Broadcom's market cap hits $1 trillion: Another surge in semiconductor sector?

Broadcom's market cap hits $1 trillion: Another surge in semiconductor sector?

Views 671K

Contents 70

Broadcom Joins Nvidia, Tesla in Top Stock Options as Market Cap Hits $1 Trillion

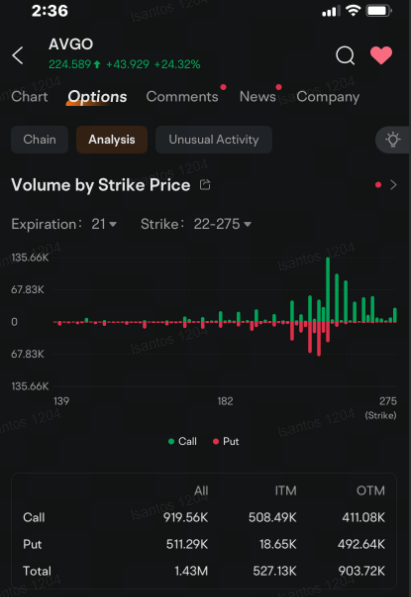

$Broadcom (AVGO.US)$'s entry into the elite group of stocks with a $1 trillion market capitalization has bolstered the appeal of its call options.

As of 2:36 p.m. in New York Friday, about more than 1.43 million Broadcom

options, making it the third most active stock option, behind

$NVIDIA (NVDA.US)$ and

$Tesla (TSLA.US)$. More than two thirds of Broadcom's contracts were call options.

(To see Broadcom's options chain, click

here. For Nvidia's options chain, click

here and you can find Tesla's

here.)

Broadcom's shares jumped more than 20% to trade at $218.04 after the supplier of semiconductors, enterprise software and security solutions provided investors a rosy outlook, buoyed by increasing demand from artificial intelligence applications. Friday's rally added almost $177 billion to its market value, taking it to $1.02 trillion.

The company reported adjusted earnings of $1.42 in the fiscal quarter that ended Nov. 3, up 31 cents from a year earlier. That beat the average analyst estimate by about 1.9%. While revenue rose 51% to $14.054 billion, it slightly missed consensus by 0.2%. But what impressed the market was the company's outlook for the AI revenue serviceable addressable market (SEM) for XPUs, the class of processors designed to handle specific types of workloads more efficiently than traditional central processing units (CPUs) and network.

"The star of the show was its massive serviceable addressable market (SAM) target of $60-$90 billion by fiscal 2027 for AI sales across three top hyperscale customers (two new customers add upside, we think)," Oscar Hernandez Tejada, an analyst at Bloomberg Intelligence said in a note Friday. "Our share assumptions applied to the updated SAM suggest significant upside to current consensus figures for AI revenue."

Call options giving the holders the right to buy Broadcom shares at $220 attracted the heaviest volume after the share price rally pushed the contract in-the-money before expiration today. More than 69,300 of those contracts were traded with more than 1 hour still left in the trading day. That's more than 24 times the open interest.

Fund inflows into the stock outpaced outflows by $752.5 million, adding to the sixth monthly net inflows into Broadcom. The biggest money came from small orders, exchange data show.

Amid the rally, technical indicators tracked by moomoo are starting to flag warning signs. The stock's surge sent the price above the upper line of the Bollinger band, a sign to some who study charts that the security is overbought, and the trend may soon turn lower. Ten of the remaining 14 technical indicators on the moomoo app tend to agree.

Share your thoughts on Broadcom's prospects in the comments section. Do you think the rally has room to run, or do you agree with the technical indicators which signal the trend could reverse? Let your voice be heard by voting below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

WadeSEC : Super informative, thanks again.

72309565 : no endersand english.

Hana Irfa : Thank you.

ariessanea chafford : what's going on here