BoC June Interest Rate Decision Preview: A Critical Juncture for Monetary Policy

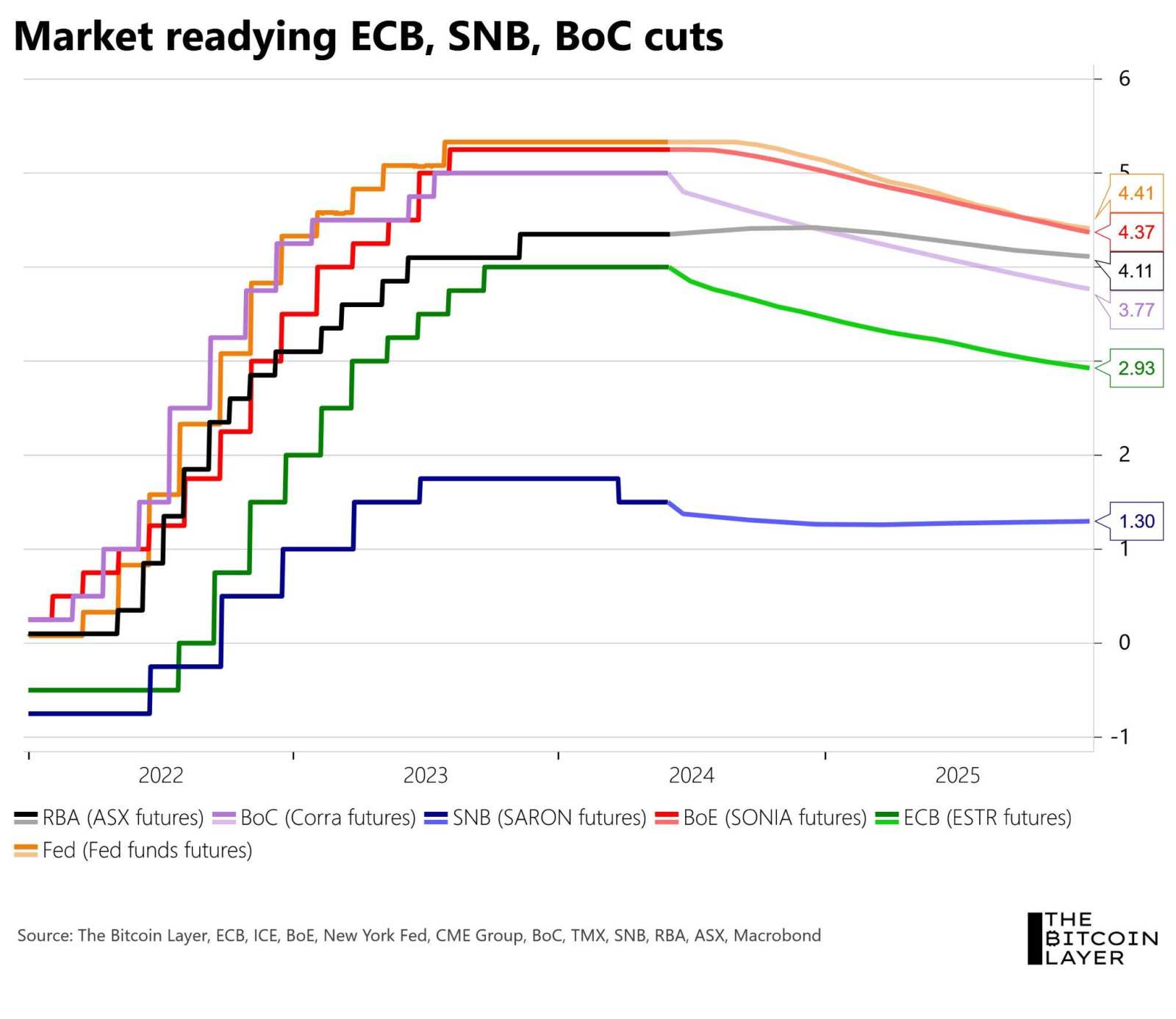

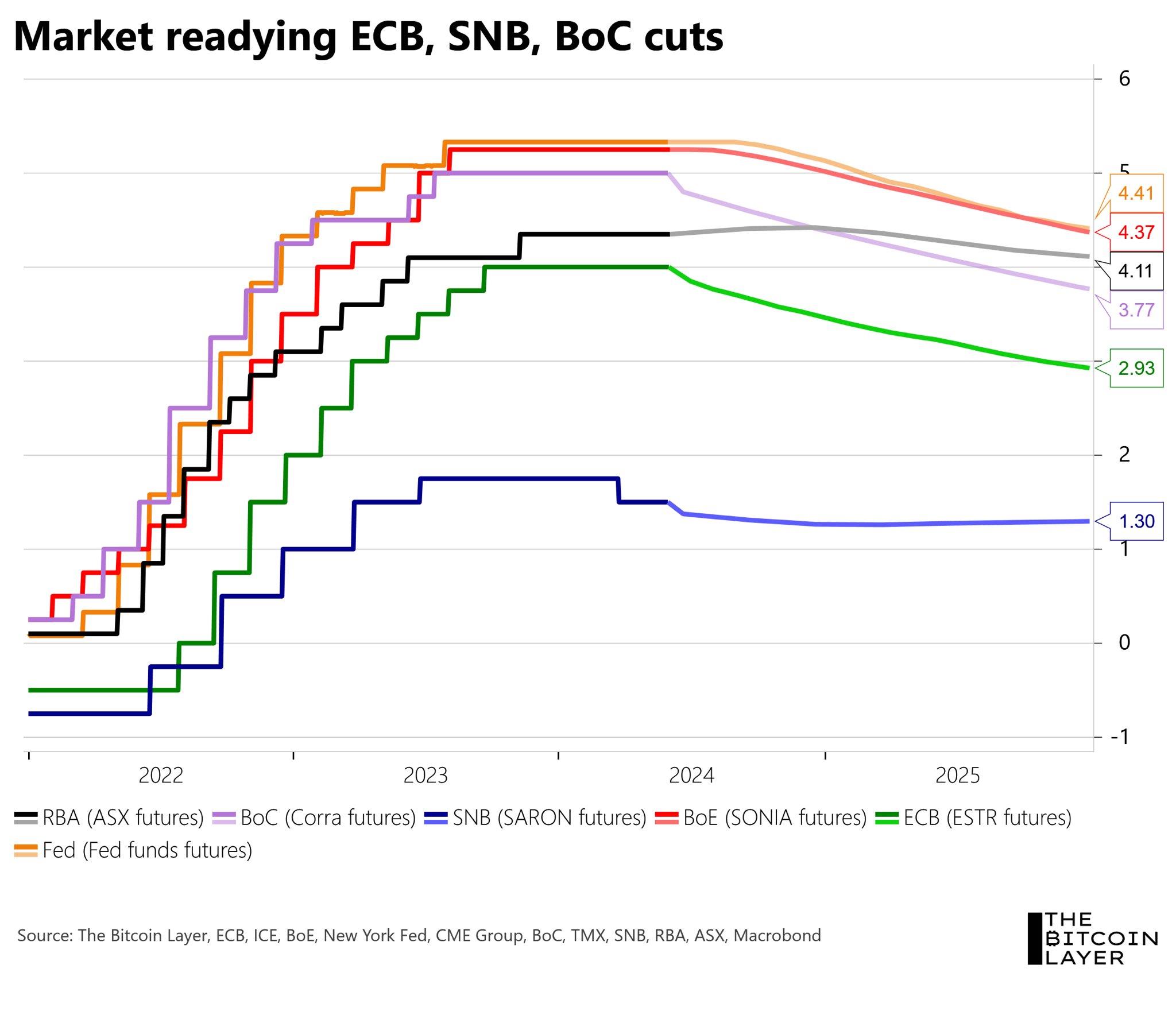

While central banks across Latin America, Switzerland, and Sweden have already been cutting interest rates, the world's most powerful central banks have yet to follow suit. This week may mark a turning point, with the European Central Bank (ECB) expected to take the lead. The Bank of Canada's decision is more uncertain, with the markets betting on a 65% chance of a rate cut. The outcome is more than just a domestic matter as it may send ripples across the pond, possibly influencing the Fed's next steps.

At 9:45 am ET on Wednesday, the BoC will issue its policy statement, followed by a press conference at 10:30 am ET with Governor Macklem and Senior Deputy Governor Rogers. Notably, there will be no Monetary Policy Report this time, with the next comprehensive forecast update scheduled for the July 24th decision.

Here's what major banks are saying about the potential outcome:

Overall, there are five broad points in favor of cutting at this meeting:

· Softening Inflation: Canada has seen a consistent downward trend in core inflation, with trimmed mean and weighted median CPI expanding at a moderate pace. This suggests the BoC could start easing rates now, with some seeing the current softening as persistent.

· Risk Management: If it appears that inflation is stabilizing, it might be prudent to start reducing rates, acknowledging that future economic conditions are unpredictable. This approach mirrors the actions of former BoC Governor Carney in 2010, who, despite uncertain forecasts, recognized the need to move away from the distortive effects of the very low-interest rates instituted during the height of the financial crisis. His strategy was to incrementally increase rates and then assess the economic response. In today's context, with peak inflation risks potentially diminishing, a similar strategy could be applied in reverse—initiating a decrease in rates and closely monitoring the economic outcome.

· Governor's Disposition: Governor Macklem has shown a tendency to respond swiftly to signs of cooling inflation, often advocating for maximum employment and economic stimulation, a stance that might favor an immediate rate cut.

