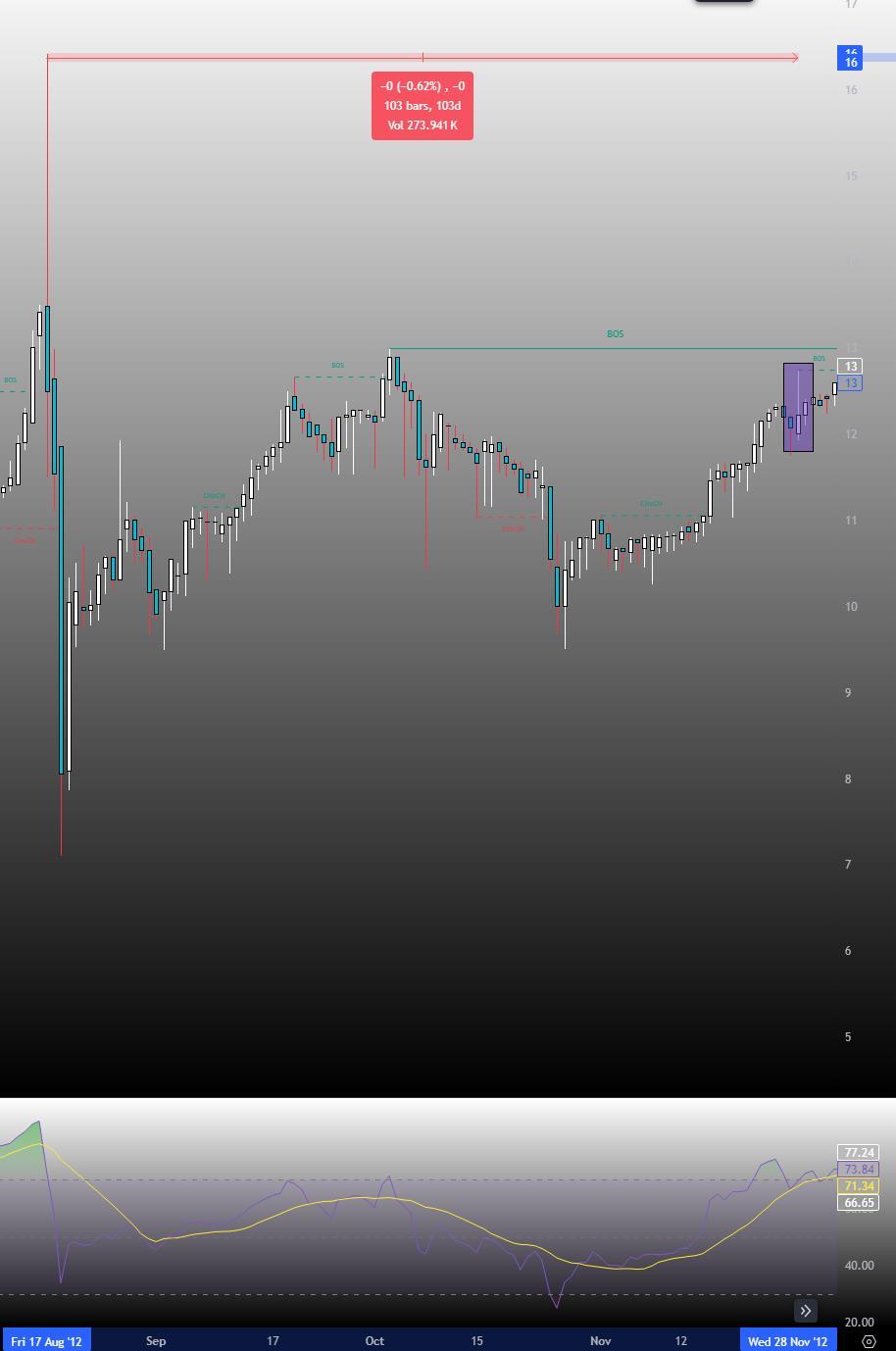

Remember, Bitcoin moved differently back in 2012. There was almost no support for the idea, minimal media coverage, and there certaintly were no Bitcoin ETF's. That being said, Bitcoin hit an all time high, dropped over the next 103 days leading into the halving, then on the day of the halving, Monday, Bitcoin actually went up.

MindOverMatter : Beautiful TA!

AkLi OP MindOverMatter : Thank you!