TSLA

Tesla

-- 421.060 PLTR

Palantir

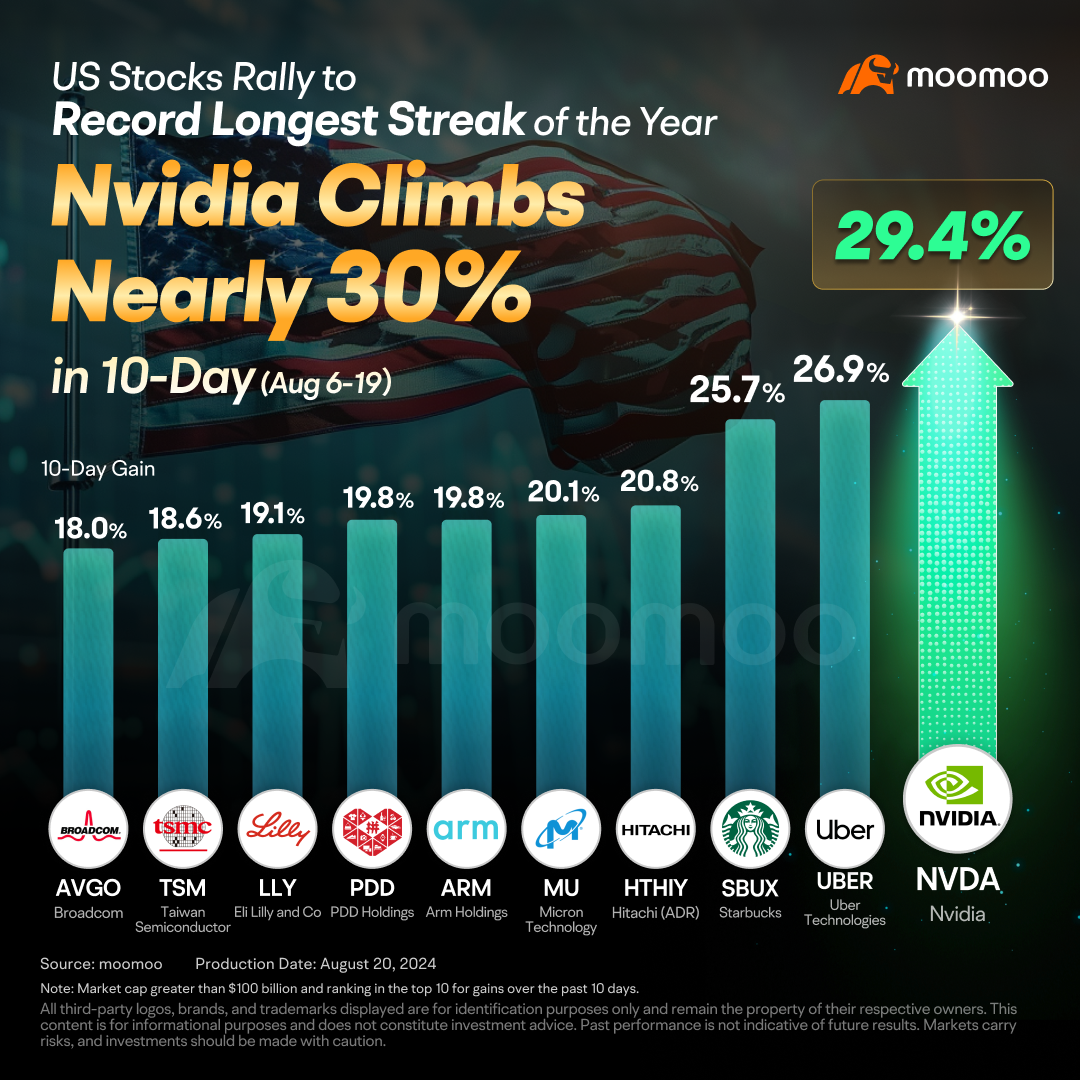

-- 80.550 NVDA

NVIDIA

-- 134.700 OXY

Occidental Petroleum

-- 47.130 AMD

Advanced Micro Devices

-- 119.210

Delayed chip release: Rumors suggest that the launch of the Blackwell GPU might be delayed until Q1 next year. This next-gen product was highly anticipated when announced earlier this year.

Executive stock sales: Following Nvidia's rise to the top of the global market in June, CEO Jensen Huang and other executives have been selling off shares.

Increasing competition: More tech giants are seeking alternatives to Nvidia for advanced AI training. $Advanced Micro Devices (AMD.US)$ 's strong Q2 performance highlights this growing competition.

Earnings significantly exceed market estimates.

Management expresses strong confidence in market demand for the rest of the year and beyond.

The Blackwell GPU delivery schedule remains unchanged.

Earnings only slightly exceed expectations.

Earnings guidance fails to excite the market.

Noticeable slowdown in revenue growth or a decline in profit margins.

Earnings guidance falls short of expectations.

AI Capital Expenditures (CAPEX) of major tech companies

Whether Nvidia can maintain its dominant market position.

Sell Signal: If the upward trend line is broken.

Buy Signal: If the downward trend line is breached.

mr_cashcow :

103970650 : so blackwell delivery schedule remain unchanged...got it.

102188573 : NVDA will beat expectation again

Edmond low : Ok

ATS A trade sniper : hohoho

104476495 : h

Yowe : lol

xiaomitu : FOMO AI MODE.

章允量 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101550592 :

View more comments...