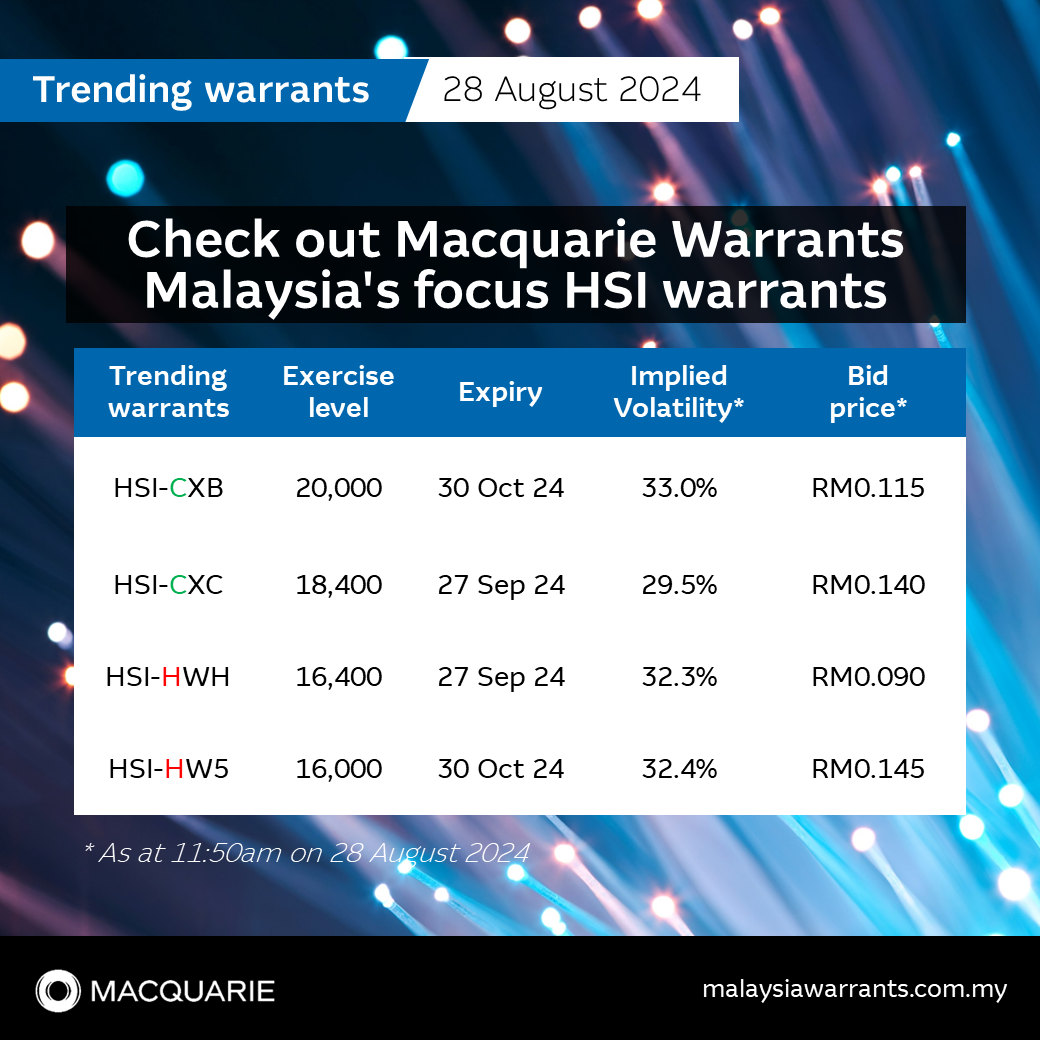

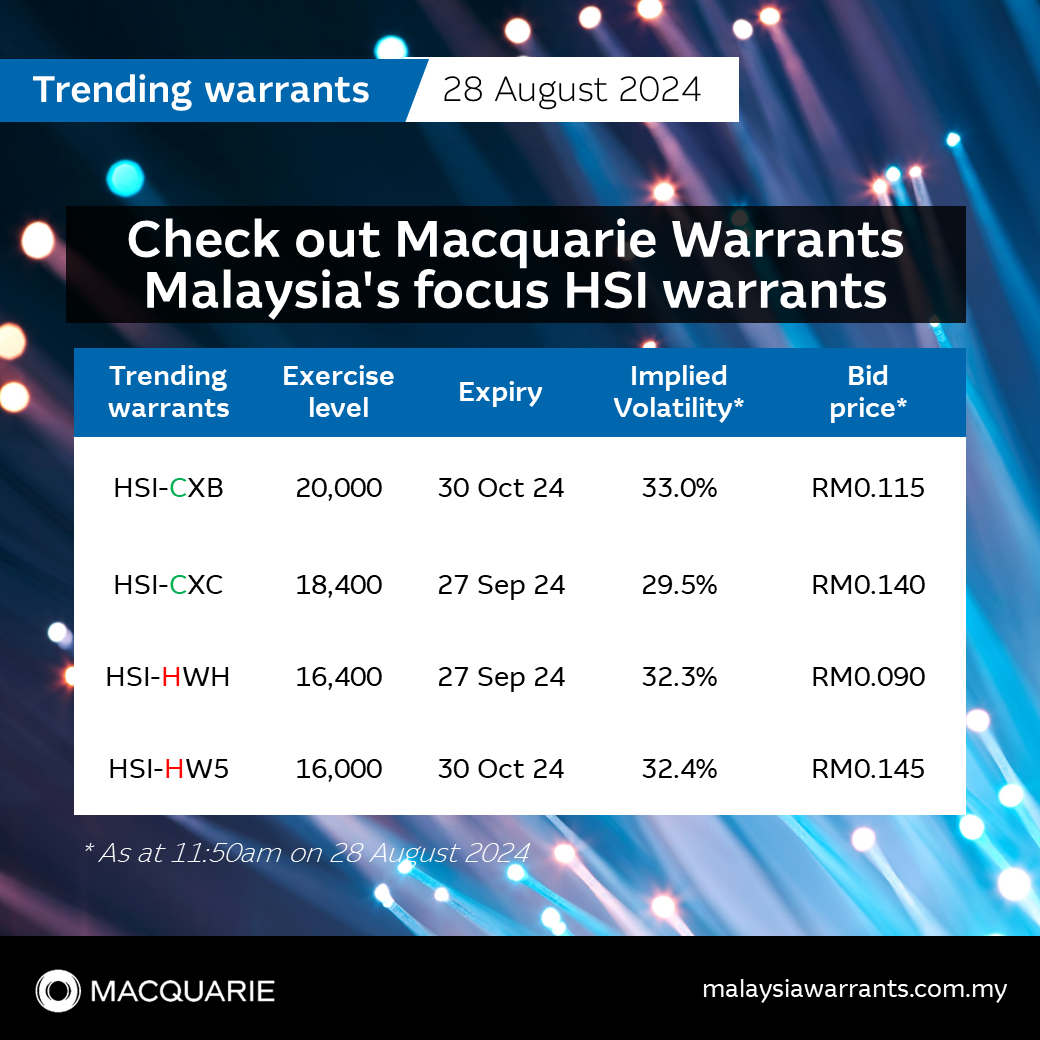

Check out Macquarie Warrants Malaysia's focus HSI warrants

With the Hang Seng Index (HSI) futures down 1.0% at the time of writing, investors net buy 15.2M units of the call warrant HSI-CXC as the warrant correspondingly fell 20%. Meanwhile, the put warrants, which move in an opposite direction to the underlying, have gained up to 100%.

Given the wide range of HSI warrants available in the market, in addition to the steps outlined on our investor academy, investors should also consider the implied volatility (IV) level and liquidity when selecting a warrant. Compared to the market, Macquarie’s HSI warrants generally have relatively lower IV and higher liquidity.

A warrant with lower IV is cheaper and will have a lower warrant price as compared to a warrant with higher IV (all other factors held constant). A lower warrant price means that a lower amount of capital is required for the same effective exposure to the underlying, allowing you to diversify your portfolio further.

In addition, Macquarie’s focus HSI warrants have high liquidity, meaning they are on tight spreads and have up to 12 million units placed on each of the best bid and offer quotes, allowing investors to enter and exit their positions with relative ease.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment