China economy's strong start to 2024 deals blow to "over-pessimism" but recovery hangs on property market

The Chinese economy could finally be turning the corner according to both technical and fundamental factors, and this could have major ramifications for the local economy and stock market.

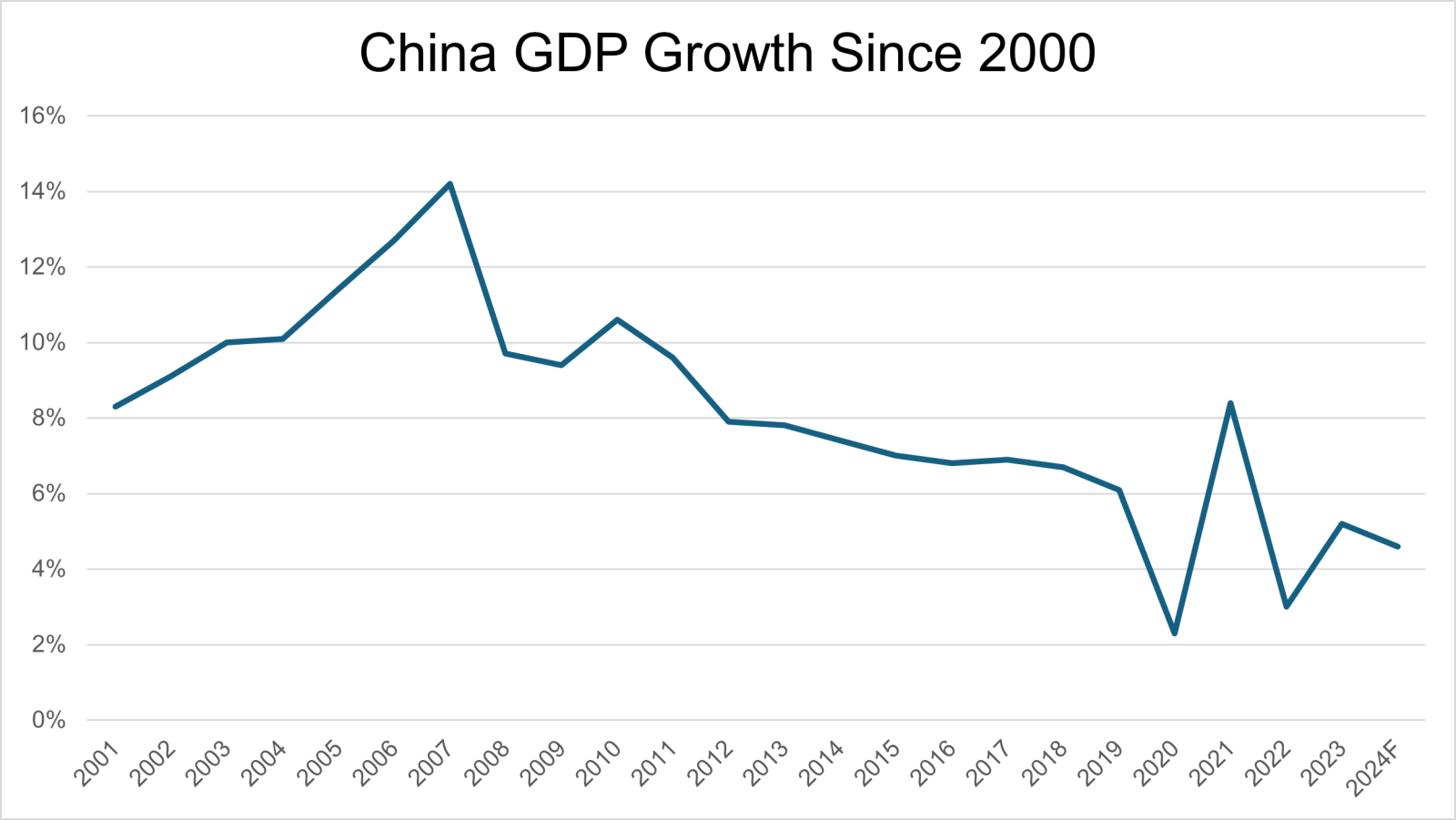

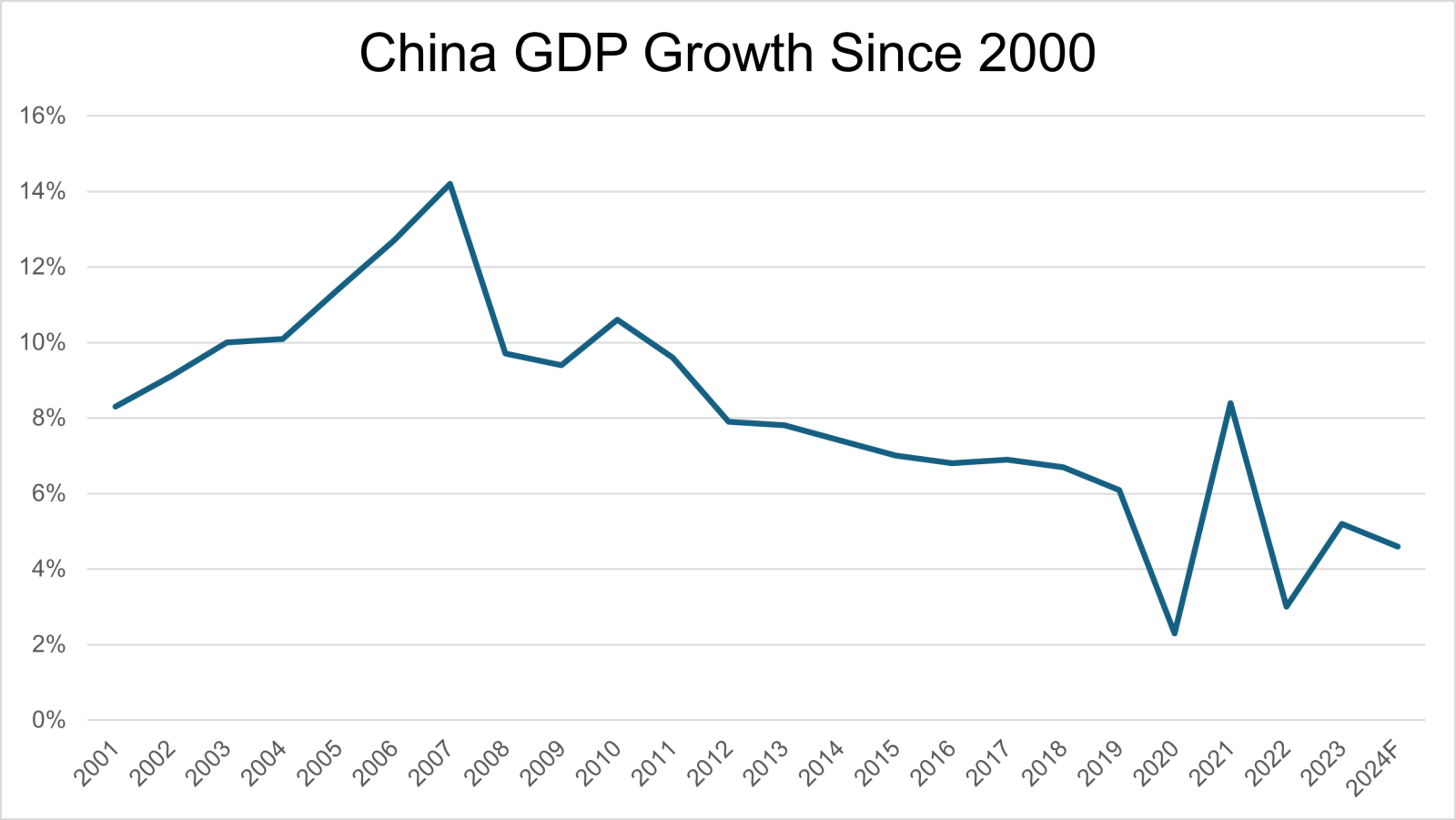

We're a long way both in time and magnitude since the double-digit growth rates enjoyed by the Chinese economy between 2000 and 2010 – a period of growth that was at the time often referred to as miraculous. China grew as fast as around 14% during that period. Chinese economic growth has moderated in recent years, partly due to Beijing's extended period of zero-tolerance COVID-19 policies, but mainly due to a withering decline in the nation's property market.

It's easy to get negative on the prospects for Chinese growth given the above chart and considering the challenges facing its heavily indebted property sector, which still accounts for roughly one-third of the country's growth.

It's important, however, to consider that while Chinese growth is slowing, the growth it's likely to achieve is occurring over a massive base. According to data from the World Bank, China's USD18 trillion economy accounted for 16.9% of global GDP in 2023, making it the world's second-largest economy after the USA.

Given the size of China's economic base, growth around 2023's 5.2% is arguably still good. Anything better would likely have a massive positive impact on both local and global economies, and therefore stocks. Further, given recent negativity towards the Chinese economy, stocks likely aren't priced for the better-than-expected case scenario.

This is pertinent given major broker Citi has just released a research report investigating the latest Chinese economic data that relates to the start of 2024. Citi suggests this data shows the Chinese economy "managed to strike a solid opening to 2024".

Let's investigate the ramifications of the data on growth expectations in 2024, and also take a look at the charts of China's major stock indices which are typically considered to be excellent forward indicators of a country's growth prospects.

A solid start amid continued property downturn

Despite the ongoing slowdown in the property market, Citi notes investment in the Chinese economy was "way higher than consensus". Fixed asset investment (FAI) was 4.2% in Jan to Feb, better than the broker's 4.0% estimate, and well ahead of the 3.2% forecast by other economists. It also increased from Dec's 4.0% rate.

The bulk of the investment is being directed in areas of China's economy away from property, in particular, manufacturing and infrastructure. Manufacturing investment rose an impressive 9.4% in the first two months of the year, well up from 6.5% recorded in the same period last year, while infrastructure investment grew 6.3%, up from 5.9%.

Much of this is deliberate, notes Citi, as Beijing has actively encouraged investment in manufacturing and infrastructure to help offset their reluctance to further boost investment in the overheated and over indebted property sector.

Just as important, suggests Citi, is a "moderate recovery" in consumption. The broker notes that retail sales grew 5.5% in Jan to Feb year on year. This was below their 6.0% forecast, but closer to the consensus estimate of 5.6%. Growth in consumer services "remained robust", growing 12.3% year on year in the first two months, and it has been a powerhouse of Chinese economic growth, expanding 20% in 2023.

Goods consumption was mixed, however. Auto sales improved 8.7% year on year, while property-related items "showed signs of broad-based recovery", picking up 2.1% year on year compared to the 7.5% decline in the same period last year.

Finally, industrial production "showed its resilience again" rising 7.0% in Jan, beating market expectations for a 5.2% gain. Again, manufacturing led the way, while property segments lagged.

In conclusion, notes Citi, the data "confirmed a solid start of the Chinese economy despite the de-property transition". Combined with low rates of inflation within China at both wholesale and consumer levels, the data implies there's less reason to be pessimistic about the Chinese economy. It "could help to ease over-pessimism", says Citi.

Still, the broker warns the recent data “could still fall short of reviving confidence”. The major issue remains the "deep contraction" in the housing sector, and the "unbalanced" and "bumpy" nature of the recovery.

Watch these 3 factors says Citi

1. The pace of fiscal policy deployment:

- Particularly with respect to infrastructure spending

- But high levels of local government debt could stymie efforts here

2. Details of equipment upgrade and trade-in programs for durable goods:

- Market is waiting on details of implementation, funding source, and scale

3. Monetary policies:

- "Additional monetary policies are necessary" notes Citi

- Expecting the first 0.10% cut to the 1-year medium-term lending facility (MLF) to occur in the second quarter of the year

Leading indicator: The Chinese stock market is turning up

The Shanghai Composite Index has been rising since Feb.

Around the start of Feb, Beijing began to take steps to curb the selling of Chinese stocks by financial institutions, reduced some margin requirements for investors, and more generally started jawboning their support for the ailing stock market. Hopes of further fiscal and monetary stimulus have also helped.

From a technical perspective, the rally is starting to look like more than just a bounce. The short term trend has swung back to up and it's also providing dynamic support to price. This imply a shift in market sentiment to a "buy the dip" mentality – which is completely at odds with the prior "sell the rally" mentality.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Momentum Trader : Long

2024. My young bull thesis still intact so far

2024. My young bull thesis still intact so far ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

bullrider_21 OP Momentum Trader : Your calf thesis still intact![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Momentum Trader bullrider_21 OP : Calf market…Learnt new term today![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

bullrider_21 OP Momentum Trader :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)