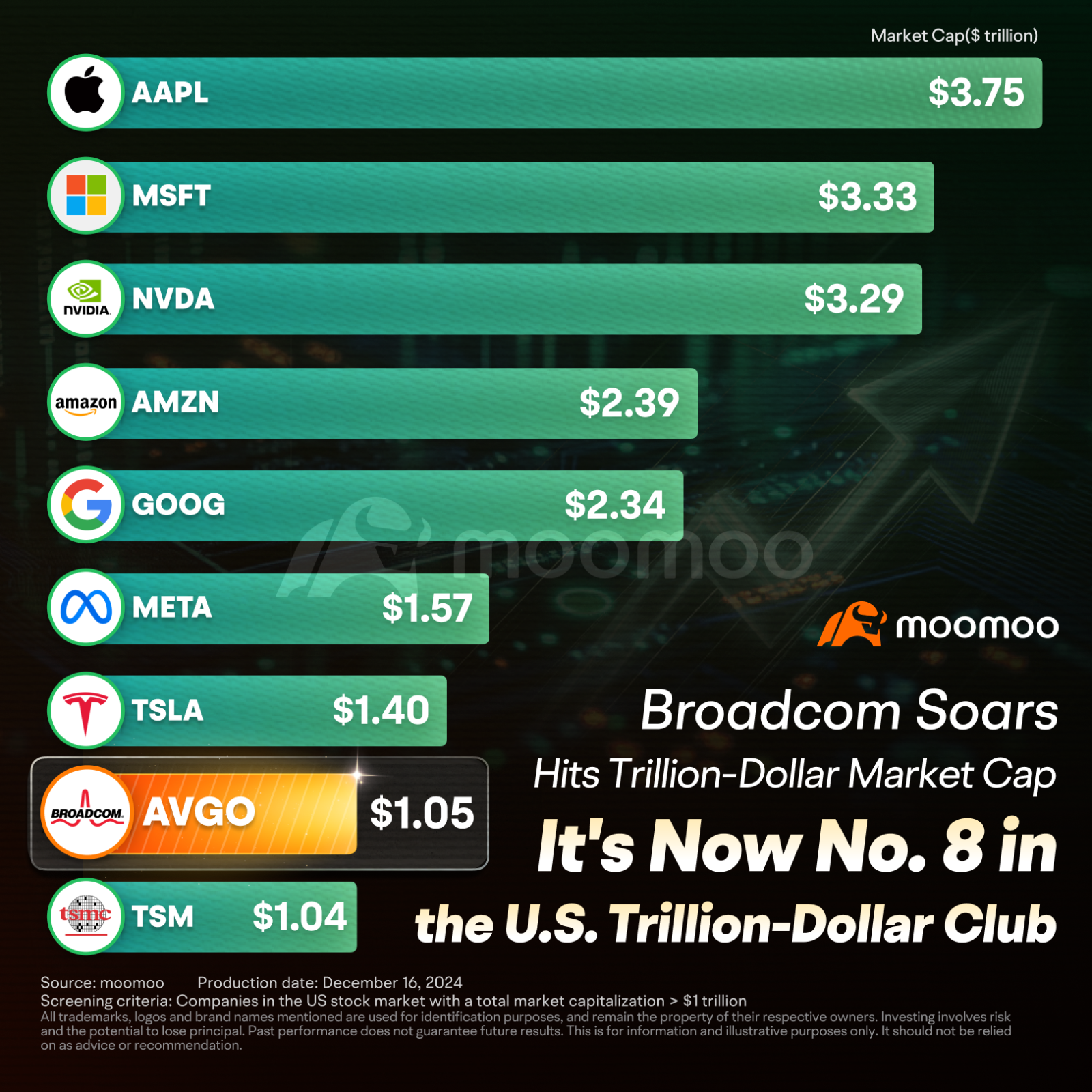

Broadcom Ranks 8th in Global Market Cap: What's Next?

On December 13th, Broadcom's stock price surged by over 24%, closing at $224.8 per share. The company's market capitalization surpassed the $1 trillion mark for the first time, making it the 12th company globally and the 9th in the United States to achieve a market value of $1 trillion. It also became the third semiconductor company to break the $1 trillion market cap barrier, following NVIDIA and TSMC.

ASIC has eclipsed GPU's glory recently

Broadcom's ASIC leadership positions it well for future AI competition. The company is developing custom AI chips with three major clients (Google, Meta, ByteDance) and working on next-gen AIXPUs with two others. It aims to convert these into revenue-generating customers by 2027, expanding its market.

On Monday, Goldman Sachs reaffirmed its buy rating for Broadcom and increased its 12-month target from $190 to $240. Bernstein reaffirmed their semiconductor cycle thesis, maintaining a positive outlook on some stocks while cautioning against others. They continue to favor Broadcom and Nvidia, both rated Outperform. Bernstein cites Broadcom's potential in AI ASICs and networking, and Nvidia's strong position in the upcoming Blackwell cycle.

Why are cloud providers still pushing ASIC design?

Despite NVIDIA's GPUs being preferred, Morgan Stanley notes that major cloud providers continue to develop ASICs for three main reasons:

To optimize internal workloads for AI inference and training.

For better cost-effectiveness. ASICs can be cheaper at scale than NVIDIA's expensive GPUs. For instance, AWS's Trainium 2 offers 30-40% better price-performance than NVIDIA's H100 for inference tasks.

To gain greater bargaining power in procurement negotiations through self-developed ASICs.

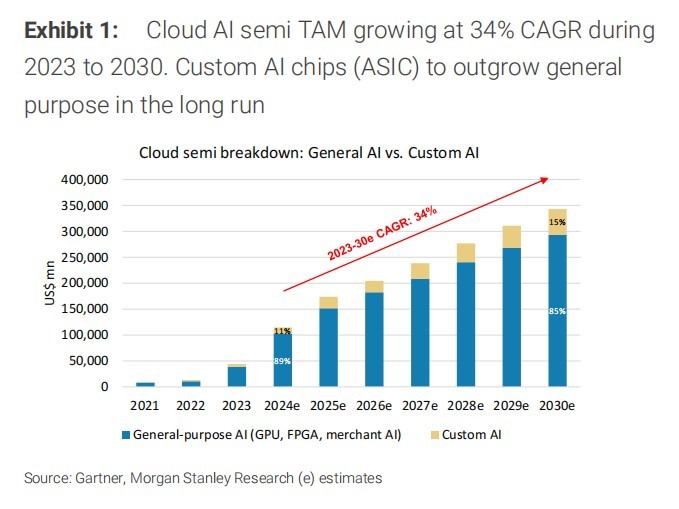

ASIC market far smaller but growing faster than GPUs

Morgan Stanley believes ASICs and GPUs will coexist long-term, serving different AI computing needs. The cloud AI chip market is expected to grow from $120 billion in 2024 to $300 billion in 2027, with a 35.7% compound annual growth rate. In the long run, ASICs are projected to outpace GPUs in this market.

Rosenblatt analyst Hans Mosesmann views comparing ASICs and GPUs as "apples to oranges." He predicts AI ASIC computing power will surpass GPUs in the near future, noting Broadcom's potential in AI acceleration, Gen AI, and cloud/edge networks.

Morgan Stanley also recommends focusing on "shovel stocks" such as TSMC and Cadence

Morgan Stanley concludes that the rise of ASICs does not mean the decline of GPUs. On the contrary, the two technologies will coexist for a long time, providing optimal solutions for different demand scenarios.

In the future AI market, ASICs will strive for a larger market share with advantages in cost and energy efficiency, while NVIDIA will continue to consolidate its market position with its technological leadership.

Regarding other potential winners, Morgan Stanley is optimistic about electronic design automation tools. Cadence is expected to achieve structural growth.

As for foundries, TSMC and its supply chain partners will benefit from the rapid growth in ASIC design and manufacturing.

Source: Benzinga, Morgan Stanley, investing.com

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Tiggerpepper : I want a trillion worth of market capital.

101550592 :

101550592 :