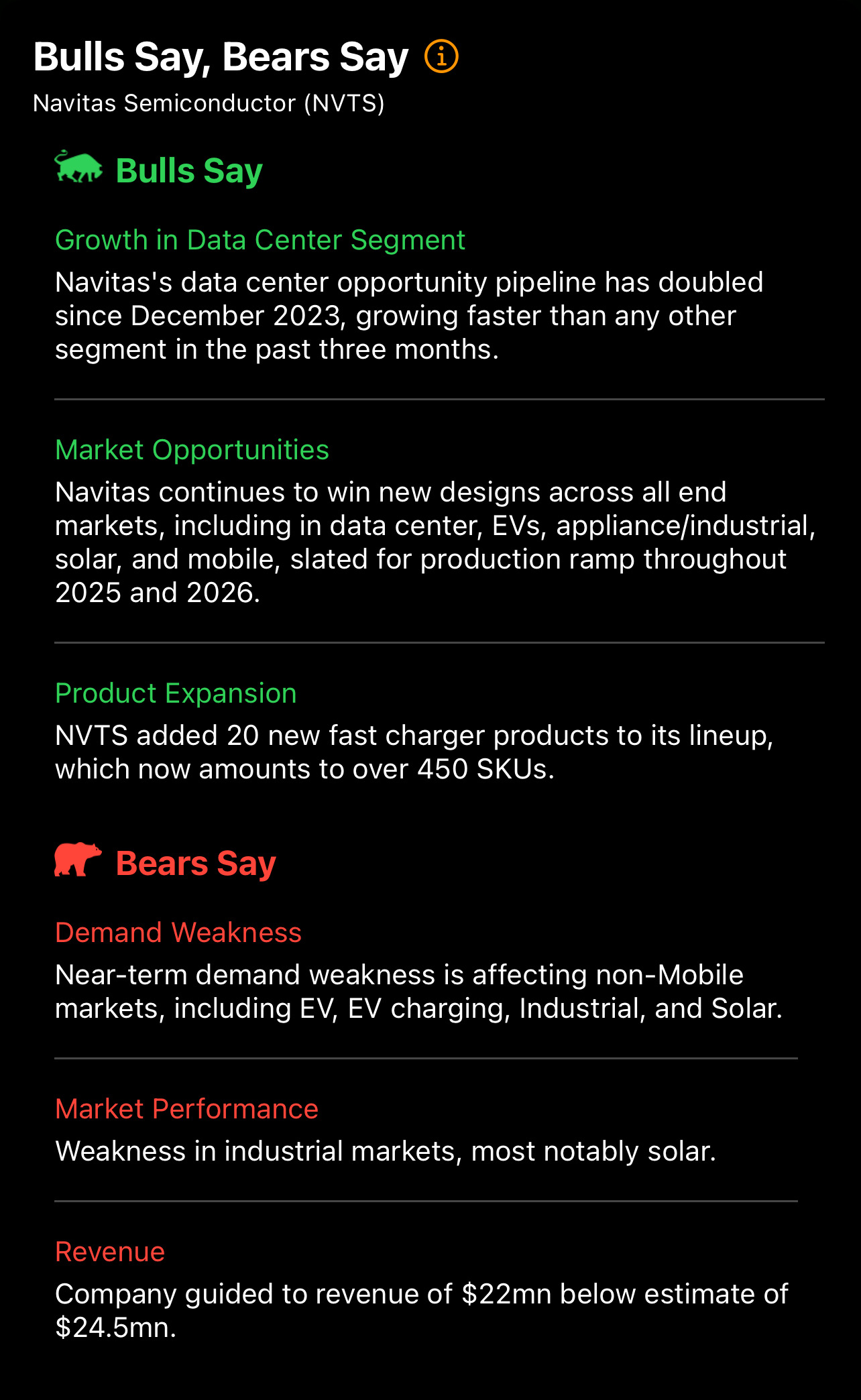

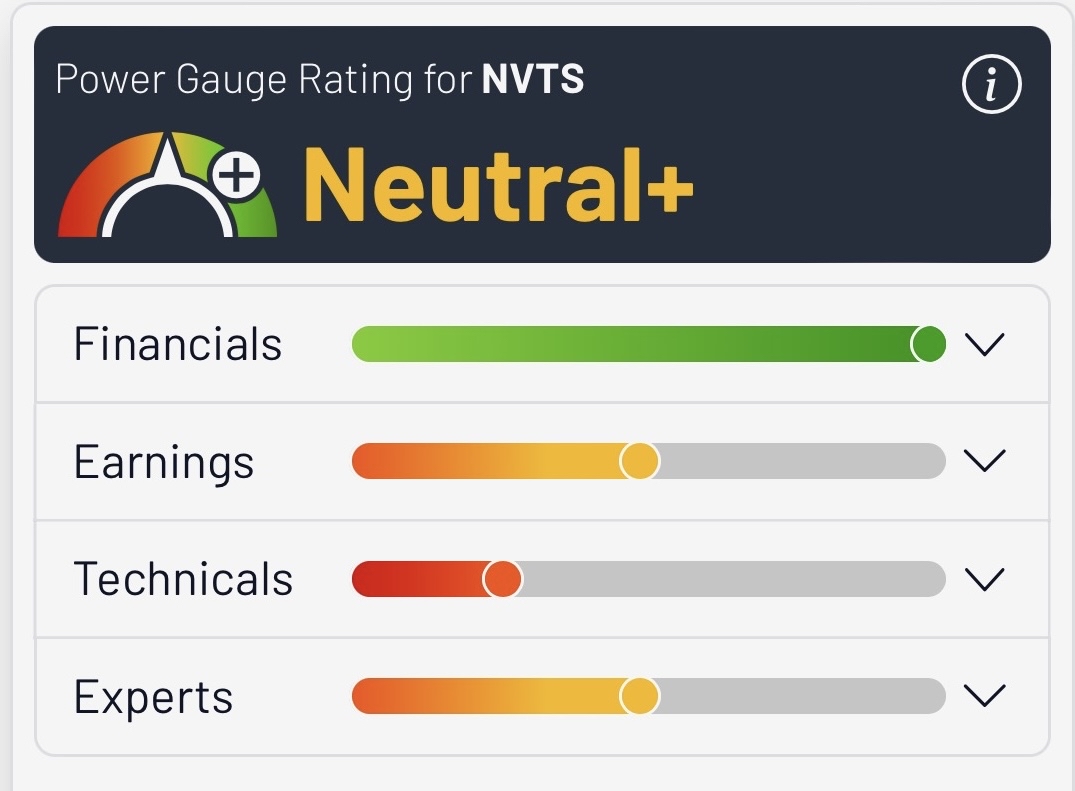

Navitas Semiconductor's revenue growth persists, albeit with ongoing negative earnings. A potential stock reversal may be on the horizon unless the company implements strategic price adjustments and refocuses on profitable earnings execution.

Notably, Navitas collaborates with established and profitable partners, presenting opportunities for synergistic growth. To capitalize on these partnerships and drive sustainability, Navitas may need to:

1. Optimize pricing strategies to enhance revenue margins.

2. Streamline operations to reduce costs and improve efficiency.

3. Enhance earnings visibility through disciplined financial management.

Successful execution of these strategies could potentially drive a stock reversal, positioning Navitas for long-term success