· Economic Slack: Canada's economy showed signs of weakening, with GDP figures from the fourth quarter of 2022 through the fourth quarter of 2023 pointing towards a slowdown that might lead to delayed disinflationary pressures through a slightly negative output gap. This trend may have extended into the first quarter of 2024, when GDP experienced a 1.7% growth rate on a seasonally adjusted annual rate basis.

· Market Expectations:Markets are now pricing about 20bps of a cut, and the BoC may not wish to disappoint markets.

The case for delaying, on the other hand, requires further patience:

Upcoming Full Forecast Meeting: July's BoC meeting will offer a full forecast, allowing for a more thorough assessment before potentially changing policy direction.

Awaiting the FOMC's Stance: The BoC may prefer to wait for the Federal Reserve's communications, including an updated dot plot on June 12th, before making its move, acknowledging that while it values its independence, it's not immune to global trends.

Persistent Shelter Costs: Strong shelter inflation cannot be overlooked. With ongoing immigration and housing shortages, this component of inflation remains a concern that must be factored into rate decisions.

· Stronger Consumer Spending Performance: Early 2024 indicators suggest a healthier Canadian economy than expected, with robust consumer spending and domestic demand. This raises caution against rate cuts that could potentially reignite economic imbalances.

· Further Evidence from Upcoming Surveys: By the time the July session rolls around, the BoC will have fresh insight from its latest business and consumer surveys, including crucial inflation expectations data—a key factor that Governor Macklem has consistently highlighted as important to watch. This advantage gives the July meeting a significant edge over the June gathering. Recent indicators from a new small business survey hint that expectations might be firmly lodged at the higher end of the BoC's 1-3% target range for inflation, suggesting that attitudes toward price growth may be tenaciously held.

Source: RBC Economics, TD Economics, Scotiabank Economics, CIBC Economics

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment