$Bitcoin (BTC.CC)$ price drops to $56,837, a two-month low.

Decline follows the Fed's indication of no imminent rate cuts.

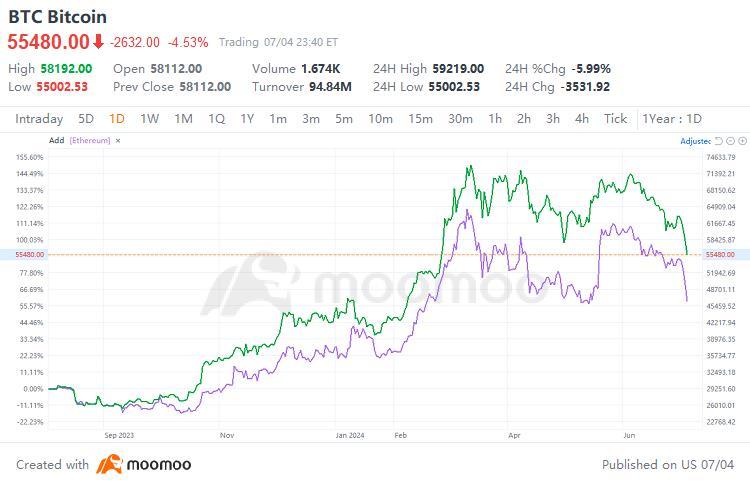

Bitcoin down 4.3% to $55,606.00

$Ethereum (ETH.CC)$ also falls 5% to $3,120.

Higher interest rates dampen investor risk appetite.

Bitcoin reached an all-time high of $73,700 in March after SEC approved first U.S. spot bitcoin ETF.

Bitcoin trading range between $59,000 and $72,000 since then.

Pressure from Mt. Gox’s expected distribution of $9 billion worth of coins.

CCData suggests bitcoin has not yet reached top of current appreciation cycle.

Historical cycles indicate price expansion post-halving event, last halving on April 19.

Tom Lee of Fundstrat predicts bitcoin hitting $150,000 despite current downturn.

10baggerbamm : the problem is Bitcoin is considered a risk on asset and typically it's been trading lockstep with tech stocks so that model now has clearly failed because the S&P NASDAQ are busting new highs and they are heavily weighted in tech stocks so those are risk on assets and earlier this year all you heard at least bobbleheads on TV saying bitcoins so if tech stocks trade high or with no imminent rate cut and today in a few hours we're getting another major economic indicator that the FED loves to look at 8:30.. well Bitcoin should be rallying and it's not and I think it has more to do with a plan to attack on bitcoin to keep the dollar from collapsing and again you can reference chairman Powell's statements and others this past week

elysium27 10baggerbamm :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)