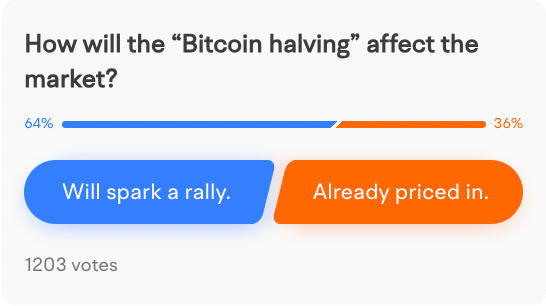

The crypto community is excited as the highly anticipated Bitcoin Halving has taken place on April 20. Historically, Bitcoin halvings have often led to substantial price increases due to reduced supply. Yet, some analysts contend that Bitcoin dominance is declining, indicating the beginning of a market rotation. The market's a mix of excitement and uncertainty, which could open the floodgates for investment. Our recent vote indicates a keen interest in Bitcoin, with the majority viewing the halving as having a bullish impact on the market.

look like a movie : I love $Coinbase (COIN.US)$ $Riot Platforms (RIOT.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$

$Coinbase (COIN.US)$ $Riot Platforms (RIOT.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$

mr_cashcow : Keeping my eyes on $MARA Holdings (MARA.US)$![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

With the bitcoin halving the here are some effects it have on related stocks:

1. Increased demand: As the amount of new Bitcoin introduced into the market decreases, demand for the existing supply increases, which can drive up the price of Bitcoin and related stocks.

2. Reduced mining profitability: As the block reward is cut in half, mining becomes less profitable, which can negatively impact the stock prices of mining companies.

3. Consolidation in the mining industry: As smaller mining operations become less profitable, they may be acquired by larger companies, leading to consolidation in the industry.

4. Increased focus on fundamentals: After the halving, investors may focus more on the fundamentals of mining companies, such as their ability to operate efficiently and effectively, which can impact their stock prices.

5. Volatility: The halving can lead to increased volatility in the price of Bitcoin and related stocks, as investors react to the event and its potential impact on the market.

6. Increased interest in Bitcoin ETFs: The halving can lead to increased interest in Bitcoin ETFs, which can provide investors with a way to gain exposure to Bitcoin without having to hold the underlying asset.

7. Potential for a "speculative bubble": The halving can trigger a "speculative bubble" in the price of Bitcoin and related stocks, as investors become more optimistic about the market and bid up prices.

zhisheng : Keeping my eyes on $MARA Holdings (MARA.US)$![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

With the bitcoin halving the here are some effects it have on related stocks:

1. Increased demand: As the amount of new Bitcoin introduced into the market decreases, demand for the existing supply increases, which can drive up the price of Bitcoin and related stocks.

2. Reduced mining profitability: As the block reward is cut in half, mining becomes less profitable, which can negatively impact the stock prices of mining companies.

3. Consolidation in the mining industry: As smaller mining operations become less profitable, they may be acquired by larger companies, leading to consolidation in the industry.

4. Increased focus on fundamentals: After the halving, investors may focus more on the fundamentals of mining companies, such as their ability to operate efficiently and effectively, which can impact their stock prices.

5. Volatility: The halving can lead to increased volatility in the price of Bitcoin and related stocks, as investors react to the event and its potential impact on the market.

6. Increased interest in Bitcoin ETFs: The halving can lead to increased interest in Bitcoin ETFs, which can provide investors with a way to gain exposure to Bitcoin without having to hold the underlying asset.

7. Potential for a "speculative bubble": The halving can trigger a "speculative bubble" in the price of Bitcoin and related stocks, as investors become more optimistic about the market and bid up prices.

gman_58 : I have many coins but the 2 best for me are FET and GRT. my strategy is to buy coins 1x per month, every month. it takes emotion and trying to time the market out of the picture. when everyone was selling crypto in 2022, I bought all the way down. it has paid off nicely

104298925 : why is moomoo until now still not offering crypto? disappointed with the progress.

104143906(ahyao) : Currently, my Ethereum is still earning Dogecoin, and it was cleared last month

Jafecheong : Bitcoin's halving will definitely drive a new round of gains, but Bitcoin's increase was limited. My opinion will definitely double again to around 140,000...

VTTO : The halving can lead to increased volatility in the price of Bitcoin and related stocks, as investors react to the event and its potential impact on the market.

Potential for a speculative bubble. The halving can trigger a speculative bubble in the price of Bitcoin and related stocks, as investors become more optimistic about the market and bid up prices.

wss fly to the moon : Euretheum is better.

Bitcoin is too expensive, halving allow more people to involve.

Willingnow : Who really is behind bitcoin? Do the research you might be surprised not everything you see is real.

View more comments...