TSLA

Tesla

-- 462.280 NVDA

NVIDIA

-- 140.220 PLTR

Palantir

-- 82.380 MSTR

MicroStrategy

-- 358.180 AMD

Advanced Micro Devices

-- 126.290

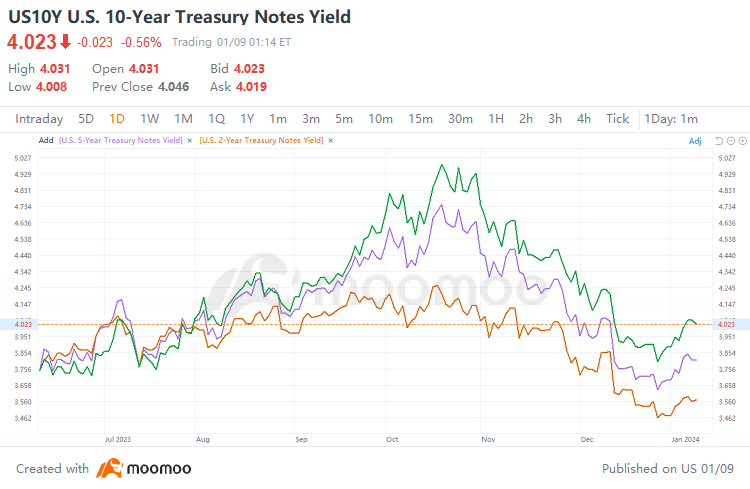

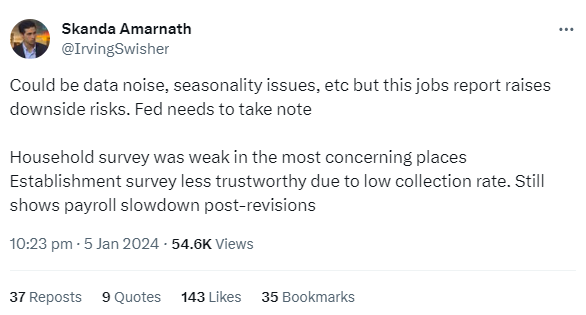

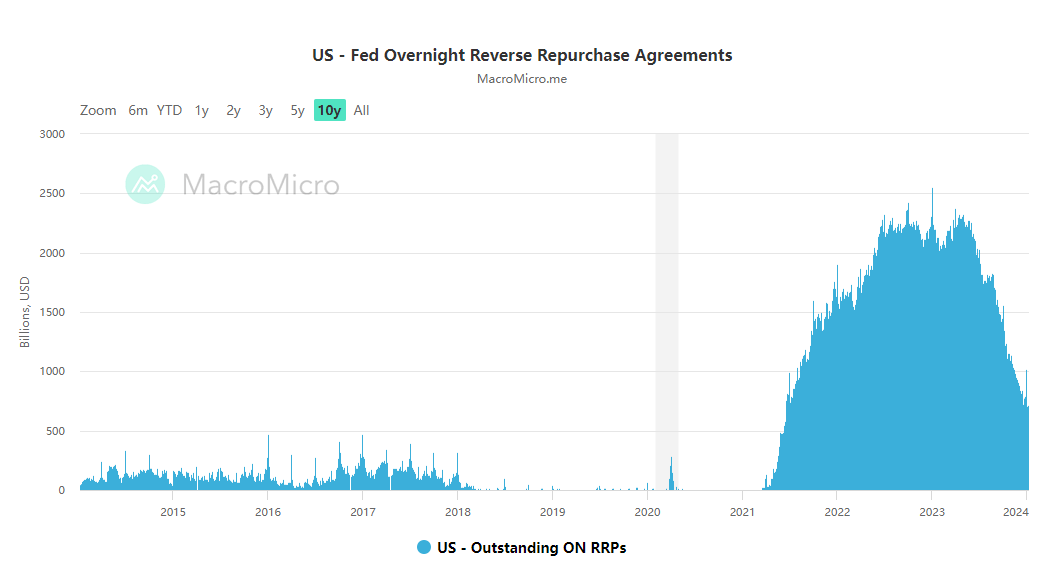

“The bond market is not ready to give up on their optimistic assessment for Fed rate cuts this year; A narrative of buying on the dips will remain, and it will take more than one jobs report to change that,” said Kevin Flanagan, head of fixed-income strategy at WisdomTree.

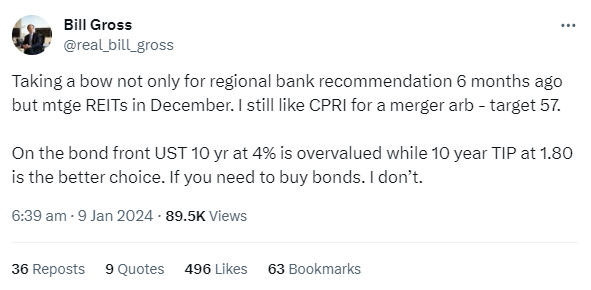

“The market got way too ahead of the Fed”, but he further suggested that investors “can start owning interest rates, this back up is great.”

“As we go through the course of the year, the 10-year can get below 3.5% and that is dependent on inflation moving lower and growth becoming a little weaker.”

She stated,“Should inflation continue to fall closer to our 2% goal over time, it will eventually become appropriate to begin the process of lowering our policy rate to prevent policy from becoming overly restrictive.”

72914002 :