TSLA

Tesla

-- 421.060 PLTR

Palantir

-- 80.550 NVDA

NVIDIA

-- 134.700 OXY

Occidental Petroleum

-- 47.130 AMD

Advanced Micro Devices

-- 119.210

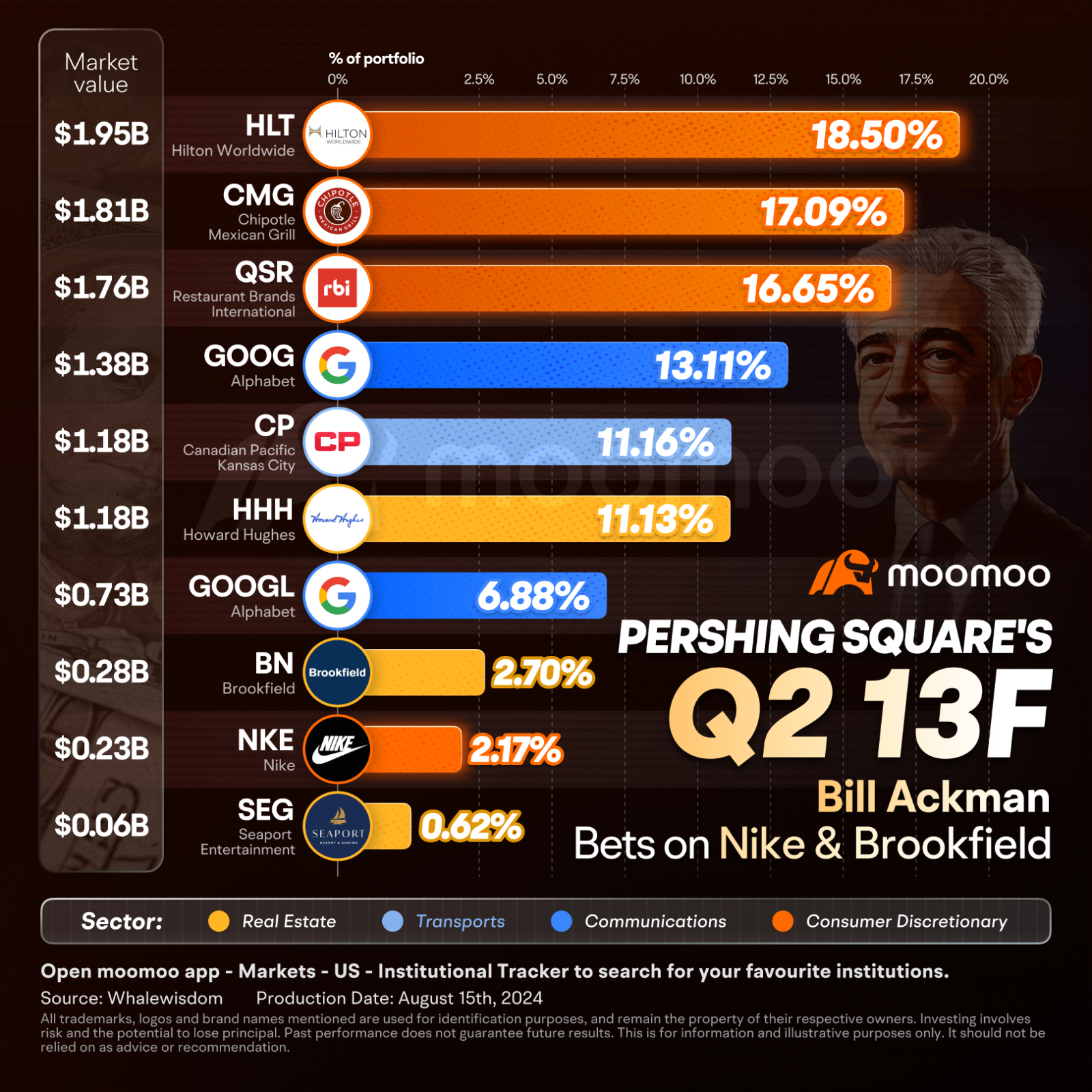

We believe Chipotle is in the early innings of a decades-long growth story. In North America, management expects to grow its restaurant count at a rate of 8% to 10% per annum, with the goal of more than doubling its store base to at least 7,000 locations. International expansion remains a largely untapped opportunity, with the company just beginning to increase investment in Europe and recently announcing its first-ever franchise agreement in the Middle East. In addition to opening new restaurants, Chipotle's many growth opportunities in existing restaurants include menu innovations, loyalty program enhancements, and the long-term potential to offer breakfast and leverage automation technology to simplify operations."

103916021 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

54088 FROM RWS : wow