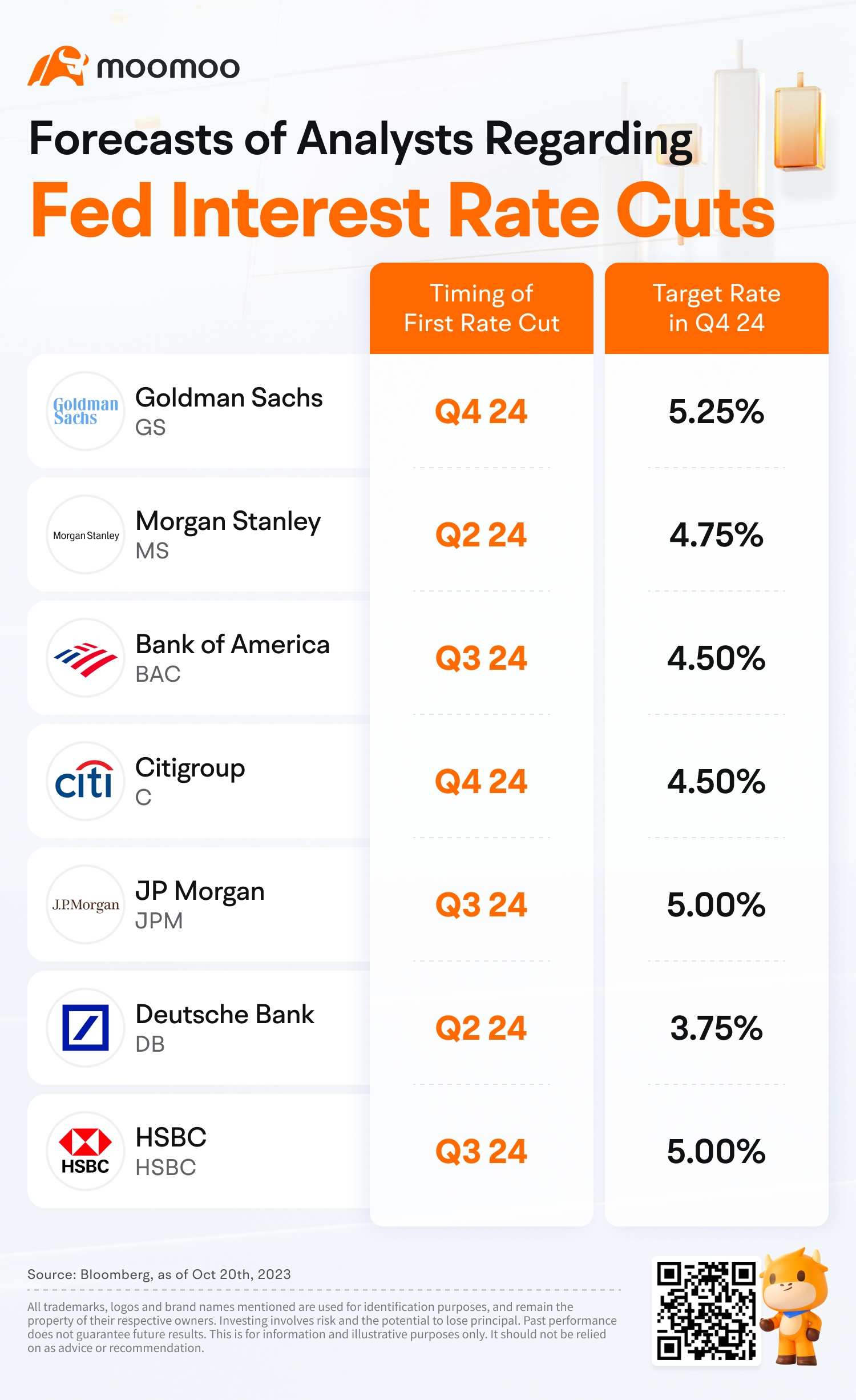

Chart Reveals Divergent Views Among Analysts on Fed's 2024 Interest Rate Policy

As inflation cools, Morgan Stanley forecasts that the Federal Reserve is expected to reduce rates in June of 2024, followed by another decrease in September of that year, and subsequently at every meeting from the fourth quarter onward. The rate cuts are expected to occur in increments of 25 basis points, bringing the policy rate to 2.375% by the conclusion of 2025.

However, Goldman Sachs predicts that the first 25-basis-point reduction will occur in the fourth quarter of 2024. There will then be one cut every quarter through mid-2026, resulting in a total reduction of 175 basis points, with rates ultimately settling at a target range of 3.5%-3.75%.

Goldman Sachs predicts that the Fed will maintain relatively high rates due to a higher equilibrium rate. They believe that the "post-financial crisis headwinds" are now in the past, and that larger budget deficits are expected to continue, resulting in increased demand.

Moreover, Deutsche Bank forecasts that the Fed will maintain higher rates and avoid rate cuts until around mid-2024, when inflation will approach the Fed's target, and there will be a significant loosening in the labor market. Overall, it is anticipated that there will be a total of 175 basis points in rate reductions through 2024 and that the fed funds rate will reach its neutral level of approximately 3% by early 2025.

Here are analysts' predictions on the Federal Reserve's interest rate policy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment