Canada GDP, CPI Challenge Bank of Canada. Eyes on Jobs

Canada's April GDP rebounded 0.3% in April after being flat in March, with preliminary data for May pointing to more gains, albeit limited to 0.1%.

While the April GDP report was as expected and matched Statistics Canada's own advance estimate, the rebound comes on the back of an unexpected acceleration in inflation.

Together, these reports challenge the Bank of Canada's confidence, raising the stakes for the upcoming employment report on Friday.

Source: Statistics Canada

Which sector have been contributing?

Gains in April GDP were broad based across of 15 of 20 sectors, with both services and goods-producing industries expanding 0.3%.

Wholesale trade, up 2% from March, was the largest monthly contributor:

● Personal household goods were up 3.5%, pointing to domestic demand momentum at a time the central bank is closely watching the balance of supply and demand in the economy.

● Motor vehicles and parts and accessories rose 8.0%, the largest monthly increase since October 2021.

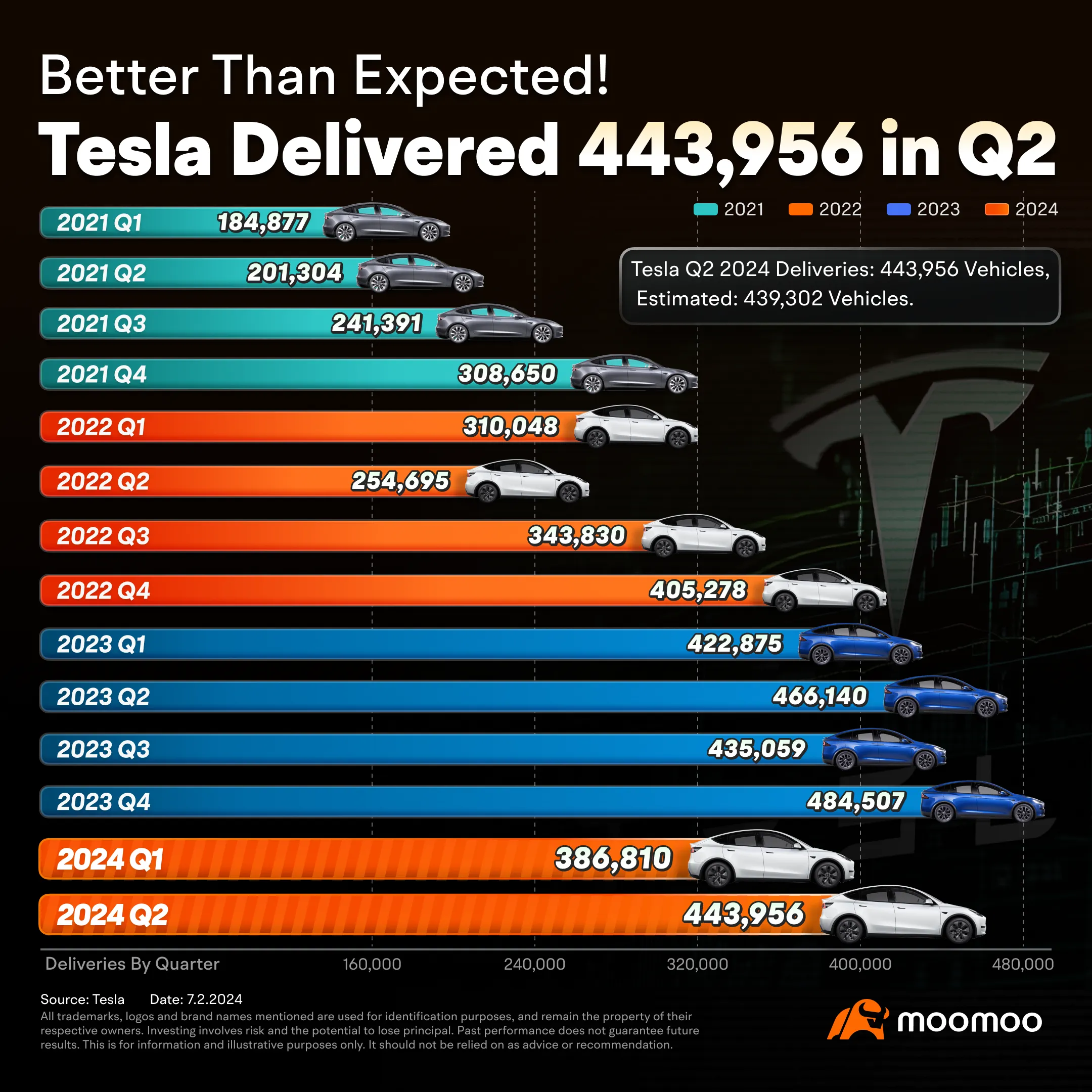

In auto-related market events this week,Tesla's vehicle deliveries were more resilient than expected in the second quarter, when they contracted 5%, driving up $Tesla (TSLA.US)$ share prices.

Besides wholesale, retail trade, mining, quarrying, and oil and gas extraction and manufacturing also supported Canada GDP growth in April.

Sector contributions to Canada's monthly GDP

Source: Statistics Canada

Eyes on Canada's employment data

While international markets will eye the US employment report - the mother of all economic indicators - let's not forget that the Bank of Canada believes current drivers of inflation are more domestic.

Among them, the central bank is particularly focused on wage growth, which makes it a key data point to watch in Friday's Labour Force Survey (LFS) report, especially since the average hourly earnings growth picked up to 5.1% year-over-year in May from 4.7% in April.

But keep in mind that the LFS is only one source of input for wage growth. The BoC follows a so-called "wage-common" quarterly indicator that also factors in average hourly earnings from the payrolls report, compensation per hour from the productivity accounts and hourly wages ans salaries from the national accounts report. The wage-common has been on an easing trend for the past year from 3.2% in the first quarer 2023 to 3.0% in the first quarter of this year. Unit labor costs are another source of wage costs the central bank is looking at.

While the LFS report provides the most timely data, it's important to keep in mind the broader approach of the central bank when looking at the overall picture.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment