Cathie Wood Bought the Dip in This Gaming Stock

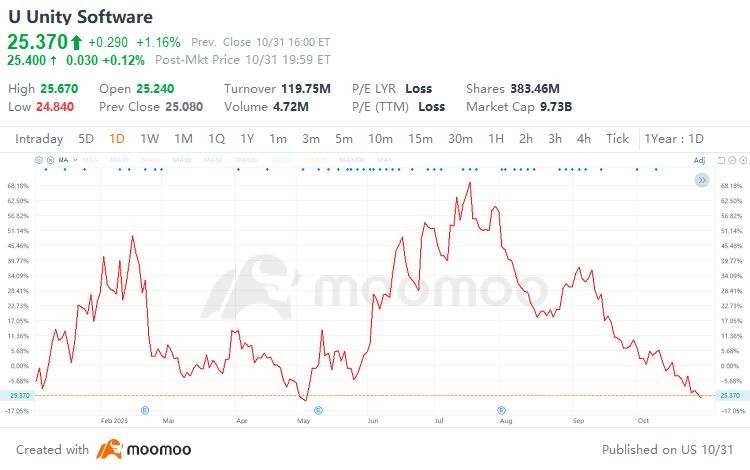

Unity Software stock is getting slammed as its CEO departs in the face of stalling revenue.

Ark Invest CEO Cathie Wood has taken advantage of the cratering stock price and has been adding to Ark's position in Unity. While speculation is rising that Unity may be acquired, I think there are plenty of other reasons to own the stock. And although its current financial profile may appear concerning on the surface, there is much more than meets the eye. Let's dig into the business and assess this opportunity to buy the dip.

A hard look at the fundamentals

Unity Software can be classified as a software-as-a-service (SaaS) business. SaaS businesses often report key metrics beyond traditional figures found on financial statements. One such metric is net dollar expansion rate (also commonly referred to as net dollar retention rate). This metric tells investors how much the company's revenue is growing among its existing customers. Ideally, investors would like to see net dollar expansion in excess of 100% as that implies the company is upselling clients and expanding the business it does with them over time. The table below illustrates Unity's net dollar expansion rate over the last year.

While the figure remains well in excess of 100%, it's declining. Unsurprisingly, the company's top line has taken a noticeable hit. Management attributed the deceleration in customer expansion and revenue growth to softness in the advertising market. $Alphabet-A (GOOGL.US)$ $Alphabet-C (GOOG.US)$ Alphabet and $Meta Platforms (META.US)$ previously echoed similar concerns, but Unity does not have anywhere near the same balance sheet strength as those tech giants, nor does it have as diversified a business model.

I'd like to focus on one item in particular as it pertains to the revenue and expense profiles. Last year, Unity rejected a takeover from rival AppLovin and chose to pursue its own strategic roadmap by acquiring a company called ironSource. While the ironSource deal has helped augment Unity's existing revenue base, the combined company's top line isn't growing at the rate many investors likely expected. During Unity's second-quarter earnings call, management said, "[W]e said that the combination of Unity and ironSource alluded to market share growth on combined mediation and not to revenue growth for us."

The way I interpret this is that new revenue generation was not necessarily the underlying inspiration for Unity's acquisition of ironSource. Rather, the company was looking to combine forces and quickly increase its market depth and reach as competition in this space intensifies. While this should lead to higher revenue in the long term, Unity appears more focused on acquiring a broader base of customers right now.

The underlying issue investors likely have with this approach is the company's inability to turn a profit. The table below outlines the company's reported net loss over the last year on a generally accepted accounting principles (GAAP) basis.

The company is losing roughly $200 million per quarter and showing few signs of slowing down. However, it's important to note that on GAAP financial statements there are a number of non-cash expenses that must be reported.

For example, Unity has incurred significant stock-based compensation expenses since its acquisition of ironSource as you can see in the table. For this reason, after adding back these non-cash expenses, investors can get a better glimpse of the company's liquidity profile. It's clear that on an adjusted EBITDA basis, profitability is moving in the right direction, albeit slower than some investors might like.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment