Bitcoin’s Bullish Run Sees It Eclipse Silver’s Market Cap

Bitcoin’s Market Cap Valuation Overtakes Silver

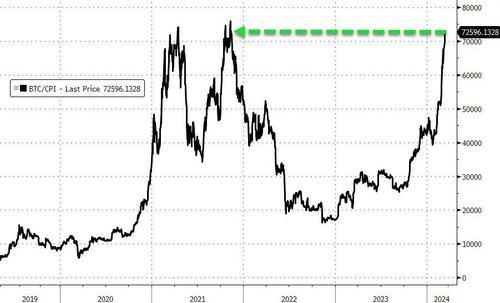

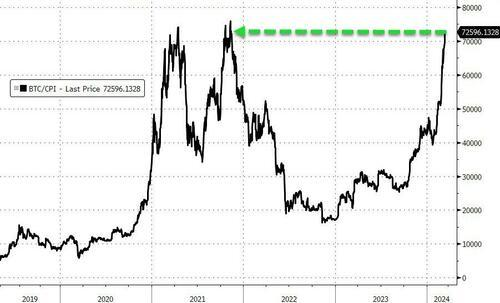

$Bitcoin (BTC.CC)$ ’s stellar price performance has propelled its market cap to $1.406 trillion , taking it past silver, which stands at $1.389 trillion, to become the 8th most valuable asset globally.

What’s more, Bitcoin is setting itself up to leapfrog $Alphabet-A (GOOGL.US)$ for the seventh most valuable asset. However, for BTC to equal Google’s valuation, its price would need to soar to around $87,400 per coin, which seems within the realm of possibility, given the cryptocurrency’s recent momentum.

However, Bitcoin maxis often tout the more challenging goal of topping gold, which holds a current mind-boggling market cap valuation of $14.703 trillion. For Bitcoin to reach parity with gold’s valuation, its price would need to skyrocket to around $748,000 per coin. This feat seems improbable, barring a cataclysmic rebalancing of the legacy financial system and triggering a flight to Bitcoin en masse. $Gold (LIST2110.US)$

$Bitcoin (BTC.CC)$ ’s stellar price performance has propelled its market cap to $1.406 trillion , taking it past silver, which stands at $1.389 trillion, to become the 8th most valuable asset globally.

What’s more, Bitcoin is setting itself up to leapfrog $Alphabet-A (GOOGL.US)$ for the seventh most valuable asset. However, for BTC to equal Google’s valuation, its price would need to soar to around $87,400 per coin, which seems within the realm of possibility, given the cryptocurrency’s recent momentum.

However, Bitcoin maxis often tout the more challenging goal of topping gold, which holds a current mind-boggling market cap valuation of $14.703 trillion. For Bitcoin to reach parity with gold’s valuation, its price would need to skyrocket to around $748,000 per coin. This feat seems improbable, barring a cataclysmic rebalancing of the legacy financial system and triggering a flight to Bitcoin en masse. $Gold (LIST2110.US)$

On the Flipside

- Market cap rankings are highly changeable and may not necessarily reflect a long-term position.

- Bitcoin’s strong performance is fueled by institutional adoption via US BTC ETF products.

- While there is anecdotal evidence of retail FOMO, retail interest remains significantly below that seen in prior cycles, as evidenced by Google search volume.

- Market cap rankings are highly changeable and may not necessarily reflect a long-term position.

- Bitcoin’s strong performance is fueled by institutional adoption via US BTC ETF products.

- While there is anecdotal evidence of retail FOMO, retail interest remains significantly below that seen in prior cycles, as evidenced by Google search volume.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

BelleWeather : There is indeed, a ‘cataclysmic rebalancing of the legacy financial system’ afoot! (Though it may take a few years to overtake gold.)