Capitalizing on the Rate Turn: Timing the Ideal US Treasury Entry

This year, the trajectory of the US stock market has been significantly influenced by market expectations surrounding Federal Reserve interest rate cuts. Following the March 21 Federal Open Market Committee (FOMC) meeting, the Fed officially announced that it would maintain interest rates at their current level while signaling to the markets a potential for three rate cuts within the year.

When central banks embark on an easing cycle, the US Treasuries – often referred to as the "anchor" of the financial world – enter a distinctive "golden buying period." History has repeatedly attested to this pattern.

Timing the commencement of such a cycle and positioning oneself in its early stages is crucial to successful investment in Treasuries. Once the market has fully digested the rate cut expectations, bond prices may have already appreciated, subsequently narrowing the scope for capital gains. Thus, promptly discerning market dynamics and making corresponding investment decisions is of utmost importance.

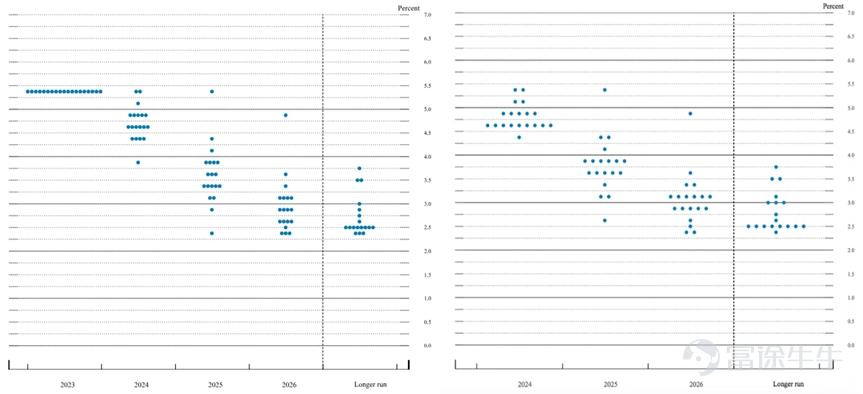

Chart: Comparison of Interest Rate Dot Plots (Left: December 2023, Right: March 2024)

I. Bond Return Components: Interest Income and Capital Gains

Bond returns are derived from two primary sources: (1) annual fixed interest income (Coupon), and (2) capital gains or losses resulting from changes in bond prices prior to maturity, which can only be realized upon selling the bond or when it reaches its maturity date. We will delve deeper into these two aspects:

1. Achieving Capital Gains

Firstly, grasping the subtle interplay between interest rates and bond prices is crucial.

(1) Price Appreciation: Given that bond prices have an inverse relationship with market interest rates, when prevailing market rates decline, the prices of already issued bonds generally rise. This occurs because, in a lower interest rate environment, the fixed yield offered by existing bonds becomes more attractive compared to the lower rates on newly issued bonds, leading to increased demand for these existing bonds and consequently pushing their prices higher.

Consequently, purchasing government bonds at the onset of a rate-cutting cycle may enable investors to realize capital gains in the future as bond prices appreciate, especially if they choose to sell the bonds before maturity.

(2) Longer-term Bonds are More Attractive: For longer-dated debt instruments, i.e., those requiring a more extended period to repay principal and interest, they are more sensitive to interest rate fluctuations. When rates decline, long-term bond prices typically experience larger increases. This is because for holders of long-term bonds, securing a relatively higher fixed interest rate results in a more substantial enhancement of the future cash flow's value, prompting investors to pay higher prices to acquire such bonds, further boosting their market prices. Consequently, the relative value of long-term bonds becomes more pronounced.

Chart: Bond Prices Move inversely with Interest Rates

2. Safeguarding Returns: Locking in Coupon Income

Purchasing long-term US Treasuries is akin to insuring future investment earnings. Even if market interest rates continue to decline, the bonds held will still provide a pre-established, higher coupon rate, serving as a robust line of defense against unforeseen risks for investors.

When market expectations suggest that the Federal Reserve will implement a series of rate cuts, previously issued, higher-yielding US Treasuries become increasingly sought-after. In a rate-cutting cycle, newly issued bonds offer lower coupon rates. This means that investors who purchase older, higher-coupon long-term Treasuries during this time effectively lock in a relatively high stream of fixed interest income, which remains unaffected should market rates drop further in the future.

3. Haven Demand Heats Up

Rate-cutting cycles often coincide with slowing economic growth or potential recessionary risks. US Treasuries, due to their high credit quality and excellent liquidity, are premier safe-haven assets, regarded as one of the world's safest harbors. They attract a surge in demand from risk-averse investors seeking safety, which in turn supports their prices.

In summary, at the onset of a rate-cutting cycle, the US Treasury market indeed exudes a unique appeal, resembling a glistening "golden buying opportunity" in the financial firmament. However, any investment decision must be based on individual investment objectives, risk tolerance, and independent assessments of economic conditions, as financial markets do not always follow a predictable script. Rational analysis and timely adjustments remain the cornerstones of successful investing.

In conclusion, the primary rationale for buying US Treasuries during a rate-cutting cycle lies in securing a relatively high fixed interest income while also exploiting bond price appreciation opportunities resulting from falling market interest rates. Nonetheless, investment decisions should be informed by a comprehensive consideration of broader market conditions, inflation expectations, economic fundamentals, and other factors.

II. Historical Performance: Predominantly Bullish Markets

Throughout past US rate-cutting cycles, the bond market has consistently demonstrated strong performance, essentially characterizing these periods as bull markets.

Reviewing the history of the Federal Funds Target Rate reveals that since 1984, the Federal Reserve has implemented seven distinct rounds of interest rate reductions. Most of these rate-cutting cycles have spanned over a year in duration and featured cuts exceeding 500 basis points (bps). The most recent instance of rate cutting lasted for 228 days, with a cumulative reduction of 225 bps.

Chart: Historical Rate-Cutting Cycles

III. Investing in Treasuries: Direct Bond Investment vs. Bond ETFs

1. Direct Investment in Treasuries

US Treasuries are debt securities issued by the US Federal Government, essentially representing loans from the public that the government commits to repaying with interest over a specified period. Given the US government's extremely high credit rating and negligible default risk, Treasuries are widely regarded as "risk-free assets." They come in various types:

(1) Short-Term Treasuries (Treasury Bills, T-Bills): Typically maturing within one year or less, T-Bills do not pay regular interest but are instead purchased at a discount to face value, with the difference between the purchase price and face value constituting the investor's return upon maturity.

(2) Intermediate-Term Treasuries (Treasury Notes, T-Notes): With maturities ranging from 2 to 10 years, T-Notes pay fixed interest semi-annually and return the principal at maturity.

(3) Long-Term Treasuries (Treasury Bonds, T-Bonds): Having maturities exceeding 10 years, T-Bonds also pay fixed interest semi-annually and redeem the principal upon maturity.

So, how do you select the right US Treasury for your portfolio?

(1) Determine Your Investment Horizon:

First, based on your liquidity needs and risk tolerance, establish the desired investment timeframe. If you have a long-term investment horizon, do not anticipate needing the funds soon, and prefer steady returns, longer-term Treasuries might be suitable. Conversely, if maintaining high liquidity is a priority, short- or intermediate-term Treasuries could be a better fit.

(2) Consider Yield:

The yield (coupon rate) of Treasuries tends to increase with their maturity, generally meaning longer-term bonds offer higher yields. Keep a close eye on current market interest rates and compare the yields of Treasuries with different maturities to find products aligning with your expected return.

(3) Stay Informed on Market Dynamics:

While Treasuries carry overall low risk, their market prices can still be influenced by changes in interest rates. When market rates rise, the prices of existing Treasuries may decline (as newly issued bonds with higher yields become more attractive to investors), and vice versa. Understanding the impact of interest rate movements on Treasury prices will help you make more informed investment decisions.

How to Purchase US Treasuries:

1. Directly from the US Treasury:

The most direct route is through an account with the US Treasury's official website, TreasuryDirect (www.treasurydirect.gov), allowing participation in Treasury auctions or secondary market purchases.

2. Via Banks or Brokerages:

Many commercial banks and online brokerages also facilitate the purchase of US Treasuries. While fees may apply, this option offers the convenience of a user-friendly trading platform and customer support services.

For instance, after opening a comprehensive account with moomoo Securities (Singapore), you can engage in bond trading.

Calculation of Total Order Amount for Buying and Selling Bonds:

2.Investing in Bond ETFs

Bonds and ETFs are fundamentally distinct asset classes. While an individual bond can be held to maturity, an ETF is essentially a fund that does not have a definitive "maturity" date. So, what happens when the bonds within an ETF's portfolio reach their maturity? The answer is, you don't need to worry about it.

For ordinary investors, investing in bond ETFs is more convenient. The primary advantage of bond ETFs lies in allowing investors to bypass the challenge of selecting specific bonds and instead hold a diversified basket of bonds at a low cost.

Suppose you purchase an ETF that invests in U.S. Treasury bonds with maturities exceeding 20 years. Periodically, the ETF issuer will review its holdings, selling bonds that are approaching the end of their "shelf life" and replacing them with newer ones.

Given this characteristic, bond ETFs inherently face relatively higher interest rate risk. However, if your objective in investing in bonds is solely to earn a steady stream of interest income, holding the ETF to maturity would still shield you from the impact of interest rate fluctuations.

Aside from these two aspects, there are other differences between the two:

1. Differing dividend payment schedules: Individual bonds typically distribute dividends once or twice a year, whereas bond ETFs generally pay out monthly.

2. Varying investment thresholds and fees: Investing in bonds entails costs such as brokerage commissions and custody fees. Investing in bond ETFs incurs fees similar to those associated with trading stocks, along with an additional management fee.

Considering the nature of bond investments, both individual bonds and bond ETFs are best suited for long-term investment strategies rather than frequent buying and selling in the medium or short term (excluding leveraged and inverse ETFs).

Available Options:

Treasury Bonds:

1. $iShares 20+ Year Treasury Bond ETF (TLT.US)$: TLT tracks the performance of long-dated US Treasuries, primarily investing in government bonds with remaining maturities exceeding 20 years. As a long-term Treasury ETF, TLT's yield is closely tied to long-term interest rate trends, typically performing well during periods of heightened market risk aversion or expectations of future rate declines. It provides an effective tool for exposure to long-term interest rate risk, suitable for investors seeking stable cash flows and a haven asset allocation.

Pros: High liquidity, offering investors a straightforward means to access returns from the long-term US Treasury market, with low correlation, aiding portfolio diversification.

2. $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$: BIL is an ETF tracking the performance of a short-term US Treasury index, primarily investing in bonds issued by the US government with remaining maturities up to one year. Due to its focus on short-term Treasuries, BIL exhibits lower volatility and can serve as a cash management tool or a lower-risk allocation within a portfolio.

Pros: Low risk, low volatility, providing investors with stable returns and high liquidity.

Cons: Compared to long-term Treasuries, short-term bonds offer limited capital appreciation when interest rates decline, potentially leading to lower overall returns.

3. $iShares U.S. Treasury Bond ETF (GOVT.US)$: GOVT is an ETF covering a wide range of maturity Treasury bonds across the entire US Treasury curve, aiming to reflect the overall performance of the US Treasury market. By investing in Treasury bonds of varying maturities, GOVT offers investors comprehensive exposure to US Treasury market risks while effectively diversifying duration risk.

Pros: Achieves maturity diversification in Treasury investments, making it an appealing choice for investors looking to participate in the entire US Treasury market and manage risk.

Cons: Given its inclusion of various maturity Treasuries, its performance is influenced by market demand for different maturity bonds, lacking the clear strategy of single-maturity Treasury ETFs.

4. $iShares 7-10 Year Treasury Bond ETF (IEF.US)$: IEF tracks a mid-term US Treasury index, investing in government bonds with remaining maturities between 7 and 10 years. Relative to long-term Treasury ETFs like TLT, IEF is moderately affected by interest rate changes, offering some room for yield enhancement while partially hedging against interest rate risk.

Pros: Mid-term Treasury ETFs strike a balance between yield potential and safety, particularly suitable for investment allocations during uncertain interest rate outlooks.

Cons: In extreme interest rate environments, whether rapid increases or significant declines, its performance may fall short of specialized ETFs betting on long or short-term rate directions.

5. $Short-Treasury Bond Ishares (SHV.US)$: SHV is another short-term US Treasury ETF, investing in government bonds with an average remaining maturity of less than one year. SHV is an ultra-short bond fund with virtually no credit risk and extremely low correlation with interest rate fluctuations, serving as an excellent cash management tool and safe-haven asset.

Pros: Extremely low volatility and risk, especially serving as a haven during market turmoil.

Cons: Limited potential returns, unable to provide substantial capital appreciation for investors.

6. $Schwab Strategic Tr Intermediate-Term Us Treasury Etf (SCHR.US)$: SCHR is a short-term US Treasury ETF offered by Charles Schwab, investing in Treasury securities maturing within one year. The ETF aims to provide returns close to those of money market funds while maintaining higher liquidity than such funds.

Pros: Extremely low risk level, high liquidity, and relatively stable returns, making it an ideal instrument for preserving and enhancing the value of short-term funds.

Cons: During periods of rising interest rates, its return growth may be slower than some slightly riskier fixed-income products.

Municipal Bonds:

7. $S&P National Amt-Free Muni Bd Ishares (MUB.US)$: MUB is an ETF focused on the US municipal bond market, investing in tax-exempt state and local municipal bonds. These bonds are often used to finance public works and infrastructure projects, with interest income being exempt from federal income tax for eligible investors.

Pros: For investors seeking stable income and looking to mitigate taxable income, MUB is an attractive option, particularly at higher marginal tax rates.

Cons: Although municipal bonds carry relatively low credit risk, they are not entirely risk-free, as individual municipal projects could still default. Additionally, the tax advantage diminishes if investors do not owe federal income tax or have lower tax rates.

Corporate Bonds:

8. $Ishares Iboxx $ Investment Grade Corporate Bond Etf (LQD.US)$: LQD is an investment-grade corporate bond ETF tracking the performance of the iBoxx USD Investment Grade Corporate Bond Index. The ETF holds bonds from numerous large, financially sound companies with strong credit ratings, providing investors with a relatively stable investment channel offering higher returns than government bonds.

Pros: Given its focus on investment-grade corporate bonds, LQD carries lower risk compared to high-yield bonds while still delivering a certain level of yield. It is a suitable tool for investors seeking fixed-income enhancement with moderate risk exposure.

Cons: Despite lower credit risk, economic downturns or deteriorating financial conditions of individual companies could lead to credit rating downgrades, affecting LQD's performance. Moreover, corporate bonds inherently carry credit risk, unlike government bonds.

9. $Ishares Iboxx $ High Yield Corporate Bond Etf (HYG.US)$: HYG is a high-yield corporate bond ETF investing in the non-investment grade or "junk bond" market. These bonds typically come from companies with lower credit ratings but offer higher coupon rates to attract investors.

Pros: HYG offers investors the potential for higher returns than investment-grade bonds, particularly during periods of low interest rates, serving as a crucial source of increased portfolio yields.

Cons: High-yield bonds carry significant credit risk, with default risks significantly increasing during economic downturns. Additionally, due to their sensitivity to market sentiment and interest rate changes, they exhibit higher volatility. Under unfavorable conditions, the value of such bonds can significantly erode.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment