Canada Housing State of Play: More Rate Cuts, More Time Needed to Boost Construction, Affordability

Housing affordability remains a major obstacle to home buying in Canada.

Canadians continue to feel the pinch of high prices on their finances despite the decline of the inflation rate to the 2% Bank of Canada's target from a peak of 8.1% in June 2022. A significant source of this inflation remains shelter, with mortgage interest cost still up 18.8% year-over-year, even though it marks a significant slowdown from over 30% in the summer of 2023.

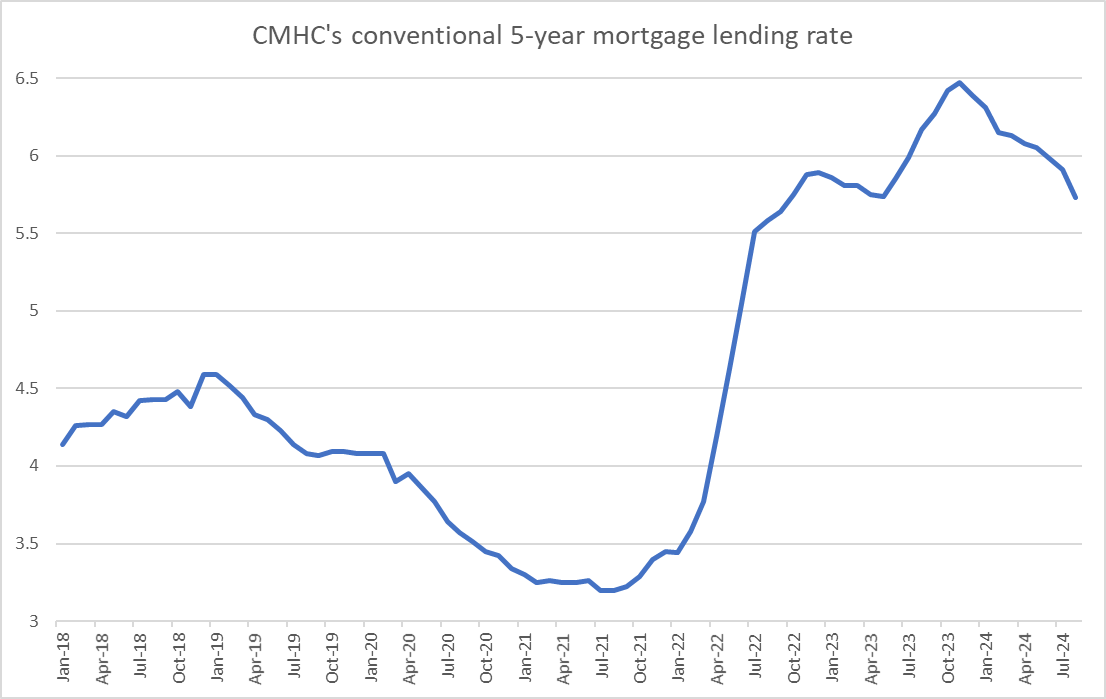

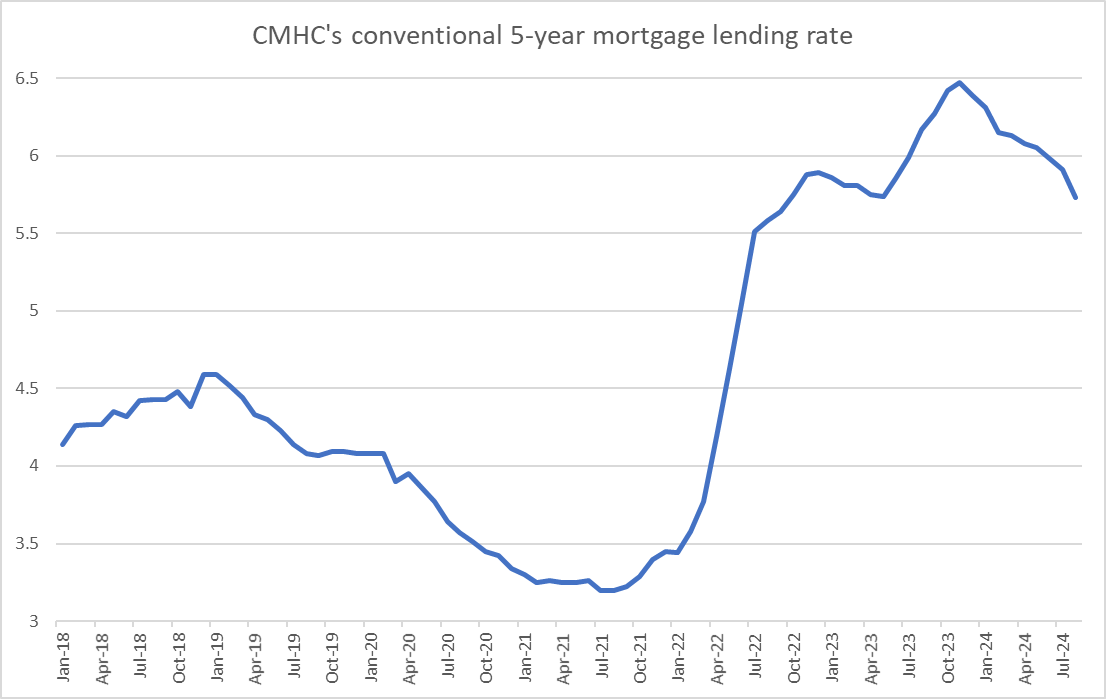

The Office of the Superintendent of Financial Institutions (OSFI) estimated that as of February 2024, 76% of outstanding mortgages will be coming up for renewal by the end of 2026, potentially creating a payment shock, especially for homeowners who took out mortgages between 2020 and 2022. In August 2024, the conventional 5-year mortgage lending rate - used in the most common types of mortagges - stood at 5.73%, compared with 3.57% in August 2020.

Source: Statistics Canada, Canada Mortgage and Housing Corporation

With mortgage debt accounting for nearly three-quarters of total household outstanding debt, surely a payment shock would have an impact on other aspects of household finances, hence spending decisions. The pace of mortgages borrowing was little changed in the second quarter, increasing to $18.3 billion after $17.3 billion in the first quarter.Household credit market debt, seasonally adjusted flows

Source: Statistics Canada

Data from the third quarter will provide a better reading of the impact of monetary policy easing as the first rate cut was in June, while the third quarter will include additional cuts in July and September that brought the key policy rate to 4.25%.

Relaxed mortgage rules

Since 2018, mortgage borrowers must qualify for a minimum rate to evaluate their ability to repay the loan when interest rates rise. This minimum qualifying rate - amounting to a stress test - is the greater of the following:

- The lender's rate + 2%

- The minimum qualifying rate set by the OSFI: currently at 5.25%.

When time comes for the 5-year interest rate reset, homebuyers are not submitted to a new stress test unless they switch bank. Recent changes impact this rule and others.

The table below summarizes the most recent mortgage rules changes.

Sources: Department of Finance Canada, Office of the Superintendent of Financial Institutions (OSFI)

The reaction to the new measures have been divided. Some experts believe the rules are too little to make a difference in affordability and could even risk increase debt levels for longer. They argue the new rules will boost housing prices by stimulating demand, leading to more affordability issues down the road in the absence of a significant increase in construction activity. Other believe it could help younger generations become owners.

More rate cuts, more construction, more time needed to boost affordability

So far, the real sate market reaction to both rate cuts and the recent mortgage rules changes has been muted, unlike real estate related stocks, which have been supported.

Rate cuts are a blunt intrument that takes months before their full impact can be felt in the real economy.

For instance, the Bank of Canada cut rates in June and July by a cumulative 50 basis points. But The Canadian Real Estate Association estimated in August that existing home sales were "mostly stuck in a holding pattern". CREA Senior Economist Shaun Cathcart sees the holding pattern as a result of buyers holding off until affordability improves further.

On the supply side, housing starts dropped 22% in August. Canada Mortgage and Housing Corporation Chief Economist Bib Dugan still estimates that contruction needs to pick up to restore affordability.

In fact, Statistics Canada reported that investment in building construction was down 1.7% in July, led by a 2.2% decline in the residential sector.

Investment in building construction, seasonally adjusted

Source: Statistics Canada

Also keep in mind that zoning rules - what you can build and where - remain an important, local and slow-to-move part of the supply equation.

What to watch for next?

The Bank of Canada will release its quarterly Business Outlook Survey October 11. It will be an important source of information potentially offering an update on anticipations from firms linked to real estate, especially since their rate cut expectations in the last survey were rather modest.

The second quarter survey was conducted right before the June interest rate cut, between May 9 and 29. At that time, Canadian businesses expected the key policy rate to decline by 0.5 to 1.0 percentage points over 12 months. Since then, the central bank has already cut rates by 75 basis points, indicating more easing was on the way.

The same day, Statistics Canada will provide its latest estimate of building permits for August, while the Labour Force Survey will provide information about employment in the construction survey in September.

Stay up to date with the latest news from Moomoo News Canada.

#monetarypolicy #ratecuts #housing

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73983492 : The only solution is for the property market to collapse, along with implementing purchase restrictions.