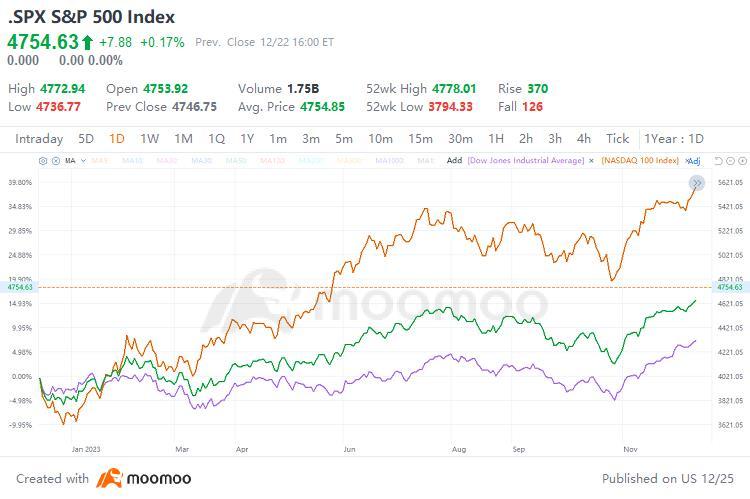

Data reveals that the gains in the S&P 500 this year are primarily driven by the "Big Seven" in the tech sector—Apple, Microsoft, Google, Amazon, Meta, and the newest additions, NVIDIA and Tesla. Excluding the "Big Seven," nearly one-third of the S&P component stocks have experienced declines this year. Additionally, 72% of S&P component stocks have underperformed the index, reaching the highest level since 2000.

102086369 : The US presidential election year next year will definitely improve the stock market

Meltyy OP 102086369 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

T JDDIBG : Entering the second half of the year, the US economy continued to outperform market expectations while the Treasury ramped up debt issuance. Reputation unexpectedly lowered the US bond rating and drove long-term US bond yields to rise rapidly, not reaching 5% in the 10-year period, creating a strong Q3 stock valuation correction. So the market will only move in a good direction, don't be nervous![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

hnubc1 : Optimistic. It’s going to be a 2018 all over again.

ZnWC : Thanks for sharing a "balance" view about the US stock market 2024.

The difference in rating among analysts showed that the stock market is still very volatile. Although voted optimistic, I think no one can accurately forecast if the market is bullish or bearish due to many uncertainties. Our view will depend on risk appetite and holding power.