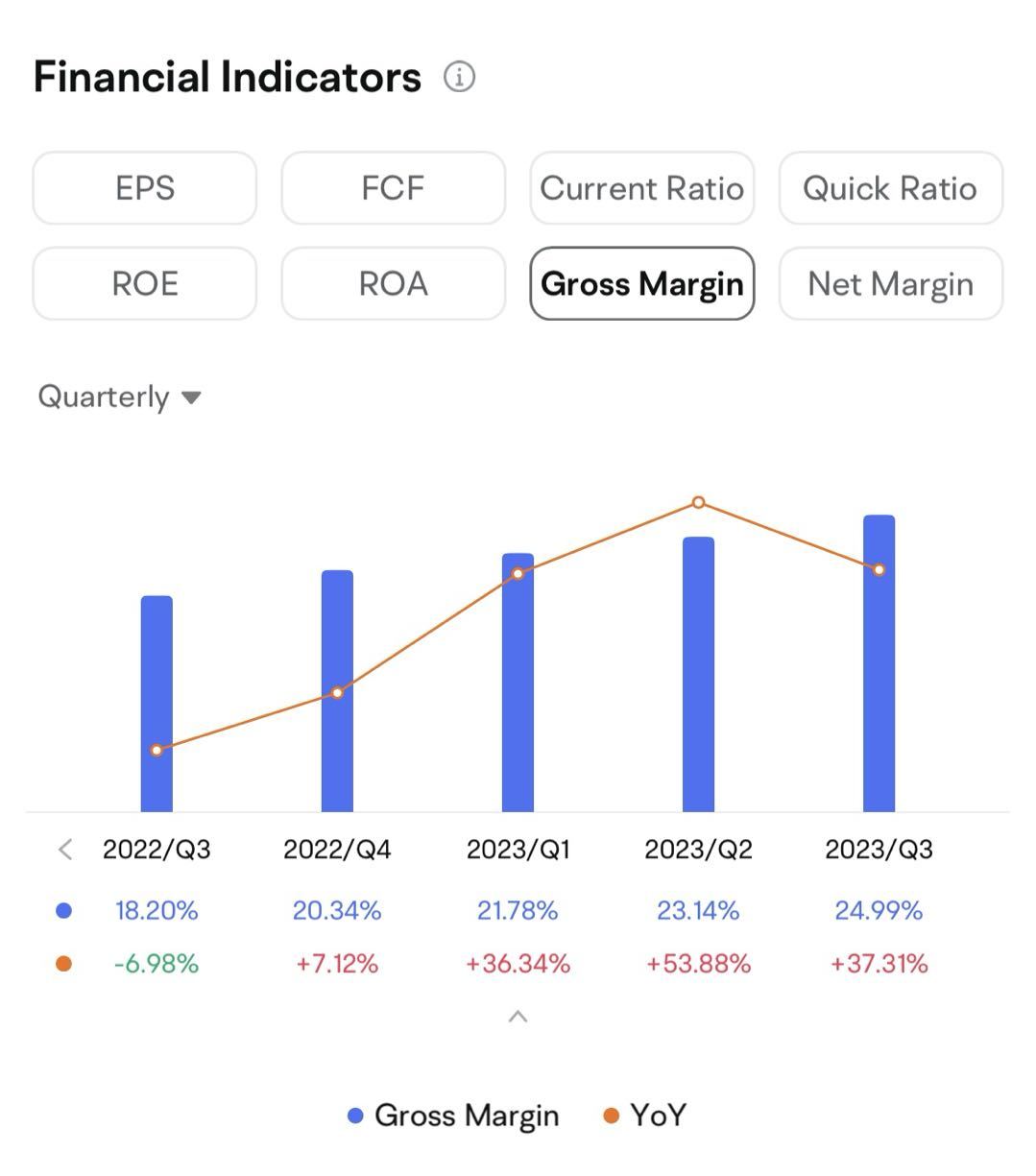

CMB International predicts that in Q4, the adjusted net loss rate will further improve, and operating cash flow will remain positive. In Q4, Bilibili will continue to optimize its in-house game development team, which CMB believes will improve its R&D efficiency. Additionally, the improving user quality and commercial ecosystem in Q4 will pave the way for Bilibili's revenue growth and breakeven. CMB International has set a target price of $24 for Bilibili, with ad business at $100.1 (42.1% of total valuation), value-added services at $91.0 (38.0%), mobile gaming at $45.0 (18.8%), and intellectual property derivatives and other projects at $0.3 (1.2%). The target price reflects Bilibili's unique value proposition and strong growth prospects in the video advertising market, as well as its growing user base and improving monetization efficiency. Due to Bilibili's lack of a successful in-house game development record, the target PE multiple for its mobile gaming business is lower than the industry average.