Carnival Call Options See Sell-Off, Tracking Slump in Stock Price

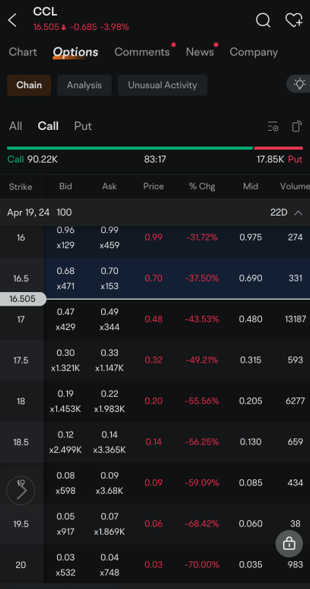

$Carnival (CCL.US)$ is seeing a sell-off in call options as shares fall further below their strike price. Calls accounted for about 84% of total options traded so far, as prices tracked the slump in the stock price.

Shares fell 68.5 cents, or about 4% after the cruise line yesterday forecast a hit of as much as $10 million from the collapse of the Key Bridge in Baltimore Harbor, muddying the outlook for the full year. The downtrend came even after the company reported a better-than-expected loss and revenue that beat estimates for its fiscal first quarter that ended Feb . 29.

The company, which temporarily moved its Baltimore operations to Norfolk, said its forecast of $5.63 billion in adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) for fiscal year 2024 doesn't include the impact from the Key Bridge collapse.

More than 13,000 call options that give the holder the right to buy Carnival's shares at $17 each by April 19 were traded as of 11:10 a.m. New York time. The contract is the most-active of all the options tied to the stock. The price of those $17 calls sank more than 40% to 48 cents as the stock trades at $16.51, down 3.9%.

Meanwhile, put options that give the holder the right to sell the stock at the same strike price of $17 by April 19 rose almost 41% to 86 cents.

The $17 calls were the most-active Carnival options expiring in next three weeks. More than 11,000 of such calls expiring today were also traded, with the price sinking 86% top 2.5 cents.

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

White_Shadow : sold that shit last week

72734102 : Who ever bought carnival? N why?