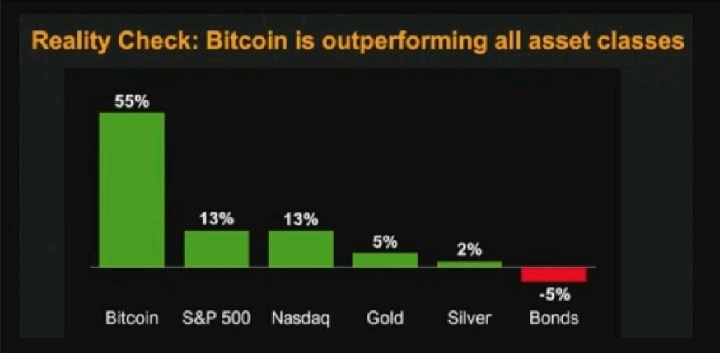

BTC’s annual return rate will gradually decline from 55% to 50%, 45%, 40%, 35%, 30%, 25%, and stabilize around 20%, roughly twice the growth rate of the S&P index.

By 2045, Bitcoin’s price is projected to reach $13 million per coin, and Bitcoin will account for 7% of global assets.

2. How to Handle High Volatility in Cryptocurrencies

Bitcoin has no options and can’t be shorted, so investing solely in Bitcoin means the volatility is essentially the risk.

For assets that can only be traded in one direction, you need to develop and stick to your trading logic, validating and refining it.

I’m not a short-term trader, so for me, using value investing methods for BTC may be more feasible: identify Bitcoin’s lows and its growth potential over the next year, three years, and five years, and ignore the volatility for long-term holding.

However, consider that Bitcoin has related stocks and ETFs. Stocks and ETFs can be shorted, and stocks have options for leveraging and profiting from volatility. For example, Coin and MSTR are strongly influenced by BTC’s performance, and ETFs are fully linked to BTC’s movements.

So, from the perspectives of crypto stocks, ETFs, and options, Bitcoin’s volatility could actually be an opportunity.

3. Potential Effective BTC Investment Strategies

Bitcoin is a high-risk investment. I’ve established some investment standards:

1. Asset Allocation

As mentioned, Bitcoin can only be bought long, but crypto stocks can be shorted, and options can profit from volatility.

So, you can hold Bitcoin and use options to hedge against Bitcoin’s downside risk.

For example, from August 2 to August 5, Bitcoin dropped 13%, while the puts on

$Coinbase (COIN.US)$ rose nearly 270%.

2. Position Management

Both Bitcoin and options are high-risk investments. Be sure to manage your positions carefully!

Never go all-in or use leverage. Always leave room for retreat and recovery capital.

Plan to invest no more than 5% of your monthly investment total in Bitcoin,

and allocate no more than 15% of your monthly investment total to Bitcoin + crypto stock options.

3. Use Profits to Play

The safest method for high-risk investments is to use profits for investing.

Allow yourself to trade short-term, like “buying the dip” and selling for profit, then reinvest the profits into BTC for long-term holding.

As always, invest in a way that lets you sleep well. Using profits for trading will never lead to losses.

Before the U.S. election, there will be many opportunities for Bitcoin volatility. I’ll try to analyze trading entry and exit points.

This is my current thinking on Bitcoin. As a newbie in BTC, I plan to try simulated trading to test my strategy.

Kinni420 : 100%