Canadian Financial Giant Spotlight: Why Has Insurance Giant Manulife Risen Over 60% This Year?

Canadian insurance giant Manulife Financial, listed in multiple global markets, has seen its Canadian stock $Manulife Financial Corp (MFC.CA)$ rise over 60% and its U.S. stock $Manulife Financial (MFC.US)$ climb more than 52% year-to-date.

The company's growth is closely tied to its international expansion strategy, consistent shareholder returns, and the high-interest rate environment.

▶ Manulife is capitalizing on the high-interest rate environment through enhanced bond interest income

From a macro perspective, the insurance industry is one of the few sectors benefiting from a high-interest rate and high-inflation environment. Higher interest rates mean insurance companies holding large amounts of cash can more easily meet their previously set investment return targets.

Meanwhile, the wealth effect in North American stock markets has helped boost Manulife's assets under management. AUM reached 1.3 trillion Canadian dollars in the third quarter of this year.

▶ Manulife's Asia-Pacific operations drive continuous revenue growth

This year, Manulife Asia's new business value grew by 55% in Q3 2024 (mainly contributed by Hong Kong), gaining more market share. In comparison, AIA Hong Kong's Q3 new business value growth was 16.80%; Prudential Hong Kong's Q3 new business profit increased by 11.28%, significantly lower than Manulife.

In terms of Manulife's own net profit contribution by region, the Asia-Pacific region sometimes accounts for over 50% of net profit. Manulife's strengths in dividend insurance and mandatory provident funds have enabled the company to achieve rapid expansion.

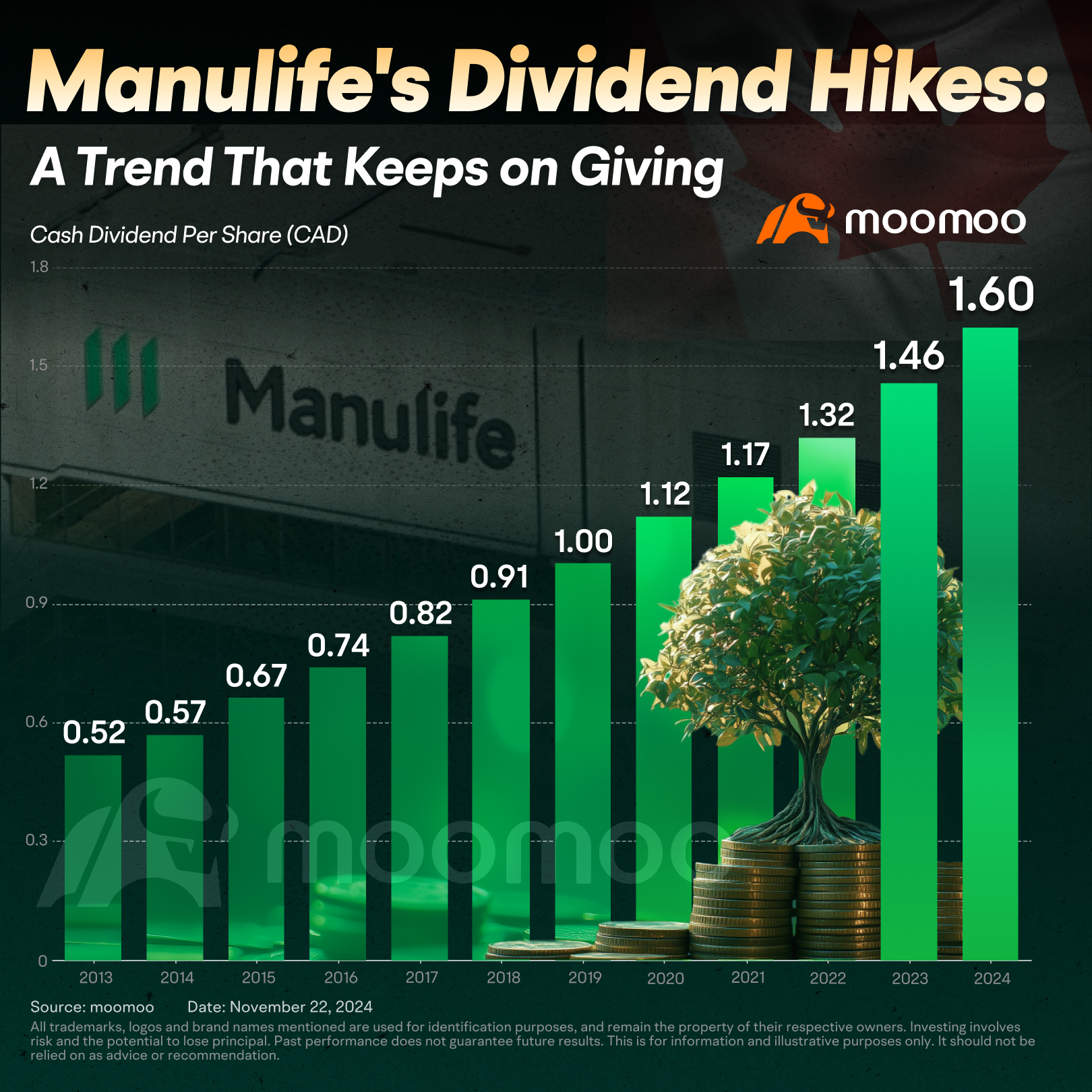

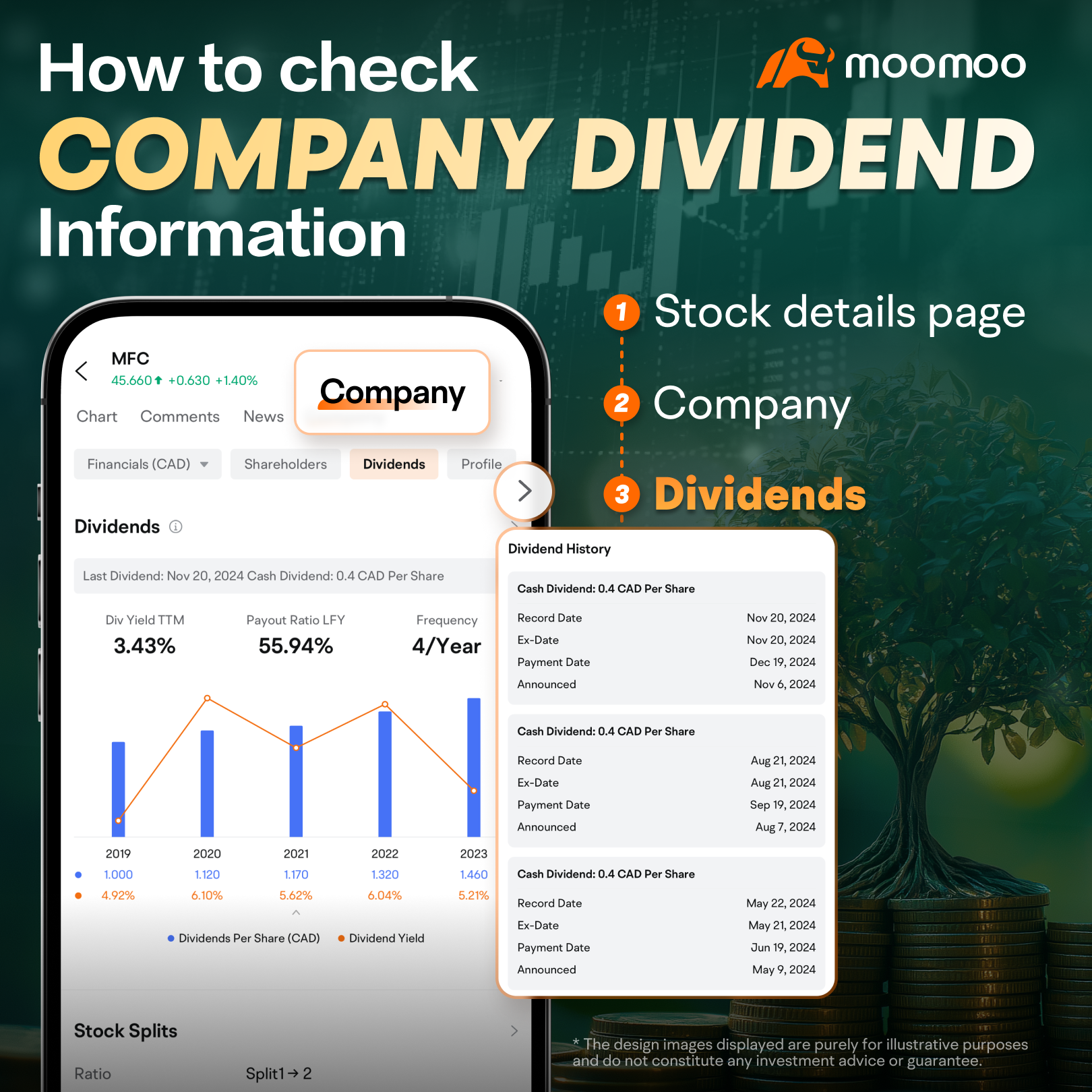

▶ Manulife paid stable dividends, focusing on shareholder returns

According to Moomoo data, Manulife has consistently increased its annual dividends, with growth rates of 8.2%, 10.6%, and 9.6% over the past three years. The company's current P/E valuation is 16.19, which remains within a reasonable range.

According to Bloomberg, over 60% of analysts now rate Manulife as a 'Buy', a significant increase from a year ago. This improved sentiment underscores the company's strengthening market position and growth prospects.

▶ Manulife Reaches $5.4-Billion Reinsurance Agreement With Reinsurance Group of America

On Wednesday, Manulife confirmed the completion of a $5.4 billion reinsurance transaction with Reinsurance Group of America. Manulife explained that this deal would boost its core return on equity and release $800 million in capital, which it plans to return to shareholders through share repurchases.

Chief Executive Roy Gori emphasized the deal's strategic significance, stating, "This transaction represents a crucial step in enhancing shareholder value. It marks our second major long-term care reinsurance deal within a year, accelerating our strategic transition to a portfolio that is both more profitable and less risky. Furthermore, it highlights our ability to handle complex transactions and collaborate with proficient counterparties to secure favorable outcomes."

Data shows that Manulife's expense ratio, after spiking in 2022, has gradually returned to normal. The expense ratio in Q4 2024 stands at 40%, the lowest level since 2022. The ongoing reduction in costs will create more profit margins for Manulife.

Source: Moomoo, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Kervencia Valmy : that sounds pretty interesting for Manulife with good profit during this year's

during this year's

Space Dust Kervencia Valmy : I agree, what's both exciting and a bummer about being a newer independent investor? finding all these other companies and bums to how come they never get media play.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) swing trader

swing trader ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) , activist investor,

, activist investor, ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) , scalper

, scalper![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) , but hopefully not a bag holder

, but hopefully not a bag holder ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) whatever I will end up being.

whatever I will end up being.

Laine Ford : good stock

Outpost : Where’s this news months ago…. Train left station long ago