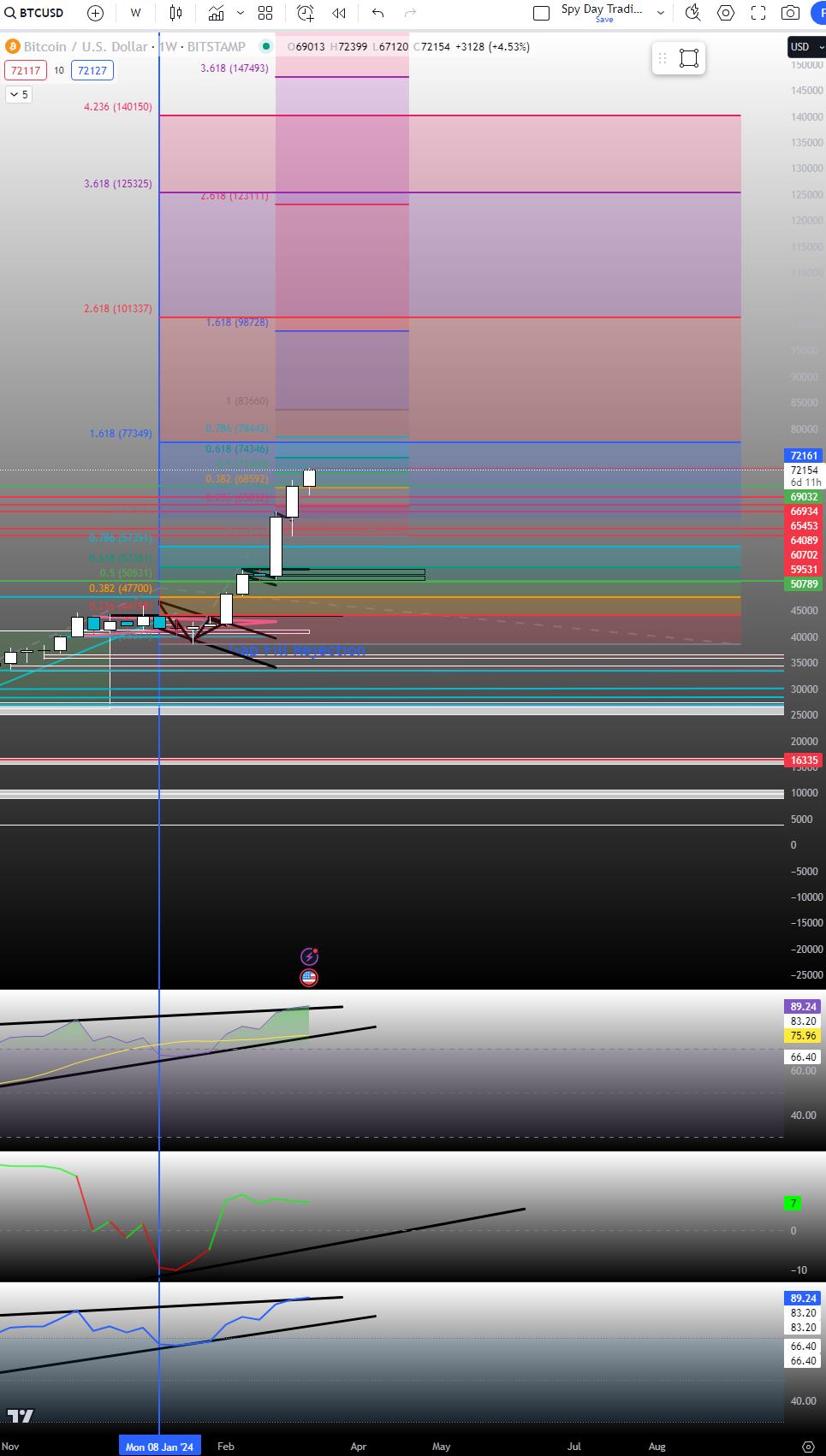

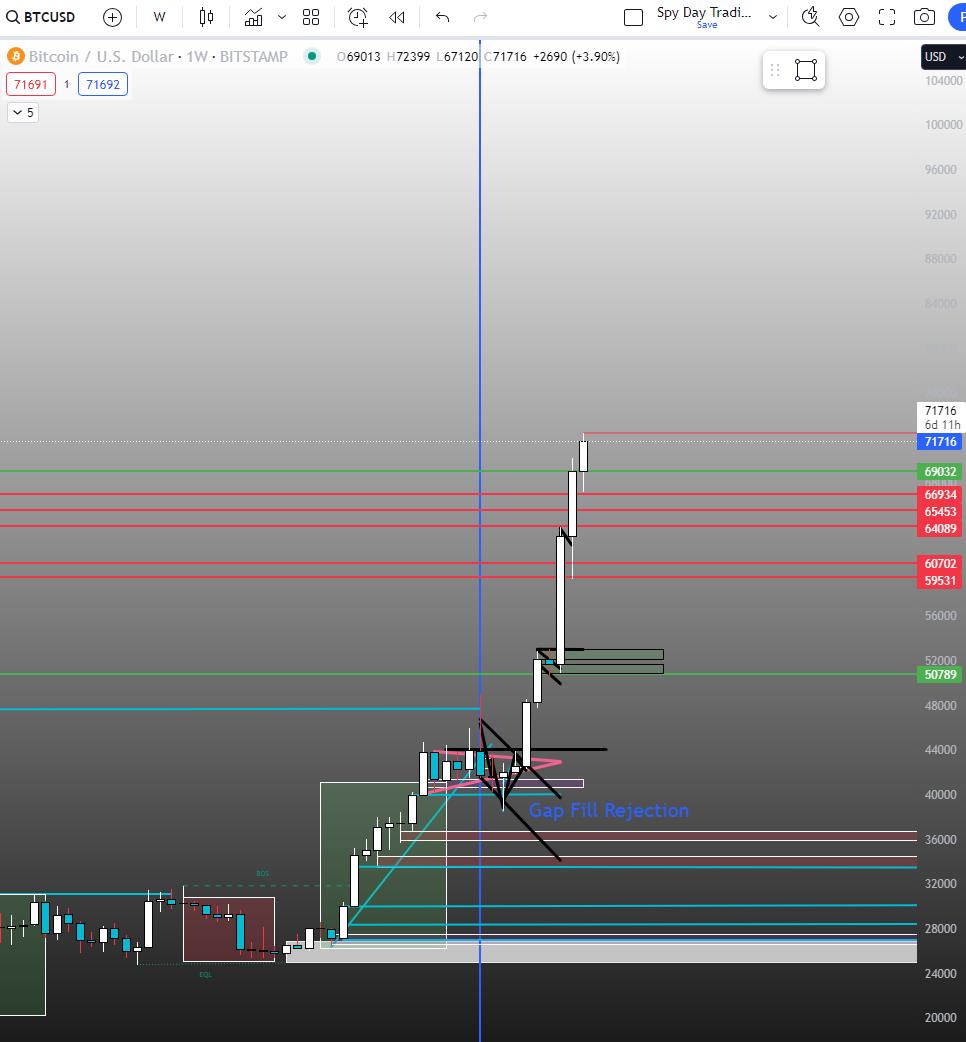

Don't get it twisted though, my levels up to this point were based off of previous levels from candles at the same price range. However, now that I know my levels from known prices are similar to the Fibinacci levels, I have a greater level of confidence that they will serve as areas of support and resistance, or in Day Trading terms, areas of possible selling and buying.

MetaClem : thanks for he effort!