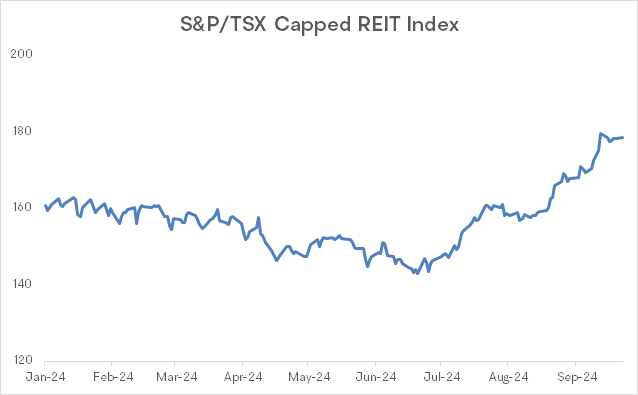

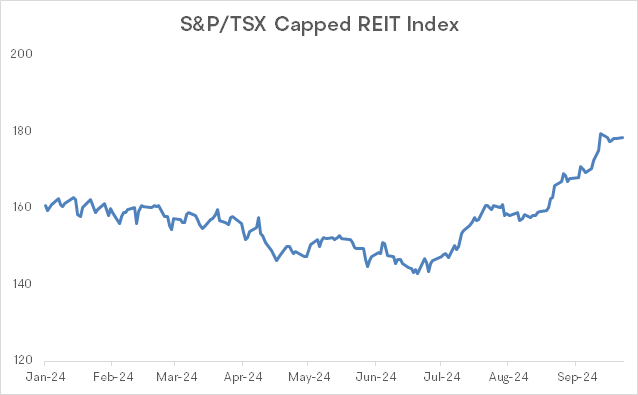

Catching the Tailwind of Canadian REITs During a Rate-Cut Cycle

Canadian real estate investment trusts (REIT) have jumped upwards 10% to 25% over the last few months. The S&P/TSX Capped REIT index climbed over 18% since the first rate cut on June 5th, thanks to ongoing rate cuts, return to office procedures and increasing confidence in the market, according to Colliers Canada.

Source: S&P Global

Adam Jacobs, head of research at Colliers Canada, said that REITs are oftentimes dependent on borrowing or re-financing, they took a hit following the COVID-19 pandemic.“REITs are still 20% below year-end 2021 levels, reflecting the spike and subsequent volatility in interest rates,” Jacobs wrote.“The good news is that those headwinds have rapidly diminished and are starting to become tailwinds.”

The re-surge in interest wasn’t unprecedented. With the Bank of Canada cut its benchmark rate three consecutive times, yield-chasing investors are starting to pull from money market funds and similar vehicles and instead plow their cash into dividend-paying REITs, Sam Damiani, a TD analyst said.

Damiani and his team expect Canadian REITs to outperform “as they have in the past similar periods since 1998.” His top picks include $Canadian Apartment Properties Real Estate Investment Trust (CAR.UN.CA)$ , $Granite Real Estate Investment Trust (GRT.UN.CA)$ and $Chartwell Retirement Residences (CSH.UN.CA)$.

So far this year, $First Capital REIT (FCR.UN.CA)$ has surged over 26%, recording the highest increase among all Canadian REITs with a market value over C$1 billion. Additionally, First Capital REIT has a dividend yield of over 8%, with its investments primarily focused on shopping centers.

$Boardwalk Real Estate Investment Trust (BEI.UN.CA)$ has risen over 23% this year, while $H&R Real Estate Investment Trust (HR.UN.CA)$, $Killam Apartment Real Estate Investment Trust (KMP.UN.CA)$, and $Crombie Real Estate Investment Trust (CRR.UN.CA)$ have all increased by more than 20%. Among them, H&R REIT and Crombie REIT offer dividend yields of over 5%.

“It’s pretty across the board,” Jacobs said about REITs. “It’s just kind of a general like ‘the worst is over, we can put our money back into this sector and probably get a good return over the next couple of years.’”

Source: Bloomberg, S&P Global

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment