Bitcoin Briefly Tops $68K Amid Biden's Withdrawal From Presidential Race: What's Next?

Financial markets, including currencies, shares, cryptocurrencies, and commodities, are poised to react to US President Joe Biden's withdrawal from the 2024 presidential race. Wall Street and European markets may face increased volatility.

Following an assassination attempt on Donald Trump, Biden has decided to withdraw from the race and endorse Vice President Kamala Harris as the Democratic nominee. Investors are cautious due to political uncertainties and anticipated Federal Reserve rate cuts in September, leading to potential risk-averse actions in the markets.

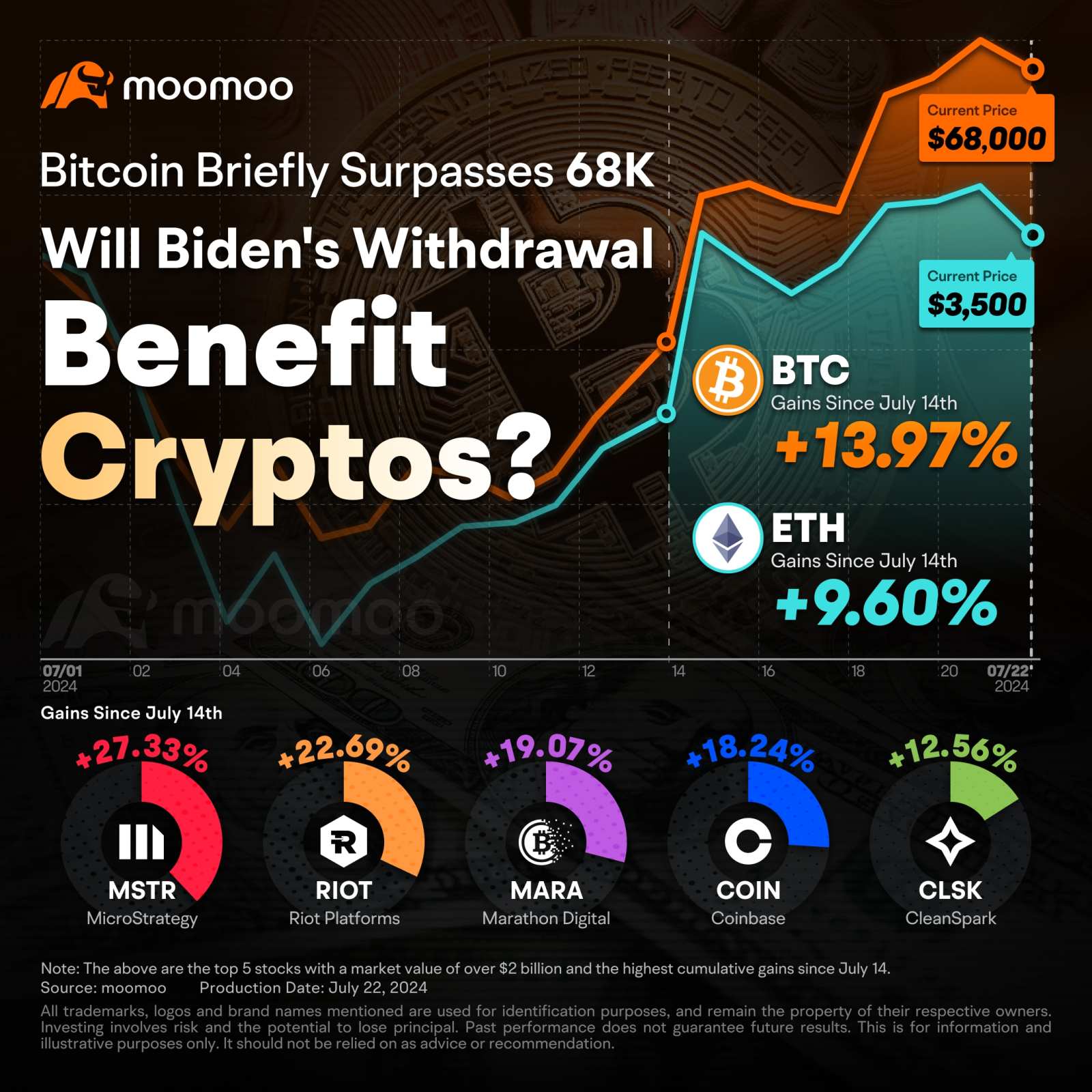

Cryptocurrencies, particularly Bitcoin, have seen strong bullish momentum since the attempt on Trump's life. The incident has boosted the chances of a crypto-friendly candidate winning, as they accepted private fundraising in cryptocurrencies. Bitcoin surged over 18% to more than $68,300 since the assassination attempt, with an additional 5% increase after Biden announced his withdrawal from the race.

Check Out the Recent Performance of Major Cryptocurrencies and Crypto-Related Stocks:

Investors have been betting on Donald Trump's return to the White House, shifting away from long-term US bonds and buying Bitcoin. With President Joe Biden announcing he will not seek reelection, this has introduced uncertainty, causing market volatility. Investors are now reconsidering their strategies, including the potential for a Democrat victory and recalibrating their "Trump trade" bets. Safe-haven assets like the Swiss franc, US Treasuries, yen, and gold saw increased demand, while Bitcoin reached its highest level in over a month. Additionally, investors are bracing for market reactions to second-quarter earnings and speculating on future Federal Reserve interest rate cuts.

Many trades are based on the belief that a second Trump presidency would be fiscally expansive and reignite inflation, boosting demand for the dollar despite Trump's preference for a weaker US currency. Other Trump-related trades include betting on rising US bond yields, gains in bank, health, and energy stocks, and Bitcoin.

Markets are now speculating on a "Harris Trade" if Vice President Kamala Harris becomes the Democratic nominee. Analysts suggest her win could mean policy continuity but with a focus on tax relief for lower-to-middle-income consumers and more consumer-related regulations. PredictIt currently favors Harris for the Democratic nomination and Trump for the presidency. The market is uncertain about how a potential Harris nomination will affect US equities, especially given her stance on oil and fracking. Traders are expected to remain cautious as they await further developments in Harris's campaign.

There is limited historical precedent for a sitting president not seeking a second term, making it challenging to predict market reactions. The last similar instance was Lyndon Johnson in 1968. The situation remains unprecedented, adding to the market's uncertainty.

This means more uncertainty," said Gene Munster, co-founder and managing partner at Deepwater Asset Management. "There was a lot of confidence about Trump winning, and markets won't like this new uncertainty, along with the news cycle about who is in, who is out, and all those unknowns."

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $NASDAQ 100 Index (.NDX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $ProShares Bitcoin ETF (BITO.US)$ $ProShares Short Bitcoin ETF (BITI.US)$ $MicroStrategy (MSTR.US)$ $Riot Platforms (RIOT.US)$ $MARA Holdings (MARA.US)$ $Coinbase (COIN.US)$ $CleanSpark (CLSK.US)$

Source: Bloomberg, Yahoo Finance, CryptoNews

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

rusli : $KGROUP (0036.MY)$ 120

103387867 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103719566⭐ :