$Bitdeer Technologies (BTDR.US)$ Bitdeer Technologies Group ...

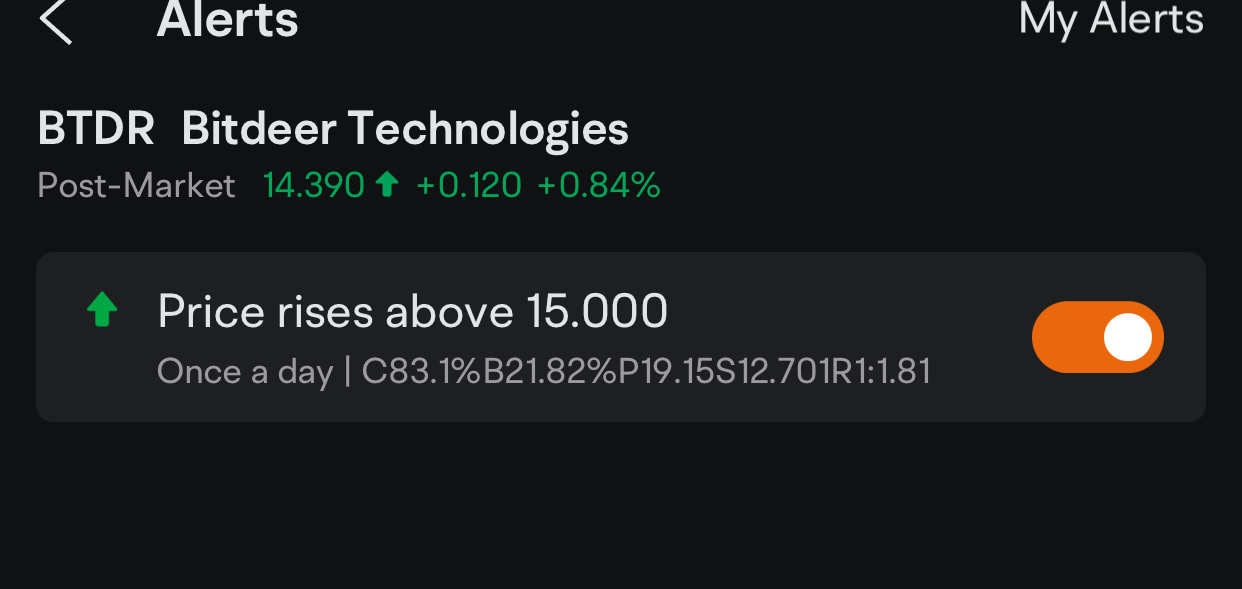

Bitdeer Technologies Group captures interest with a notable 83.1% confidence score on overnight ( 24 hour time frame ) trading viability scale. A positive catalyst underpins the score, fortified by the stock's significant movement upward nearing its Daily High, supported by a favorable sector backdrop in Application Software. Despite short interest percentages not significantly impacting the stock, other technical indicators like chart breakouts and valid float range working in its favor. Although recent earnings show a challenging financial quarter affected by revenue drops, future mining expansions may enhance sentiment. Positive long-term investor faith and sector heat combine in offering a promising overnight prospect.

key attributes worksheet

Short Interest ( No) ,Hot sector ( Yes), Catalyst (Yes), Valid float ( Yes), Near 52 week high (No), Near HOD ( Yes)

Risk Level: 7 (Moderately High Risk)

This stock exhibits a moderately high risk for overnight trading. Its position in the hot Application Software sector and robust performance nearing its daily high give it buoyancy despite underlying concerns. The negative earnings guidance and struggle for financial stability introduce a conservative friction. High volatility paired with leverage dependency heightens caution, demanding vigilant short-term scrutiny. The moderately elevated risk level, scoring 7, reflects the mix of optimism and caution in the current outlook for Bitdeer Technologies Group.

This stock exhibits a moderately high risk for overnight trading. Its position in the hot Application Software sector and robust performance nearing its daily high give it buoyancy despite underlying concerns. The negative earnings guidance and struggle for financial stability introduce a conservative friction. High volatility paired with leverage dependency heightens caution, demanding vigilant short-term scrutiny. The moderately elevated risk level, scoring 7, reflects the mix of optimism and caution in the current outlook for Bitdeer Technologies Group.

Levels

Support at 14.27: Marked as a level of strength shown by company interest and viable stock movement influence.

Resistance at 52-week high of 15.5: This forms the initial upper trading capping, offering exit potential should the stock's path clear additional turbulence.

Floating resistance around whole numbers like 15 and half dollars like 14.5 can impact interim trading sentiment influenced by market psychology dynamics.

Support at 14.27: Marked as a level of strength shown by company interest and viable stock movement influence.

Resistance at 52-week high of 15.5: This forms the initial upper trading capping, offering exit potential should the stock's path clear additional turbulence.

Floating resistance around whole numbers like 15 and half dollars like 14.5 can impact interim trading sentiment influenced by market psychology dynamics.

Trading Strategy

Evaluating BTDR's score prompts a vigilant long-position strategy, offering a favorable chance to execute a technical entry at a designated level of 15. The plan capitalizes on buoyant percentage movement and sentiment-driven momentum aiming to exit at 19.15, reflecting a tactical stretch into present resistance areas. Calculating available capital constraints and risk management, the strategy keeps a stop at 12.701 while assigning 21.82% of a $10,000 equity stake aligned with a 1:1.81 risk-reward balance.

Evaluating BTDR's score prompts a vigilant long-position strategy, offering a favorable chance to execute a technical entry at a designated level of 15. The plan capitalizes on buoyant percentage movement and sentiment-driven momentum aiming to exit at 19.15, reflecting a tactical stretch into present resistance areas. Calculating available capital constraints and risk management, the strategy keeps a stop at 12.701 while assigning 21.82% of a $10,000 equity stake aligned with a 1:1.81 risk-reward balance.

Equity: $10,000

Bias: Long

Allocation: 21.82%

Size: 145

Entry: 15.0

Exit: 19.15

Stop: 12.701

Risk-Reward: 1:1.81

Bias: Long

Allocation: 21.82%

Size: 145

Entry: 15.0

Exit: 19.15

Stop: 12.701

Risk-Reward: 1:1.81

Conclusion

This thorough evaluation finds Bitdeer Technologies Group as a strong contender for a short, strategically driven overnight trade. Despite some financial shortcomings from recent earnings, the uplifting sector support and potential positive outcomes from technological expansions contribute positively to sentiment and future outlook. With a recommendation to trade supported by an above-threshold score, risk-conscious traders can find this stock well-suited for diversification within certain equity allocations.

This thorough evaluation finds Bitdeer Technologies Group as a strong contender for a short, strategically driven overnight trade. Despite some financial shortcomings from recent earnings, the uplifting sector support and potential positive outcomes from technological expansions contribute positively to sentiment and future outlook. With a recommendation to trade supported by an above-threshold score, risk-conscious traders can find this stock well-suited for diversification within certain equity allocations.

Final Verdict: Trade

By combining its attractive trade score and the positive momentum indicators, BTDR offers traders solid short-term engagement opportunities. Suitable for diversified portfolios aiming to capitalize on sector momentum, while keeping risk management in tight check.

By combining its attractive trade score and the positive momentum indicators, BTDR offers traders solid short-term engagement opportunities. Suitable for diversified portfolios aiming to capitalize on sector momentum, while keeping risk management in tight check.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment