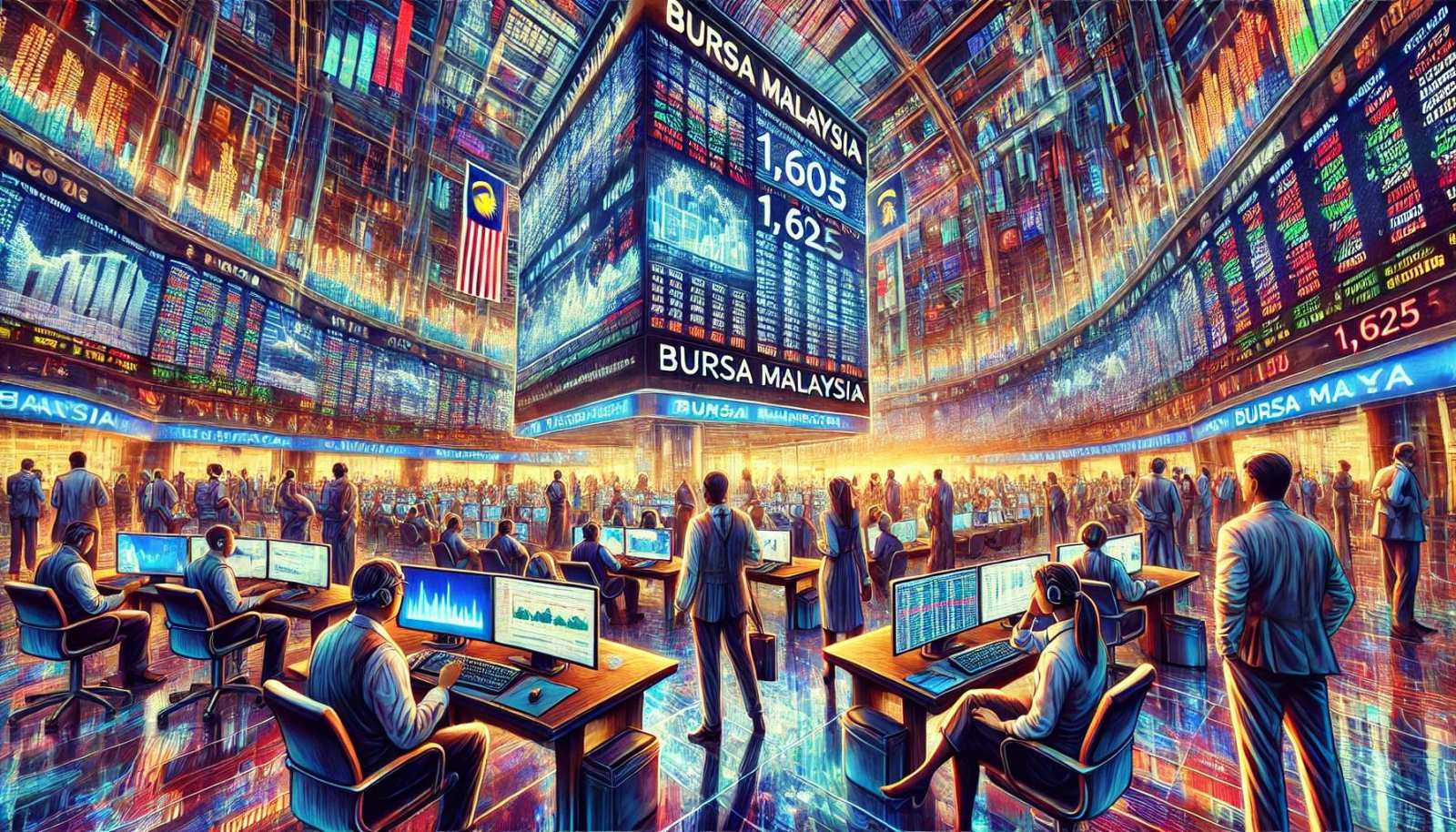

Bursa Malaysia to Consolidate with Upside Bias Next Week

Follow Our Official Telegram Channel tynkrlab

Bursa Malaysia is expected to remain in consolidation mode next week, with a slight upward bias. The index is anticipated to fluctuate within the 1,605-1,625 range, supported at the 1,600 level. Investors should keep an eye on potential market movers and sector-specific trends.

Key Sectors to Watch

• $Bursa Plantation (0025I.MY)$: This sector is showing appealing valuations and could see some action.

• $Bursa Energy (0061I.MY)$: Despite recent declines, energy stocks may offer opportunities for rebounds.

• $Bursa Finance Services (0010I.MY)$: The financial sector remains stable, presenting potential buy opportunities.

• $Bursa Technology (0005I.MY)$ and $Bursa Construction (0003I.MY)$: Select stocks in these sectors are also expected to attract interest, particularly those related to data center themes.

Economic Events and Company Earnings

Investors should stay tuned for the release of the US GDP advance estimate and consumer sentiment data, which may provide guidance on potential interest rate changes. These events could influence global market sentiment and, consequently, Bursa Malaysia.

Insights

• Short-Term Consolidation: While the market is consolidating, the long-term trend remains upward as the index holds above the 50-day EMA.

• Turnover Trends: Turnover has eased slightly, indicating cautious trading. However, there’s potential for selective accumulation in undervalued sectors.

• Global Influence: Be prepared for spillover effects from Wall Street and other regional markets, which may impact local sentiment.

Potential Market Movers

• Selected Blue Chips: Keep an eye on blue-chip stocks for potential rebounds after profit-taking activities.

• Construction and Property: These sectors might see increased activity due to ongoing infrastructure developments and attractive valuations.

Actionable Insights for Investors

• Buy the Dips: Consider accumulating stocks in sectors like plantation, energy, and banks during dips.

• Monitor Global Data: Stay updated on key economic indicators and corporate earnings reports that could influence market movements.

• Diversify: Spread investments across different sectors to manage risks and capitalize on potential growth areas.

• $Bursa Plantation (0025I.MY)$: This sector is showing appealing valuations and could see some action.

• $Bursa Energy (0061I.MY)$: Despite recent declines, energy stocks may offer opportunities for rebounds.

• $Bursa Finance Services (0010I.MY)$: The financial sector remains stable, presenting potential buy opportunities.

• $Bursa Technology (0005I.MY)$ and $Bursa Construction (0003I.MY)$: Select stocks in these sectors are also expected to attract interest, particularly those related to data center themes.

Economic Events and Company Earnings

Investors should stay tuned for the release of the US GDP advance estimate and consumer sentiment data, which may provide guidance on potential interest rate changes. These events could influence global market sentiment and, consequently, Bursa Malaysia.

Insights

• Short-Term Consolidation: While the market is consolidating, the long-term trend remains upward as the index holds above the 50-day EMA.

• Turnover Trends: Turnover has eased slightly, indicating cautious trading. However, there’s potential for selective accumulation in undervalued sectors.

• Global Influence: Be prepared for spillover effects from Wall Street and other regional markets, which may impact local sentiment.

Potential Market Movers

• Selected Blue Chips: Keep an eye on blue-chip stocks for potential rebounds after profit-taking activities.

• Construction and Property: These sectors might see increased activity due to ongoing infrastructure developments and attractive valuations.

Actionable Insights for Investors

• Buy the Dips: Consider accumulating stocks in sectors like plantation, energy, and banks during dips.

• Monitor Global Data: Stay updated on key economic indicators and corporate earnings reports that could influence market movements.

• Diversify: Spread investments across different sectors to manage risks and capitalize on potential growth areas.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment