Bitcoin plummeted on Friday, was it the beginning of a bear market or a bull market correction

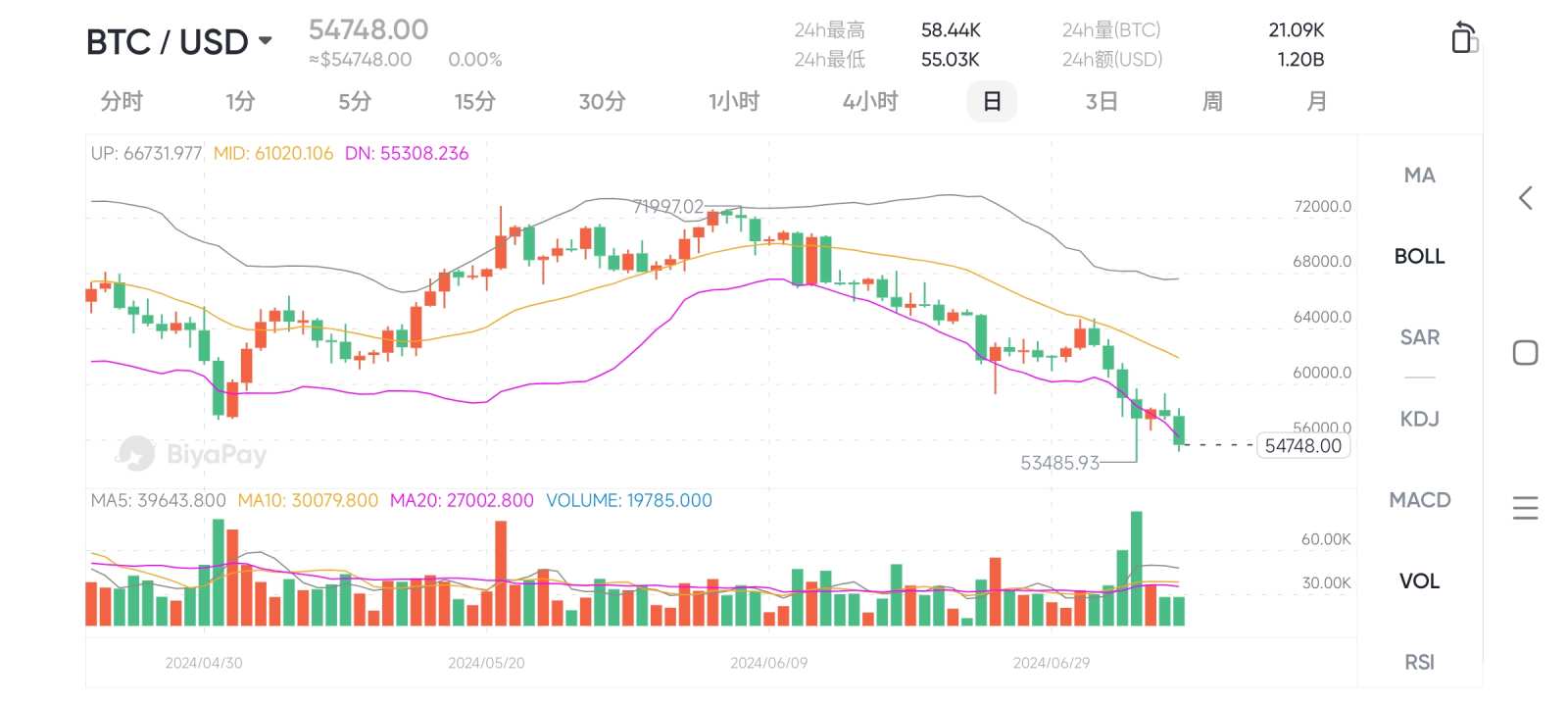

Recently, Bitcoin experienced a significant price crash, which attracted widespread attention in the market. On Friday, the price of Bitcoin plummeted by more than $6,000 in 24 hours, from around $60,182 to $53,600, a historic one-day decline. This sharp drop has caused investors to speculate whether it marks the beginning of a bear market or a correction in the middle of a bull market.

Bitcoin's price trend was quite volatile in 2024. At the beginning of the year, it reached an all-time high of $73,798, but the price has remained unstable since then. There are many factors affecting this sharp decline, the main ones including the upcoming implementation of Mt. Gox's customer compensation program, political uncertainty over Trump's possible return to the White House, and the German government's massive Bitcoin sell-off.

Mt. The Gox customer compensation program will be implemented in July 2024 and is expected to distribute more than $8 billion in Bitcoin and Bitcoin Cash to victims. This large-scale market injection is expected to trigger significant selling pressure, thereby putting downward pressure on the Bitcoin price. Meanwhile, the large-scale sell-off of Bitcoin by the German government further increased the selling pressure on the market and pushed down the price of Bitcoin.

Mt. Gox Customer Reimbursement Program

“Mt. The “Gox Customer Reimbursement Program” is for 2014 Mt. A plan to pay compensation to victims of the Gox exchange hacking incident. Mt. Gox was the largest Bitcoin exchange in the world at the time. In February 2014, it lost about 850,000 bitcoins (worth about 0.45 billion US dollars at the time) due to a major security breach, causing the exchange to go bankrupt.

This event is considered a major turning point for the cryptocurrency industry, leading to significant improvements in security and regulatory frameworks across the industry. Mt. The Gox incident revealed security flaws in early cryptocurrency exchanges, driving the establishment of stricter regulations and higher security standards.

The upcoming compensation program will begin in July of this year, and it is expected that more than $8 billion in Bitcoin and Bitcoin Cash will be distributed to victims.

The Mt.Gox bankruptcy trustee said they began paying settlements in Bitcoin last Friday, which means that Bitcoin worth around $9 billion could be under selling pressure. Fundamentally, selling pressure experienced a brief, sudden spike, without a corresponding increase in demand.

Notably, the sell-off actually began on July 4, when the regular US market was closed, and people expect the cryptocurrency market to be less liquid than usual.

Since most of the holders of these bitcoins are early investors, they may sell off part or all of them at the current higher price level, thereby increasing the selling pressure on the market, which may cause the price of Bitcoin to drop further. This large-scale injection of Bitcoin into the market is expected to exert significant downward pressure on the Bitcoin price and further push down the Bitcoin price.

The government is selling

Recently, the German government announced that it would sell off a large amount of its Bitcoin holdings, and this news caused an uproar in the market. Bitcoin holdings held by the German government stem from criminal proceeds confiscated by law enforcement agencies over the past few years, and after accumulating to a certain scale, they decided to sell them. The German government sold around $0.175 billion worth of bitcoin on July 4, according to ON.chain data. And that's just the tip of the iceberg, as the European country still holds around 40,000 bitcoins.

The impact of this incident was immediate. As soon as news of the large-scale sell-off came out, it directly impacted the market. The supply of Bitcoin in the market increased sharply, causing its price to drop rapidly. Large-scale sell-offs have increased the selling pressure on the market, causing investors to expect prices to continue to fall, thus triggering more sell-offs, which in turn creates a vicious cycle of falling prices.

The market's response to this large-scale sell-off was multi-faceted. Investors' fears are growing stronger, and many investors are selling off their bitcoins to avoid possible greater losses. At the same time, although market liquidity has increased, prices have dropped sharply, demonstrating the imbalance between supply and demand.

Following the initial price crash, Tron (TRON-USD) founder Sun Yuchen proposed to buy all of Germany's bitcoins off-chain to prevent further price crashes.

Some German lawmakers disagreed with the country's actions. Joana Costa said that selling Bitcoin was a hasty move and the government should consider holding this cryptocurrency to diversify the country's fiscal reserves. In addition to the German government selling bitcoin (which is a verifiable fact), there are speculations that investors may sell the bitcoin they received from the recent Mt.Gox settlement, or that short sellers may have spearheaded the move.

Trump returns to the White House

The US election debate has come to an early end recently, and news about Trump's possible return to the White House has received widespread attention. This potential political dynamic affects not only America's internal affairs and diplomacy, but also has a profound and complex impact on global financial markets, particularly the BTC/cryptocurrency sector.

Trump was known for his unique and controversial policy style during his administration. His economic policy favors protectionism and traditional industries. His attitude towards emerging financial sectors, such as cryptocurrencies, is vague and changeable, and support for cryptocurrencies during the election period may only be a political strategy. Historically, many of Trump's policies during his tenure, such as trade wars and regulatory actions against tech giants, have led to increased market volatility.

Judging from the current price trend, there is a high possibility that it will fall in the short term. Investors are concerned that he may introduce strict regulatory policies to limit the development of cryptocurrencies. For example, it may increase the regulation of cryptocurrency trading platforms, increase transaction costs, or limit trading activities. This can make investors feel that trading becomes difficult and unliberal, and they lose their enthusiasm for investing.

However, in the long run, there are also significant positive effects. In the past, many traditional investors were deterred by these illegal acts in the cryptocurrency market. But if Trump's strict regulatory policies successfully crack down on illegal activities in the market, such as money laundering and fraud, the market environment will become fairer, more just, and more transparent.

Traditional investors who are originally cautious about cryptocurrencies will be more willing to participate. Their entry will bring richer sources of capital and more mature investment ideas. These participants have stronger financial strength and more professional investment strategies, and can inject stable strength into the market.

As illegal activity declines, the credibility of the market will increase significantly. Investors no longer need to worry too much about the safety of funds and the fairness of transactions, which creates favorable conditions for large-scale capital inflows in the future.

Fundamental analysis

Currently, Bitcoin's fundamentals are still very supportive of price increases. In the next few years, three major sources of demand will drive the price increase:

institutions

country

Younger investors

The adoption of institutions, including funds and companies, is already progressing smoothly, and the asset management scale of institutions alone is over 60 trillion dollars. Microstrategy (MSTR) is massively accumulating Bitcoin, as are other companies like Tesla (TSLA).

As of June 2024, MicroStrategy held approximately 226,331 bitcoins with a total value of approximately $8.33 billion. The most recent major purchase was in June 2024, when they bought 11,931 bitcoins for $0.786 billion, at an average price of $65,883 each.

US companies hold around $6.9 trillion in cash reserves, which could flow into Bitcoin or even other cryptocurrencies.

Furthermore, we may also see a shift in national attitudes. Although this hasn't happened yet, Germany's recent sell-off has brought this fact to the forefront, and politicians within the system are defending Bitcoin. Currently, countries like El Salvador have used Bitcoin as legal tender and have accumulated large reserves.

Also influenced by the election, Donald Trump, who is likely to become the next US president, also mentioned using Bitcoin as a strategic reserve asset.

Finally, it's worth noting that we'll see a shift in the direction of investment from Gen X or millennial investors.

According to Bank of America (BAC), up to $84 billion will be passed on to younger investors, and these younger investors are more likely to invest that money in cryptocurrencies. Because according to Bank of America research, cryptocurrencies and digital assets are second only to real estate in terms of investor preferences.

As these assets move from the older generation to the younger generation, we can expect these young investors to allocate a larger share of their wealth to the cryptocurrency market. The market is unpredictable, and opportunities are fleeting. Forward-looking investors are already taking action. We recommend that you use BiyaPay, a new multi-asset trading wallet. In addition to being able to use USDT to buy cryptocurrencies such as Bitcoin and Ethereum, it also supports USDT's ability to trade US stocks and Hong Kong stocks. In addition to having simple spot, it also supports safe and quick withdrawals of mainstream fiat currencies such as USDT for US stocks and Hong Kong dollars to your bank account.

summed

In summary, I still think this Bitcoin sell-off is a huge opportunity for investors. The technical level is still stuck to the larger time frame, and fundamentals still support the continued rise in Bitcoin's price, thanks to these three sources of demand.

While Bitcoin's market capitalization won't increase 100 times from these levels, I believe there's plenty of room for Bitcoin to appreciate as it becomes mainstream in the portfolios of institutions, companies, and the next generation of retail investors around the world. Currently, Bitcoin has received social recognition and has become an effective form of investment.

Today's pullback does not mark the end of the asset rally; it is only a slight correction in a potentially larger bull market in the future.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

24721331 : When will it reach 0.1 million?