Buying This Takeover Target Offers 10X Upside. Esperion Therapeutics.

$Esperion Therapeutics (ESPR.US)$ $Esperion Therapeutics (ESPR.US)$ Esperion Therapeutics (ESPR) is a biotech company that focuses on developing and commercializing therapies to lower cholesterol, specifically offering the only FDA-approved statin alternatives: NEXLIZET and NEXLETOL for PRIMARY PREVENTION. These drugs are designed for individuals who are statin intolerant or cannot achieve adequate cholesterol lowering with statins alone. Statins are widely used to manage high cholesterol, and millions of Americans either cannot tolerate them or have maxed out their doses, presenting a substantial market opportunity for Esperion’s drugs.

Given that approximately 21 million Americans are statin intolerant or have reached the maximum dosage of statins, and over 71 million Americans take statin drugs, there is a significant patient population that could benefit from NEXLIZET and NEXLETOL. The company expects that NEXLIZET alone will have over 500,000 patients using it by 2026, generating potentially over $1 billion in annual revenue. This forecast is based on ongoing prescription growth and market demand.

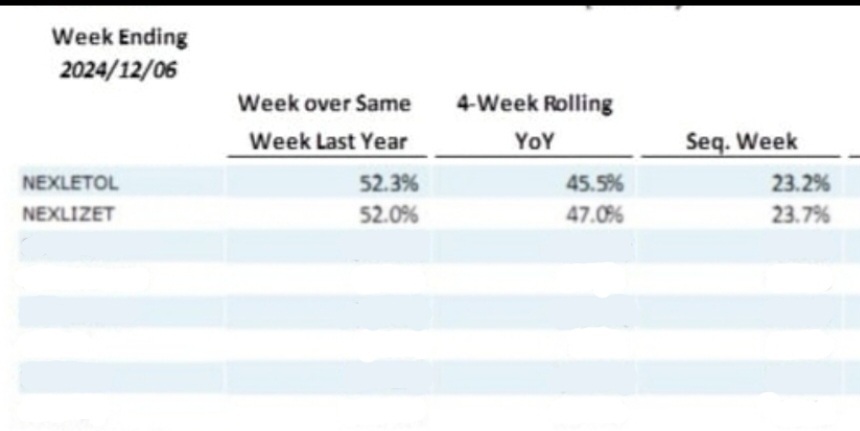

Last weeks strong Script growth:

Esperion's projected 2025 earnings estimate is between $0.25 and $0.35 per share, which signals the company is soon moving toward profitability. As a result, some analysts believe that Esperion could become a prime acquisition target, with a potential acquisition price significantly higher than its current stock price of $2.25. The belief is that, given the strong market opportunity and the company's role in addressing a critical need for statin alternatives, a larger pharmaceutical company could acquire Esperion at a premium, possibly above $10 per share.

Average $0.32 Earnings by Analysts 2025.

Esperion Therapeutics (ESPR) has recently faced a pullback in its stock price, despite reaching a 52-week high near $4 per share. The decline in its stock price seems to be driven by news of a competitor, $NewAmsterdam Pharma (NAMS.US)$ NewAmsterdam Pharma's (NAMS), Phase III trial results for its CETP inhibitor, Obicetrapib. The trial showed a 33% placebo-adjusted reduction in low-density lipoprotein cholesterol (LDL-C) and a 21% reduction in major adverse cardiovascular events (MACE) after one year. These results were seen as competitive against Esperion's NEXLETOL, which reduces LDL-C by 25%, and NEXLIZET, which reduces LDL-C by 38%, with many patients experiencing up to a 50% reduction.

However, several important points suggest that the market's reaction to this news may have been overblown:

1. Different Mechanisms of Action: NEXLETOL and NEXLIZET are unique because they do not require patients to take a statin. They can be used as standalone treatments for cholesterol reduction, whereas NewAmsterdam's drug, Obicetrapib, is considered an add-on therapy to statins, and is not intended to be taken alone. This gives Esperion’s drugs a distinct advantage in terms of patient population and ease of use.

2. HS-CRP Reduction: One of the key differentiators for NEXLETOL and NEXLIZET is their ability to lower high-sensitivity C-reactive protein (hs-CRP) levels, an important marker of inflammation. Elevated hs-CRP levels are associated with increased cardiovascular risk, even in individuals with normal cholesterol levels. Both NEXLETOL and NEXLIZET have been shown to reduce hs-CRP by about 25%, which suggests they may help address both cholesterol levels and inflammation, a combined risk factor for cardiovascular events. In contrast, NewAmsterdam's Obicetrapib has not demonstrated a significant effect on hs-CRP levels, which could limit its overall cardiovascular benefit. Even major drugs like Amgen's Repatha and Regeneron's PCSK9 inhibitors, which lower LDL-C significantly, do not impact hs-CRP levels.

3. Market Opportunity and FDA Approval Timeline: While NewAmsterdam's drug may show promising LDL-C reduction, it is not expected to be FDA-approved until late 2027, and it will take longer for insurance coverage to be widespread, making the drug less accessible in the near term. In contrast, Esperion's NEXLIZET and NEXLETOL are already FDA-approved, with NEXLIZET having a primary prevention label, a significant advantage for addressing heart disease risk in a broad patient population.

4. Strong Market Position: Esperion’s drugs are well-positioned in the statin alternative market, especially given the large number of statin-intolerant patients (around 21 million Americans) and those who have maximized their statin doses. The projected growth of NEXLIZET, with an estimated 500,000 patients using it by 2026 and generating over $1 billion in annual revenue, further strengthens Esperion’s potential for long-term success.

Given these factors, the market's reaction to the news about NewAmsterdam Pharma may not fully reflect the underlying strength of Esperion's position in the market. The company's ability to offer statin-free alternatives, along with its demonstrated impact on both LDL-C and hs-CRP levels, provides a compelling case for its future growth. Additionally, the long timeline for approval and insurance coverage of Obicetrapib further diminishes the immediate competitive threat.

The recent stock sell-off based on NAMS news of Esperion (ESPR) seems unwarranted based on these competitive dynamics and the company's differentiated product offering. The current pullback could represent a buying opportunity.

The recent selloff of Esperion Therapeutics (ESPR) stock appears to be unjustified for several key reasons, including a favorable new debt deal and the growing likelihood of an acquisition. Here's an overview of the factors that support a positive outlook for Esperion:

1. New Debt Deal

Esperion recently secured a $250 million debt deal that is favorable for shareholders, positioning the company for solid growth. Key points include:

– The previous convertible debt of $265 million was significantly reduced, with $210 million paid off, leaving only $55 million at a 4% interest rate, Esperion intends to pay in full at maturity 11/2025.

– The new debt structure involves two loans: $100 million New Notes equal to 32,679,740 shares at $3.06 a share will be redeemable, in whole or in part, for cash at Esperion’s option at any time, and from time to time, on or after December 20, 2027 and prior to the forty-first (41st) scheduled trading day immediately before the Maturity Date, but only if the last reported sale price per share exceeds 130% of the conversion price for a specified period of time and certain other conditions are satisfied.

Favorable non dilutive $150 million simple loan at 9.75% Maturity 12/2029. The annual interest payments for both loans will be manageable totaling $20.4 per year.

– Importantly, $140 million will be paid by Otsuka in 2025, along with new royalties, boosting Esperion's cash flow and further reducing financial strain.

2. Operational Improvements and Cost Savings

Esperion has entered into an arrangement with DSE to take over product manufacturing, which will result in significant cost savings:

– Esperion is expected to save an minimum by our model of $5.96 per script due to the switch to DSE’s manufacturing, based on their current 475,000 scripts. By the end of 2025, DSE is projected to have over 600,000 scripts, leading to an minimum estimated $33.9 million in total savings for the year. Of this, about $17 million will be saved in 2025 from the expected tech transfer mid 2025.

– These savings significantly improve Esperion’s cost structure, making the company more profitable in 2025.

3. Strong Growth Potential

Esperion is poised for strong growth in 2025:

– With new markets opening in Canada, Israel, and Australia, the company is set to generate additional revenue streams starting in 2025.

