Bridgewater, the world's largest hedge fund founded by Mr. Dalio, expanded its holdings of Apple shares in July-September, selling off Nvidia shares?

This article uses auto-translation in part.

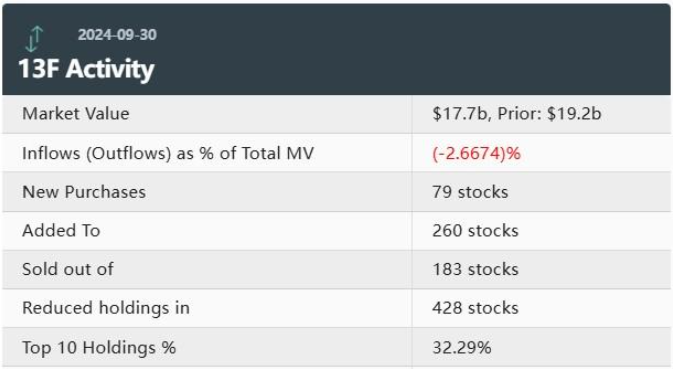

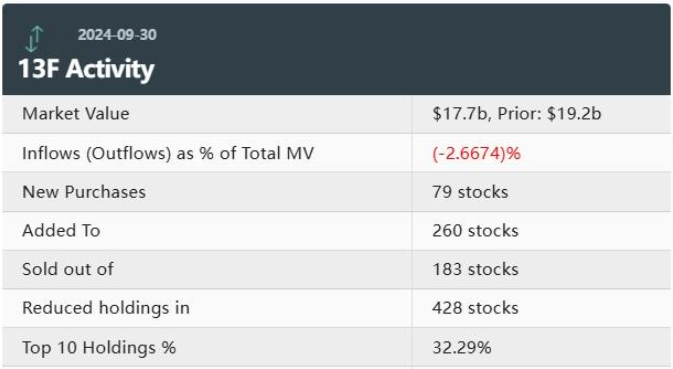

According to the disclosure from the U.S. Securities and Exchange Commission (SEC), Bridgewater Associates submitted the third quarter holdings report (13F) as of September 30, 2024.

According to statistical data, Bridgewater's total holdings in the third quarter were $17.7 billion, an 8% decrease from $19.2 billion in the previous quarter. In the third quarter, they acquired 79 new positions, added to 260 positions, reduced 428 positions, and sold 183 positions. The top 10 holdings account for 32.29% of total assets.

Among the top 5 stocks, the 1st place $iShares Core S&P 500 ETF (IVV.US)$holds approximately 2.22 million shares, with an evaluation value of around 1.28 billion dollars, accounting for 7.26% of the total portfolio. The number of shares held increased by 5.77% compared to the previous quarter.

2nd place is $iShares Core MSCI Emerging Markets ETF (IEMG.US)$with approximately 17.78 million shares held, valued at about 1.02 billion dollars, representing 5.78% of the total. However, the number of shares held decreased by 4.73% compared to the previous quarter.

The 3rd place is $Alphabet-A (GOOGL.US)$is in 3rd place with approximately 4.38 million shares held, valued at about 0.726 billion dollars, accounting for 4.11% of the total. The number of shares held has decreased by 3.54% compared to the previous quarter.

The 4th place is $NVIDIA (NVDA.US)$in 4th place, with approximately 4.75 million shares held, valued at about 0.577 billion dollars, representing 3.27% of the total portfolio. The number of shares held has decreased by 27.48% compared to the previous quarter.

The 5th place is $SPDR S&P 500 ETF (SPY.US)$So, the number of shares held is about 0.84 million shares, the valuation is about 0.48 billion dollars, accounting for 2.72% of the total. The number of shares held increased by 17.52% compared to the previous quarter.

Ranking from 6th to 10th are $Meta Platforms (META.US)$ 、 $Microsoft (MSFT.US)$ 、 $Procter & Gamble (PG.US)$ 、 $Amazon (AMZN.US)$ 、 $Apple (AAPL.US)$It is. Among them, the number of Apple shares held increased by about 120% compared to the previous quarter, while the other 4 positions have decreased significantly.

In addition, the holdings acquired in the third quarter include $Micron Technology (MU.US)$ 、 $Alibaba (BABA.US)$ 、 $ASML Holding (ASML.US)$ 、 $Bank of America (BAC.US)$ 、 $Baidu (BIDU.US)$including etc. On the other hand, $Oracle (ORCL.US)$ 、 $IBM Corp (IBM.US)$ 、 $Disney (DIS.US)$ I have sold all of the holdings such as etc.

Looking at the changes in holding ratios, the top 5 stocks with increased purchases are $iShares S&P 500 ETF (IVV.AU)$ 、 $Constellation Energy (CEG.US)$ 、 $Lam Research (LRCX.US)$ 、 $Apple (AAPL.US)$ 、 $Broadcom (AVGO.US)$That is. On the other hand, the top 5 selling positions are, $Procter & Gamble (PG.US)$ 、 $Amazon (AMZN.US)$ 、 $Costco (COST.US)$ 、 $Johnson & Johnson (JNJ.US)$ 、 $McDonald's (MCD.US)$It has become so.

moomoo News Zeber

Source: moomoo, Bloomberg

This article uses automatic translation in part.

Source: moomoo, Bloomberg

This article uses automatic translation in part.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment