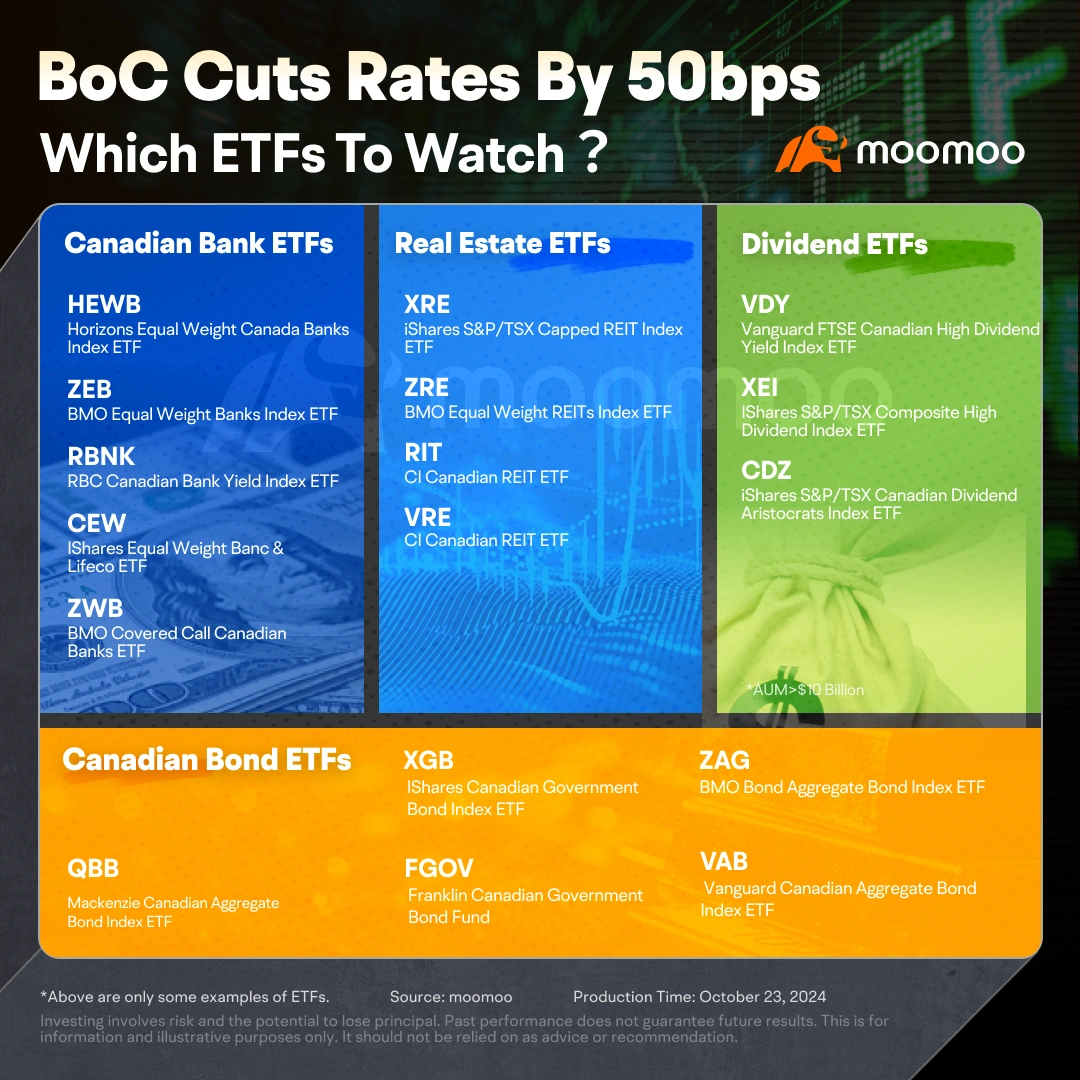

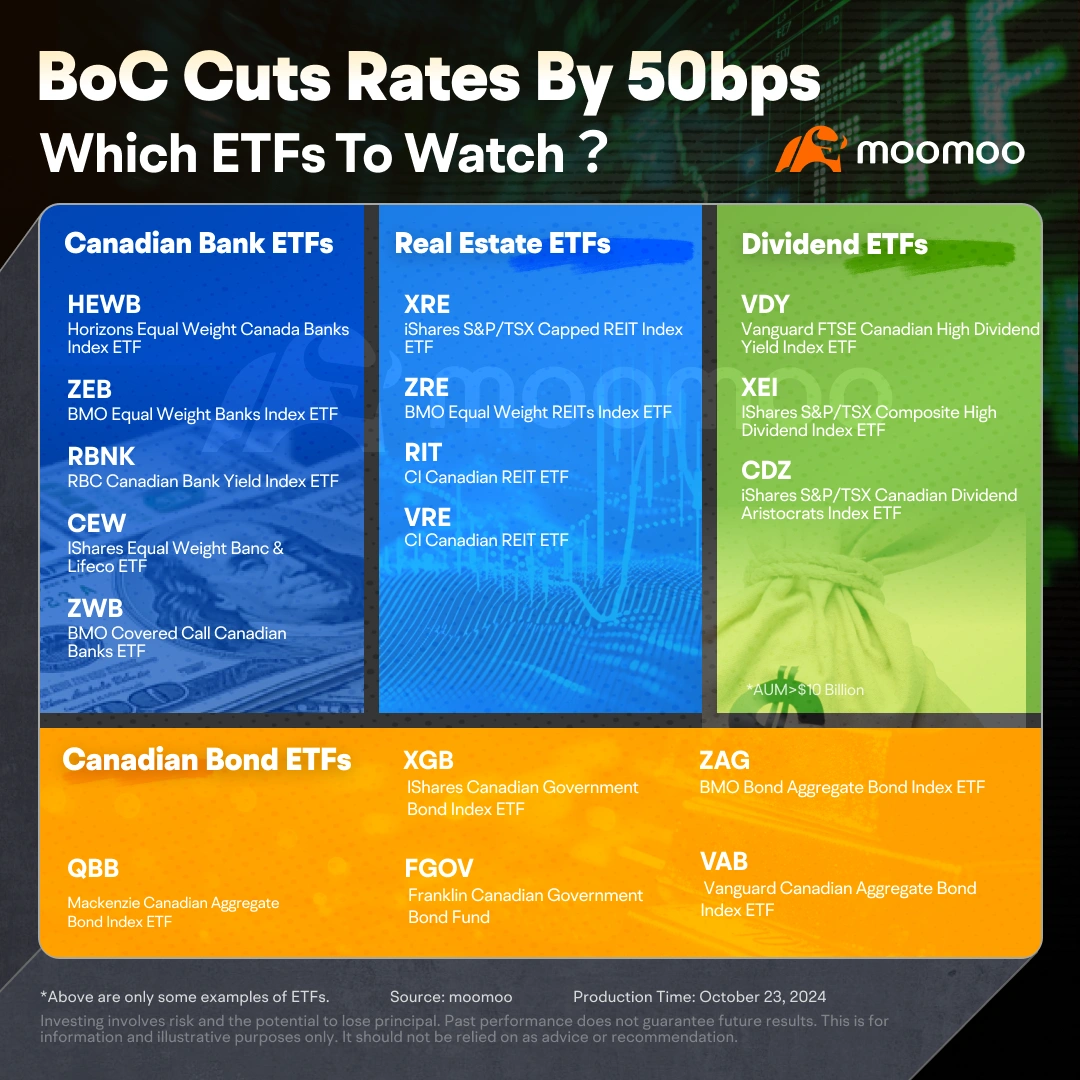

ETFs: Your best tools to harvest this cut!

Hey mooers! ![]()

Amid inflation below the central bank's 2% target and disappointing economic growth, the Bank of Canada cut its key interest rate by 50 basis points to 3.75% on Wednesday, marking the largest reduction since the pandemic and indicating a shift towards more aggressive monetary policy. ![]()

At the news conference following the decision, Governor Tiff Macklem indicated the possibility of further easing if inflation and growth continue to underperform. Read more>>

What other ETFs can I look at and how do I buy them, then? ![]()

In light of the Bank of Canada's recent rate cuts, investors should adjust their strategies accordingly. These cuts generally benefit bond ETFs, high-dividend ETFs, the real estate sector, and REITs while also favoring equity assets like large-cap indices, and financial and technology sector ETFs due to a more accommodating monetary policy. Given global rate cuts and geopolitical uncertainties, safe-haven assets such as gold are also wise investments.

And to assist your selection of ETF, remember to check our past ETF Playbook series to find out the best one in our toolkit!

Share your insights or P/L to win 50 points! ![]()

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102362254 : For ETFs, I’d consider real estate, utilities, and bonds, as they may benefit from lower rates. A mix of growth and income ETFs could balance risk and returns

Jason Fung : BoC made the right decision to drop interest rate by another 0.5%. Canadian economy has been struggling in the past two quarters and we depend a lot on real estate to grow our GDP. Lowering interest rate will certainly help the real estate market but on the other hand, Canadian government has imposed a limit on the number of international students and immigrants that can enter. I read it as they want to revive the real estate market but also don't want it to get overheated again.

CNNT : While the rate cuts intention ls are clear, the results are not.

I would prefer ETFs with a diversified country and regional mix, esp. in high growth countries / emerging or under-valued markets such as South East Asia, certain Middles East countries, East Asia, India, Africa etc.

It's good for Canadian to embrace global perspectives to hedge against domestic economy uncertainty.

73279472 : i

Bobbyjee : I am expecting another cut before the year end for a .50 base point. this will boost my REITs indices and some high yield ETFs

Neel Patel : I favour dividend ETF investing during volatility to prevent downside risks.

Meme_Short_Queen : doubling down on REIT ETFs

BILL DING : OK $Trump Media & Technology (DJT.US)$ 100000000

$Trump Media & Technology (DJT.US)$ 100000000

COCO 2024 : It is expected that there will be another 0.50 basis points rate cut before the end of the year. I will continue to buy technology index and some high-yield etf. Also considering buying some bonds.

Callin33 : Love it

View more comments...