– The company’s NEXLIZET and NEXLETOL are the only statin alternative drugs with primary prevention labels, offering a unique position in a massive market of statin-intolerant patients or those requiring additional LDL-C lowering. These drugs are expected to see strong prescription growth, contributing to further revenue growth.

4. Increased Acquisition Likelihood

The favorable debt structure, improving financials, and unique market position make Esperion an attractive merger and acquisition candidate:

– Analysts from Needham and Jefferies anticipate that acquisition offers could materialize in early 2025.

– HC Wainwright analyst Joseph Pantginis has set a $16 price target for the stock, with a $12 to $16 buyout range considered reasonable. Factors contributing to this include Esperion’s $1.5 billion tax loss carryover, which could be highly beneficial for an acquirer.

– Esperion’s patent protection for its drugs extends until 2031, with additional patents extending out to 2040, providing strong intellectual property protection and long-term market exclusivity.

5. Potential Acquisition Premium

Given Esperion’s solid patent portfolio, market-leading position in statin alternatives, and favorable financial structure, it is highly likely that the company will attract acquisition interest. The $16 price target reflects potential buyout offers, which analysts believe could materialize as early as 2025, with a $12 to $16 buyout range being considered reasonable.

The recent stock selloff in Esperion Therapeutics (ESPR) is not justified, as the company is in a strong financial position, has a favorable new debt structure, and is poised for growth in 2025. The new debt terms make the company more attractive to potential acquirers, and Esperion’s unique position in the market for statin alternatives strengthens its acquisition prospects. With the addition of new market opportunities and cost-saving measures, Esperion is expected to be profitable in 2025, and its potential acquisition could lead to substantial upside for shareholders. Given these factors, Esperion remains a strong investment, with a 2025 year-end conservative stock price range estimated between $7 and $9.

For investors, this combination of unmet medical need, market growth potential, and the possibility of an acquisition presents a compelling case for the stock's future growth.

Esperion Therapeutics (ESPR) appears to be significantly undervalued relative to its competitor NewAmsterdam Pharma (NAMS), with a market cap of under $450 million compared to NAMS’ $2.3 billion. However, the dynamics of the market, particularly with the growing acceptance of Esperion's drugs, NEXLIZET and NEXLETOL, make a compelling case for why Esperion should be valued much higher. Here are the key points supporting this:

1. Esperion’s Growth Trajectory

Esperion is entering a strong growth curve, as more insurance companies are beginning to cover the cost of its drugs. This is crucial because NEXLIZET and NEXLETOL are becoming widely accessible, and script sales are expected to grow at a compounding rate. The company’s milestone payments and royalties are expected to continue increasing significantly over the next few years, with projections of $300 million and $600 million in milestone and royalty payments within the next three years alone. This revenue growth, coupled with rising demand for statin alternatives, paints a positive future for Esperion.

2. Statin Side Effects Drive Demand for Alternatives

A major catalyst for Esperion’s success is the growing dissatisfaction with statin drugs due to their side effects. Over 30% of statin users experience adverse effects, which include:

– Muscle pain and tendinopathy

– Type 2 diabetes

– Memory loss

– Fatigue

– Depression

– Low testosterone

– Vision problems

These side effects are significant enough to cause many patients to seek alternatives. NEXLIZET and NEXLETOL provide a critical solution, as they specifically target LDL-C lowering without causing widespread effects on the body. Unlike statins, which get into all cells, NEXLIZET works specifically in the liver and small intestines, reducing the risk of side effects.

3. NEXLIZET and NEXLETOL: A Better Solution

– NEXLIZET (bempedoic acid + ezetimibe) and NEXLETOL (bempedoic acid) work exclusively on the liver and intestines, targeting cholesterol production more precisely and without affecting other parts of the body. This targeted mechanism of action drastically reduces side effects compared to statins, which affect multiple body systems.

– PCSK9 inhibitors also lower LDL-C, but they can cause side effects like low energy, flu-like symptoms, rashes, and injection site swelling. In contrast, NEXLIZET and NEXLETOL have no known side effects, as confirmed by experts like Dr. Peter Attia, who advocates for these drugs due to their safety profile.

4. The Market Shift Toward Statin Alternatives

The shift away from statins is a key trend, as patients and healthcare providers are becoming more aware of the adverse effects associated with these drugs. This shift will likely accelerate, benefiting Esperion significantly, as the company offers the only FDA-approved statin alternatives with primary prevention labels.

– NEXLIZET and NEXLETOL are statin-free options, which are particularly important for statin-intolerant patients and those who cannot achieve adequate LDL-C lowering with statins alone. As this patient base grows, so will the demand for Esperion's drugs.

5. Underestimated Value

Given the market potential, unique position in the statin alternative market, and strong growth trajectory, Esperion’s current valuation is highly undervalued at under $450 million. With the increasing demand for statin alternatives, growing market share, and upcoming milestone payments and royalties, the company’s potential to grow revenue and profit over the next few years is substantial.

6. Acquisition Potential

With a favorable debt deal, growing revenues, and a clear path to profitability, Esperion is increasingly seen as an attractive acquisition target. Larger pharmaceutical companies looking to expand into the statin alternative market may see Esperion as a valuable addition to their portfolio, especially as the demand for safer cholesterol-lowering therapies grows.

Esperion’s NEXLIZET and NEXLETOL offer significant benefits over statins and other alternatives, with their targeted mechanism of action and absence of side effects. As insurance coverage expands and sales grow, Esperion’s stock price should reflect its true value, which is currently underappreciated. Given the growing market for statin alternatives, the company’s favorable financial position, and the potential for future acquisition, Esperion is well-positioned to see substantial growth in the coming years.

Esperion’s market cap should indeed be much higher, and its entry into a growth phase combined with its strong position in the statin alternative market presents a compelling opportunity for investors.

1. The Statin Landscape: Dominance and Limitations

– Statins are the most prescribed drugs worldwide, used by 71 million Americans to lower cholesterol. However, over 10% of statin users are statin intolerant, meaning they cannot tolerate the common side effects like muscle pain, fatigue, and elevated blood sugar.

– Additionally, over 20% of statin users need additional treatments to lower their LDL-C (bad cholesterol) to a safe level. This creates a massive unmet need for statin alternatives.

2. The Need for Statin Alternatives

While drugs like PCSK9 inhibitors (e.g., Repatha by Amgen and Alirocumab by Regeneron) can lower LDL-C significantly, they come with higher costs and injection-related side effects. Another commonly used statin alternative is Ezetimibe, but it’s only 15% effective on its own and has a limited effect in patients who need more significant LDL-C lowering. This makes Ezetimibe less effective for many patients, and its prescription growth may decline due to the availability of more effective and safer alternatives.

3. NEXLIZET and NEXLETOL: The Statin Alternatives of the Future

Esperion’s NEXLIZET (a combination of bempedoic acid and ezetimibe) and NEXLETOL (bempedoic acid) are the only statin alternative drugs with a primary prevention label, which makes them suitable for patients at risk for cardiovascular disease but not yet diagnosed. They are not just LDL-C lowering agents; they also provide additional benefits by lowering hs-CRP (high-sensitivity C-reactive protein), a marker of inflammation that is linked to cardiovascular events. This makes them a comprehensive solution for managing cholesterol and cardiovascular risk.

– NEXLIZET is as effective as a statin and works better than many statins without the associated serious side effects like raised blood sugar or muscle pain. It can lower LDL-C by 40%, and some patients achieve reductions of over 50%.

– NEXLETOL, which is just bempedoic acid, provides a similar effect and can also be used as a statin-free alternative either alone or in combination with statins.

4. Massive Market Opportunity

There is a significant market opportunity for NEXLIZET and NEXLETOL:

– 21 million Americans (out of the 71 million who take statins) need additional cholesterol-lowering therapies to reach safe LDL-C levels, creating a large patient population that these drugs can serve.

– In particular, NEXLIZET, with its combination therapy, has the potential to become a first-line choice for many patients because of its efficacy and safer side effect profile.

– Ezetimibe, with its limited effectiveness, is likely to see a decline in usage as more patients turn to NEXLIZET and NEXLETOL.

5. Prescription Growth and Revenue Potential

By 2028, NEXLIZET is projected to easily exceed 2 million prescriptions per year, which will drive massive revenue growth for Esperion. The combination therapy's superior efficacy, fewer side effects, and primary prevention label will make it an attractive option for both doctors and patients.

– As more patients switch from statins or need additional therapies, Esperion is poised to capture a significant portion of the cholesterol-lowering market.

6. Long-Term Market Trends

– Insurance coverage for NEXLIZET and NEXLETOL is expanding, making them more accessible to patients and likely boosting adoption rates.

– The demand for statin alternatives will continue to rise as more patients experience side effects from statins or require more effective treatments to lower LDL-C.

Conclusion: Esperion’s Strong Position in the Market

Esperion has positioned itself as a leader in the statin alternative space with its NEXLIZET and NEXLETOL drugs, which provide highly effective LDL-C lowering with a better safety profile compared to statins. As more patients require statin alternatives due to intolerance or insufficient LDL-C lowering, Esperion is poised for significant growth, with 2 million prescriptions for NEXLIZET alone expected by 2028. The company’s primary prevention label for both drugs, combined with their cost-effectiveness and fewer side effects, makes them ideal options for the millions of Americans who need better cholesterol management.

Esperion Could Reach $21 In 2026 On A 30X Forward P/E of $0.70 (Price To Earnings Ratio) Based On Analyst Estimates:

Amgen $Amgen (AMGN.US)$ and other PCSK9 companies know they will lose market share, a once a day pill is by far the easier and safer option versus an injection, also PCSK9 drugs don't lower HSCRP levels, and that is a BIG concern. NEXLIZET and NEXLETOL significantly lower hscrp levels, they have an edge over statin drugs and pcsk9 injections because they basically have no side effects and do not cause A1C #'s to rise, which is a becoming a serious concern because more and more people are seeing their A1C levels rise while taking a statin drug and at the risk of type 2 diabetes.

$Pfizer (PFE.US)$ has been active in the cardiovascular space and acquiring Esperion would complement its existing portfolio, providing a boost with Esperion's cholesterol lowering drugs, Pfizer's extensive marketing and distribution network could significantly increase the reach and sales of Esperion's drugs.

AstraZeneca $AstraZeneca (AZN.US)$ has a strong cardiovascular franchise and has shown interest in expanding its pipeline in this therapeutic area. Esperion's products would enhance AstraZeneca's offerings, especially given the complementary nature of their drug portfolios.

Novartis $Novartis AG (NVS.US)$ has also been expanding its cardiovascular and metabolic disease portfolio. Acquiring Esperion could fit, adding innovative therapies that align with Novartis's focus on cardiovascular.

Merck $Merck & Co (MRK.US)$ Is developing a PCSK9 pill that could come to market by 2030 yet it would be wise for Merck to snap up Esperion now before NEXLIZET becomes a blockbuster drug. Merck could easily offer a stock deal that could be very favorable and value ESPERION near the $15 per share valuation. MRK has an oral PCSK9 in trials that will be completed in Nov 2029. So won't come to market until 2030. it takes additional years for the FDA to grant a primary prevention label.

AstraZeneca $AstraZeneca (AZN.US)$ has a strong cardiovascular franchise and has shown interest in expanding its pipeline in this therapeutic area. Esperion's products would enhance AstraZeneca's offerings, especially given the complementary nature of their drug portfolios.

Novartis $Novartis AG (NVS.US)$ has also been expanding its cardiovascular and metabolic disease portfolio. Acquiring Esperion could fit, adding innovative therapies that align with Novartis's focus on cardiovascular.

Merck $Merck & Co (MRK.US)$ Is developing a PCSK9 pill that could come to market by 2030 yet it would be wise for Merck to snap up Esperion now before NEXLIZET becomes a blockbuster drug. Merck could easily offer a stock deal that could be very favorable and value ESPERION near the $15 per share valuation. MRK has an oral PCSK9 in trials that will be completed in Nov 2029. So won't come to market until 2030. it takes additional years for the FDA to grant a primary prevention label.

$Johnson & Johnson (JNJ.US)$ is another company that would do well to acquire Esperion, Interesting is Esperion former Chief medical Officer is now at JNJ,

Esperion currently has 18% of the float held short, if investors in $GameStop (GME.US)$ $Chewy (CHWY.US)$ $AMC Entertainment (AMC.US)$ with #wallstreetbets seriously researched Esperion they would realize how deeply undervalued the company is and recognize the upside reward is incredible. I doubt you will find another biotech or company that is valued so low and could generate billions on a yearly basis, investing in ESPR now is like buying some of these big names before the massive upside returns, such as $NVIDIA (NVDA.US)$ $Advanced Micro Devices (AMD.US)$ $AST SpaceMobile (ASTS.US)$ $SoundHound AI (SOUN.US)$ $Alphabet-C (GOOG.US)$ $CrowdStrike (CRWD.US)$ $Coinbase (COIN.US)$ $Qualcomm (QCOM.US)$ $Spotify Technology (SPOT.US)$ $Adobe (ADBE.US)$ $Lululemon Athletica (LULU.US)$ $Oracle (ORCL.US)$ $Palo Alto Networks (PANW.US)$ $Carvana (CVNA.US)$ $Dell Technologies (DELL.US)$ $Arista Networks (ANET.US)$ $Applied Materials (AMAT.US)$ $Texas Instruments (TXN.US)$ $Ulta Beauty (ULTA.US)$ $Synopsys (SNPS.US)$ $Cummins (CMI.US)$ $Trump Media & Technology (DJT.US)$ $KLA Corp (KLAC.US)$ $GE Aerospace (GE.US)$ $Intuitive Machines (LUNR.US)$ $Netflix (NFLX.US)$ $Apple (AAPL.US)$ $Regeneron Pharmaceuticals (REGN.US)$ $Jazz Pharmaceuticals (JAZZ.US)$ $C3.ai (AI.US)$ $Palantir (PLTR.US)$ $Snowflake (SNOW.US)$ $Costco (COST.US)$ $Microsoft (MSFT.US)$ $Meta Platforms (META.US)$ $Uber Technologies (UBER.US)$ $Lyft Inc (LYFT.US)$ $Core Scientific (CORZ.US)$ $Moderna (MRNA.US)$ $MARA Holdings (MARA.US)$ $Riot Platforms (RIOT.US)$ $Tilray Brands (TLRY.US)$ $Viking Therapeutics (VKTX.US)$ $Meta Platforms (META.US)$ $Novavax (NVAX.US)$ $Broadcom (AVGO.US)$ $Intel (INTC.US)$ $Tesla (TSLA.US)$ $Super Micro Computer (SMCI.US)$ $Salesforce (CRM.US)$ $Micron Technology (MU.US)$ $Xeris Pharmaceuticals (XERS.US)$ $Candel Therapeutics (CADL.US)$ $IREN Ltd (IREN.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Millaai : Are you being trapped and looking for a rescuer everywhere?

Growth Investor27 : Good info, NEXLIZET is a great drug, my brother takes it. ESPR stock is undervalued, should be above $5

Growth Investor27 Millaai : The author has been buying below $2 so your comment is off. This research article has all the due diligence to see, other than the fact Institutions have been heavly buying this year, fintel shows now 74% owned. ESPR is a good investment.

104248191 : please f o

Detached House Millaai : You are wrong. Though short term looks like the price is consolidating, the weekly chart looks promising! So look at the chart to see if it aligns with the fundamentals before criticising others!

105251507 : medical stock is thrash btw...look elli lilly lose all the hype and in downward turn

Black Hole : Please do research by yourself about the stock and buy. This is just advertising to buy and they make profits. Author account does not do any trading here, only doing advertising.

104803845 : This is by the absolute definition of not promising lol

AsianSlaveMaster Detached House : Did you take a position on this stock? With a comment like that to hold water, it's expected for you to hv skin in the game - otherwise your post doesn't differentiate much from previous person.