Cash flow is considered a very important aspect of any company's financial stability. Positive and stable cash flow can be crucial to maintaining financial health, while cash flow disruptions can lead to bankruptcy risk.

Moreover, cash flow often has a significant impact on stock valuation.

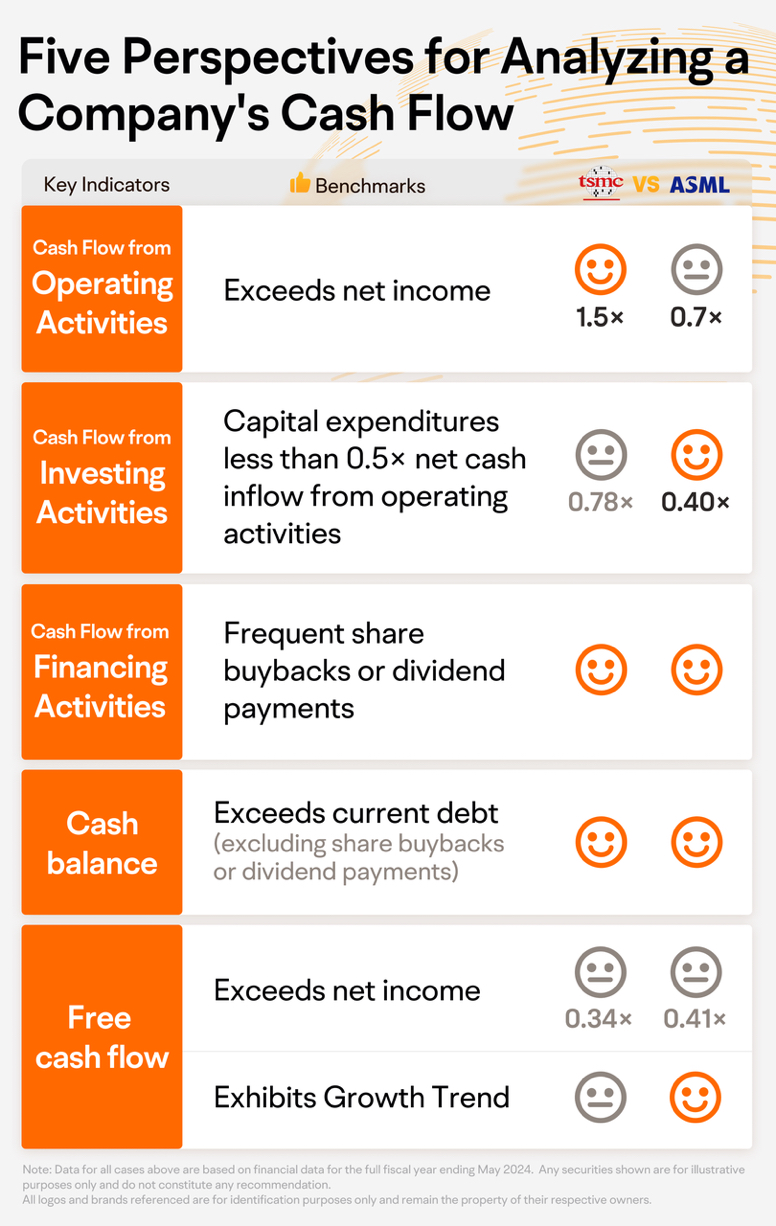

To evaluate a company's cash level, it's important to consider focusing on five key areas which we'll explore in more detail below.

1. Cash flow from operating activities

This section shows the cash inflows and outflows from the company's daily operations, such as sales income and cash paid to suppliers. Subtracting cash outflow from cash inflow, we can get the net cash flow from operating activities.

If the number is positive, it means the company's operating activities generate more cash than it consumes;

If the company's net cash flow from operating activities exceeds net income, the company typically is in a sound financial position.

2. Cash flow from investing activities

Cash flow from investing activities involves new plant construction and investments. When analyzing cash flow, it's important to pay close attention to the capital expenditures related to the purchase and sale of fixed assets.

If a company spends too much of its net income on expansion, its overall cash flow will usually be affected. Moreover, the depreciation of equipment and production lines, as well as potential future replacement costs, can further erode net income.

This may explain why many companies with an asset-heavy structure tend to have lower valuations.

3. Cash flow from financing activities

Cash flow from financing activities includes debt addition and repayment, the issuance and buyback of stocks or bonds, and dividends paid to shareholders.

Closely monitoring dividend payments and share buybacks is also key.

Even in the absence of financial outperformance, companies like Coca Cola and Oracle have seen their stock prices rise in the long term after increasing their ROE through dividend payments or boosting EPS by share repurchases.

4. Cash balance

A company's cash balance is the amount of cash it currently has on its balance sheet, as well as any short-term investments that can be quickly converted to cash.

If a company's cash balance exceeds its short-term liabilities, this indicates that it has sufficient liquidity and less immediate pressure to service its debt.

Moreover, if the company's cash balance continues to grow over time, it generally sends a positive signal to investors.

However, it's worth noting that some companies with large cash flows may use their excess funds to buy back shares or pay dividends instead of maintaining a high cash balance. As such, when evaluating a company's cash flow, it may be necessary to exclude the impact of share buyback and dividend payments to get a more accurate picture of their financial health.

5. Free cash flow

Many US-listed companies disclose free cash flow in their financial statements. It is calculated by subtracting capital expenditures from operating cash flow.

If a company's free cash flow consistently grows and exceeds its net income, it may be more attractive to investors. Besides, the market may be willing to give a higher valuation for such companies.

Coach Donnie OP : * ETFs, Longs, Shorts in that order.

in that order.

does 7-10% a year, my ETFs gotta yield or earn the same or MORE on an annual basis, to be worth my time.

does 7-10% a year, my ETFs gotta yield or earn the same or MORE on an annual basis, to be worth my time.

ETFs and Longs is the retirement and Generational Wealth. NO funny stuff in the ETFs and the Longs. Shorts is for fun and Free Cash Flow… but can occasionally also hit 2x to 10x plus, if it doesn’t go to 0. Hail Mary.

* Only invest LONG TERM in stuff that’s outperforming the market. S&P 500

* The Long Game

Recognize that investing is often about long-term growth rather than short-term gains. The market can be volatile, and understanding that ups and downs are part of the journey can help you remain patient.

* A Setback is just a Setup for a Comeback

#CoachDonnie

Coach Donnie OP : Some ‘do’s’ and ‘don’t’s’:

Do:

- Read, study, listen and learn daily. Information is power, use it to advantage.

- Ask questions! It’s silly to be shy, there are eight billion of us, and we are ALL learning.

- Buy ETFs at least 80% of your portfolio (like SPLG FTEC FHLC FSKAX VOO VGT). You don’t have to be the expert with ETFs.

- Build a base in shares through DCA or an allotment strategy using income (perhaps to weight more on equities that are down in a given moment). DCA is recommended.

- Whether growth or value, invest in that which has promise of greater comparative returns.

Growth is recommended unless you’re at retirement enjoyment protection phase.

- Know yourself. Focus on strengths and mitigate weakness, be who you are.

Don’t:

- Buy individual stocks only, especially if you don’t know what you’re doing. Hedge your bet with ETFs, Real Estate when the Cash on Cash return makes sense, Gold and Silver, Businesses, other assets.

- Overleverage, Overbuy, Overtrade. Only make a move based strong conviction.

- Forget that there is always an opportunity.

- Blindly follow others. Getting ideas is great, be sure to conduct your own due diligence as well.

- Be afraid to ‘lose’ sometimes. That is part of this exercise; accept that and move on.

- Overleverage. Stay within a safe zone and build over time.

Happy investing

Coach Donnie OP : Money is a Wicked Master, but a Faithful

Master, but a Faithful  Servant…

Servant…

Money

Money  don’t let it master you

don’t let it master you

we can enjoy the journey more

we can enjoy the journey more

laugh

laugh  this is as much about us Becoming Better as it is about Asset Accumulation.

this is as much about us Becoming Better as it is about Asset Accumulation.

ETF that represents the Best of Broader Market

ETF that represents the Best of Broader Market

Master

Don’t let the market chew you up and spit you out.

• Make sure you have your portfolio diversified you’re not just ALL IN on NVDA or any one stock

• Markets go up and down

Either way we’re good

• Long term investors benefit from ups and downs

Downs: everything is on sale - buy the dip but only on solid assets

Ups: assets appreciate aka rally

• 80% in ETFs like SPLG FTEC FHLC FSKAX VOO

• 20% in individual stocks that are doing well ANNUALLY

Earning 7-10% on average is good

Earning 10-20% or more per year is great

If an asset isn’t earning at LEAST 7-10% year - which we only know after a year - why keep it

* Do what’s best for you at the end of the day.

ETFs

Stocks

Real Estate

Real Estate for Cash /

Rental Properties

Businesses

Physical Gold and Silver

Art

All have Cycles

When we understand the cycles

We can buy the dips and unplug (or do nothing) when there’s downtrends, dark pool market manipulations, sell offs etc

We can also enjoy the upswings without getting caught up in FOMO and succumbing to the pressure of buying stuff at All Time Highs

Gotta enjoy yourself otherwise the market is more stressful than a job

Mindset produces Assets:

Enjoy the journey smile

#CoachDonnie

Many of us need

An S&P 500

Like SPLG (VOO)

& an ETF like FTEC (VGT)

FHLC (health) FSKAX (total market)

Don’t have to be an Individual Stock Expert

They can’t manipulate those

Don't gotta be extreme just consistent

Happy investing

Coach Donnie OP : SCARED MONEY DONT MAKE NO MONEY

MONEY DONT MAKE NO MONEY

using propaganda slander law suits etc

using propaganda slander law suits etc

so we sell

so we sell

BE FEARFUL WHEN OTHERS ARE GREEDY

BE FEARFUL WHEN OTHERS ARE GREEDY

- WE COLLECT OUR WEALTH IN THE GREEN

- WE COLLECT OUR WEALTH IN THE GREEN

They the 1% DRIVE GREAT COMPANIES DOWN

To make the 99% fearful

THEN they (The Culture Vultures) SWOOP IN BUY EVERYTHING AT A DISCOUNT & RUN IT BACK UP to MAKE THEIR WEALTH

KEEP YOUR RESOLVE

KEEP BUYING

STAY LONG

IN THE RED: WHEN THE MARKET OR STOCKS ARE GOING DOWN

IN THE BLACK/GREEN: WHEN THE MARKET IS GOING UP

BE GREEDY WHEN OTHERS ARE FEARFUL

WE BUILD OUR WEALTH IN THE RED - WHEN THE MASSES ARE SCARED

#AssetAppreciation

#GenerationalWealth

#NoteToSelf #AppliesToUsAll

Coach Donnie OP : Propaganda is linked with Dark Pools and Market Manipulation

so they control you with fear

so they control you with fear  and make you think it’s logic

and make you think it’s logic

applies to all Long Term Assets that Bring 10-25% a year or more ROI & CAGR

applies to all Long Term Assets that Bring 10-25% a year or more ROI & CAGR

Remember that.

They don’t want you to win

Remember that

We’re not Gamblers

We’re Investors, Asset Accumulators…

Too many are focused on tiny short term swings, feelings, fears, FUD, FOMO & market manipulation.

All you need to do is accumulate shares of quality solid companies and let TIME do its thing.

Example:

when NVDA is 200+ all that matters is how many shares you have. whether you paid 95 or 105 doesn't really matter

This

THINK LONG TERM.

#CoachDonnie #AssetAccumulation #AssetAppreciation

Coach Donnie OP : When it’s a Bear Market a downtrend a sell off and/or market manipulation

Market a downtrend a sell off and/or market manipulation

(stocks and ETFs that’ll go back up

(stocks and ETFs that’ll go back up  not just anything)

not just anything)

Because everything’s on sale

Because everything’s on sale

(realized gains) means quick taxes.

(realized gains) means quick taxes.

it’s Wise to either

Buy the Dip

Dollar Cost Average or

Be Patient with Positive Expectancy/Do nothing.

It’s not wise to

Sell for a loss

Listen to propaganda

Try to Time the market

Freak out

Check the stock every hour

Expect the worse

Remember 2 thangs Freedom Fam

Buy The Dips do the opposite of what “errybody and they mama” does

* Be fearful when others are greedy and to be greedy only when others are fearful.

Warren Buffet was letting us know to pay attention and when most people are too afraid to buy (Red Days)

BUY

WHY

* Bulls make money, bears make money, but pigs get slaughtered - aka don’t get too greedy

You can get paid when the market is going up or down but don’t be greedy.

TIME in the market > TIMIN the market

Investors who know what they’re doing typically do better than traders and those tryna TIME the market

Long Term

The unappreciated beauty of stocks is that they are a semi passive or passive asset/investment/vehicle with deferred taxes.

Quick cash

Many peeps end up making less than minimum wage for their time expended.

But not YOU

You’re Patient.

You’re Disciplined.

You’re the Chosen Few.

You understand Delayed Gratification.

You have Long Term Vision.

I salute you

#CoachDonnie

#AssetAccumulation #AssetAppreciation