BOC Leaves Door Open to Further Cuts. Timing Is Data Dependent

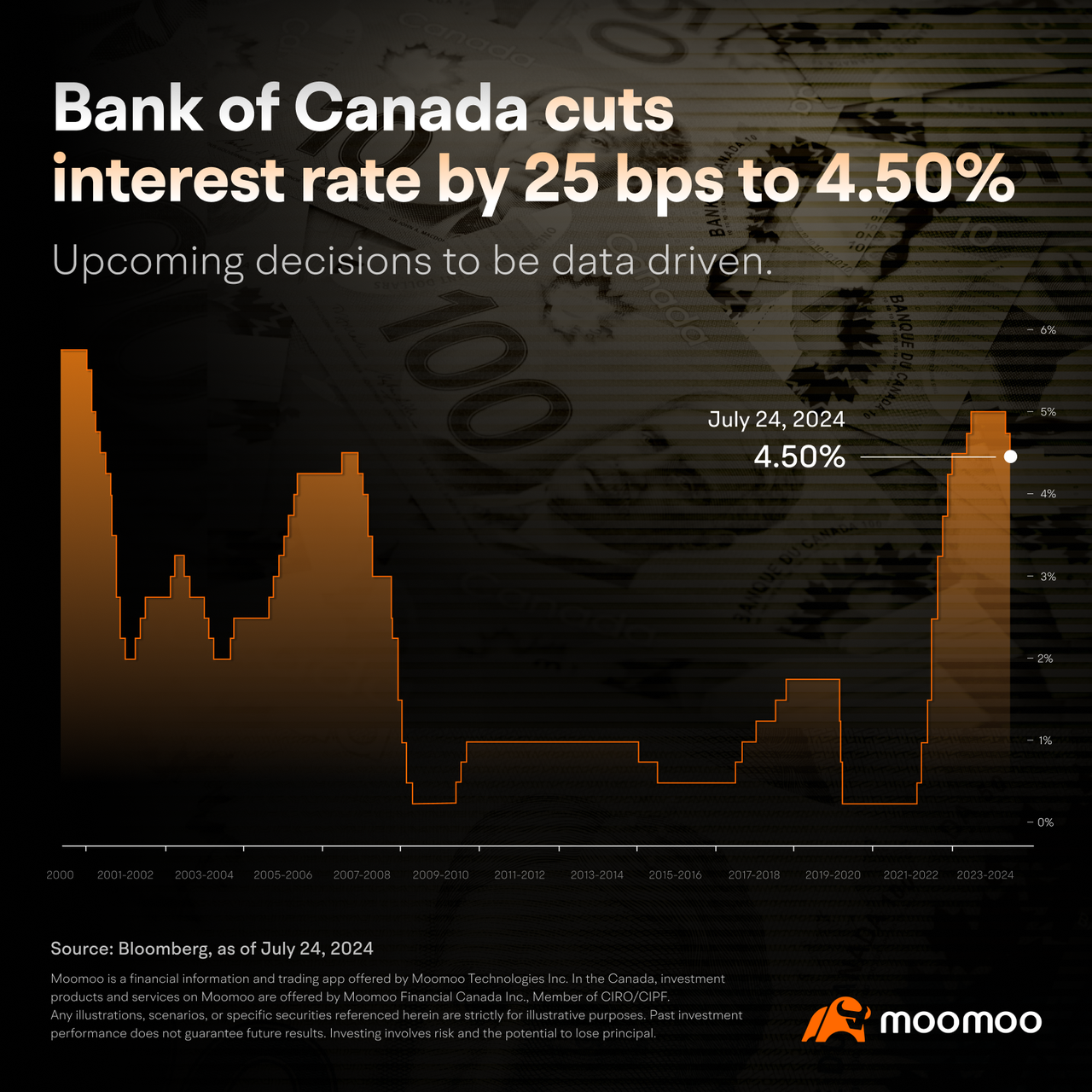

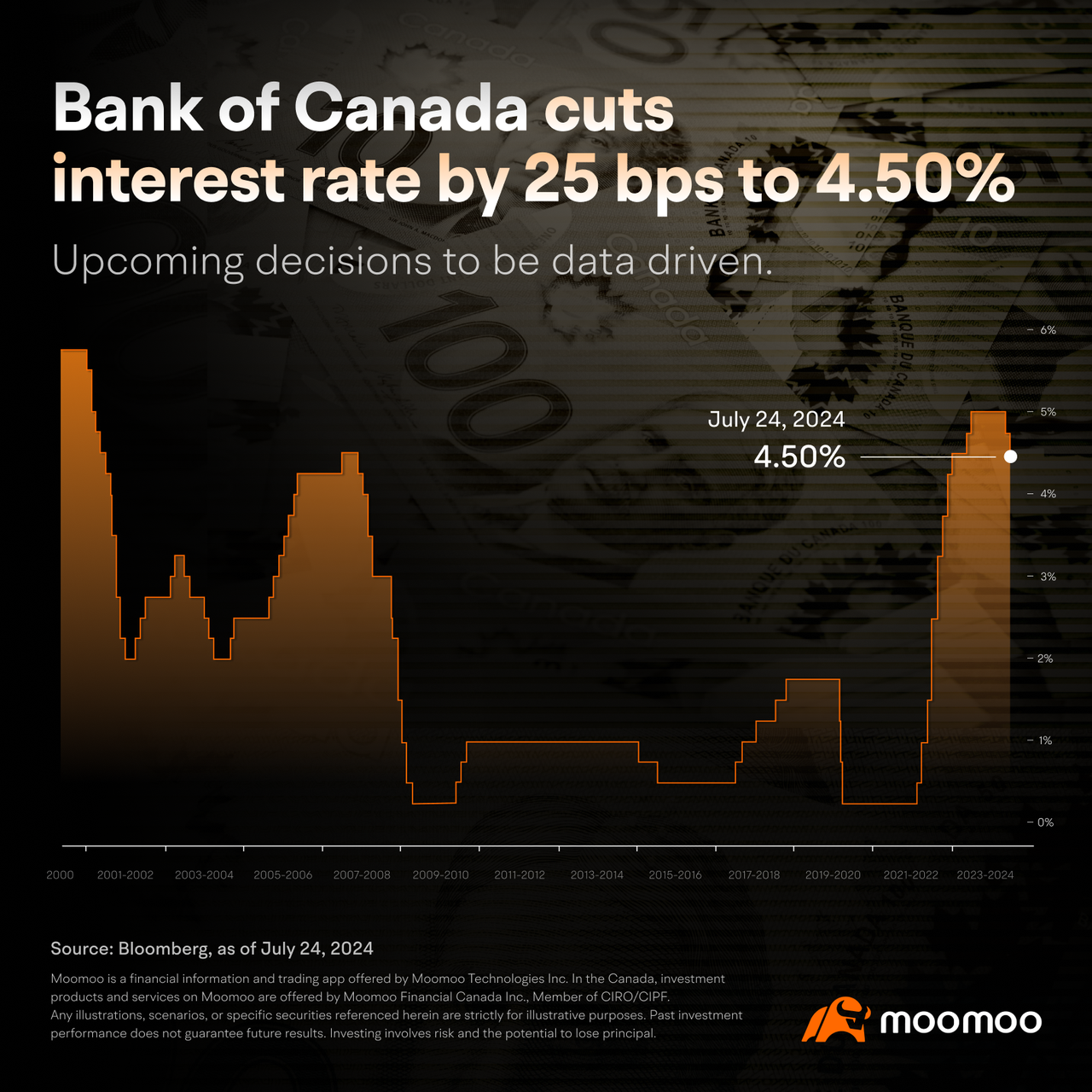

The Bank of Canada cut its key monetary policy rate to 4.50% Wednesday from 4.75%, leaving the door open for more rate cuts. Governor Tiff Macklem said it is "reasonable" to expect further easing if the economy and inflation evolve as expected.

So what exactly is the BOC expecting?

The central bank expects a soft landing in Canada, adding there is room for the economy to grow even as inflation eases, partly because of the excess supply.

The new economic projections show the CPI is seen averaging 2.3% in Q3, down from 2.7% in Q2, while real GDP growth is seen rebounding to an annual rate of 2.8% from 1.5% in Q2.

When will rate cuts happen?

BOC officials were pressed Wednesday during a press conference to give hints about the timing of interest rate cuts. The answer was that it will depend on incoming data. So keep watching indicators of:

● The balance between demand and supply in the economy

● Inflation expectations

● Wage growth

● Corporate pricing behaviour.

Also watch some factors that pose a risk to the inflation outlook:

● On the upside: persistent inflation in shelter and other services

● On the downside: weaker-than-expected household spending.

● With eyes on data, the central bank will make its decisions "one meeting at a time".

How low and how fast?

Going into the Covid-19 pandemic, the overnight rate target was 1.75% and Tiff Macklem warned that the current easing cycle won't take us that low. So don't plan for a BOC rate going back to that level.

Nor should you expect the central bank to ease as fast as it raised interest rates. The target rate went from 0.25% at its lowest level before the tightening cycle started in February 2022 to 4.25% at the end of 2022: this was a 400 basis point climbing journey within the span of just nine months. The policy rate peaked at 5% in July 2023.

The governor indicated the way down will likely be more gradual.

In the latest BOC quarterly Business Outlook Survey (BOS) conducted right before the June 5 rate cut - so when the policy rate was 5% - most Candian firms expected rates to decline by 0.5 to 1.0 percentage points over 12 months, which would put the target rate at 4.0% at the lowest by the spring of 2025.

How much room to diverge from the Fed?

Another question on investors' mind is whether the BOC has much room to diverge from the Federal Reserve.

On that front, Tiff Macklem said that while there are limits as to how much the BOC can diverge from the Fed, "we're not close" to having reached them yet.

His Senior Deputy Governor, Carolyn Rogers, also reminded that the drivers of Canadian inflation are more domestic today than they were before, when global supply-chain disruptions were affecting economies worldwide.

What about quantitative tightening?

The BOC continues its quantitative tightening. While it might appear contradictory at a time it says cutting rates is appropriate, it's important to remember that it currently aims to make monetary policy "not as restrictive". In other words, the stance remains restrictive. Just less than before.

This is why the central bank prefers to talk about a normalization of its balance sheet by letting bonds expire.

We can expect an update on the balance sheet front "sometime" in 2025 when we get closer to the point where the central bank believes the balance sheet is normalized, opening the door for government bond purchases again in the context of normal operations.

Opportunities for investors

How can investors find opportunities in the current easing cycle?

● The BOS survey showed that firms tied to consumers' essential spending reported a better sales outook than businesses related to discretionary spending.

● Firms related to industrial and heavy civil construction also expect sales to pick up due to demand coming from infrastructure projects in the tech and public sectors.

● Interest rate reductions are also brightening the outlook for residential real estate in the year ahead, although businesses see no substantial increases in housing demand, supply and prices.

● Since the June 5 BOC rate cut, the real estate, information technology and consumer staples sectors have led gains in the S&P/TSX Composite Index.

Follow the top Canadian market news to stay on top of market moving events.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment