China Stock Euphoria: Optimism Takes the Helm as Hedging Fades Away

When discussing Chinese equities, the overall sentiment has shifted dramatically towards optimism. The nation’s recently announced stimulus package has propelled Chinese stocks traded in Hong Kong to their best weekly surge in nearly 13 years, setting them on a path to be among the world’s top performers in 2024. Furthermore, market participants jumping on the rally have driven the cost of volatility hedges for the next month to a two-year high compared to six-month contracts, signaling medium-term confidence.

Over just a few days, China has bolstered measures to stimulate various sectors, from consumer spending to the housing market and local equities. The Hang Seng China Enterprises Index, which was barely up for the year earlier this month, rebounded more than 22% in 11 straight days, marking its longest streak of gains since its heyday in 2018.

It feels like this time, the Chinese government truly senses the urgency for change. If investors buy into the notion that the Chinese government will keep supporting the market, the rally can certainly continue. The Chinese market was simply too undervalued.

Previously, Chinese stocks had been facing headwinds, with a series of disappointing economic data making investors skeptical about the country’s ability to meet its annual expansion target of 5%. Earlier this month, the China Enterprises index’s valuation hovered close to 7 times estimated earnings for the next 12 months, compared to a five-year average of over 8 times.

It feels like this time, the Chinese government truly senses the urgency for change. If investors buy into the notion that the Chinese government will keep supporting the market, the rally can certainly continue. The Chinese market was simply too undervalued.

Previously, Chinese stocks had been facing headwinds, with a series of disappointing economic data making investors skeptical about the country’s ability to meet its annual expansion target of 5%. Earlier this month, the China Enterprises index’s valuation hovered close to 7 times estimated earnings for the next 12 months, compared to a five-year average of over 8 times.

But last week was a game-changer. China cut interest rates, the banks’ reserve ratio, and borrowing costs; pledged billions of dollars to boost equities; announced incentives to spur consumer spending; and even provided support for local milk production.

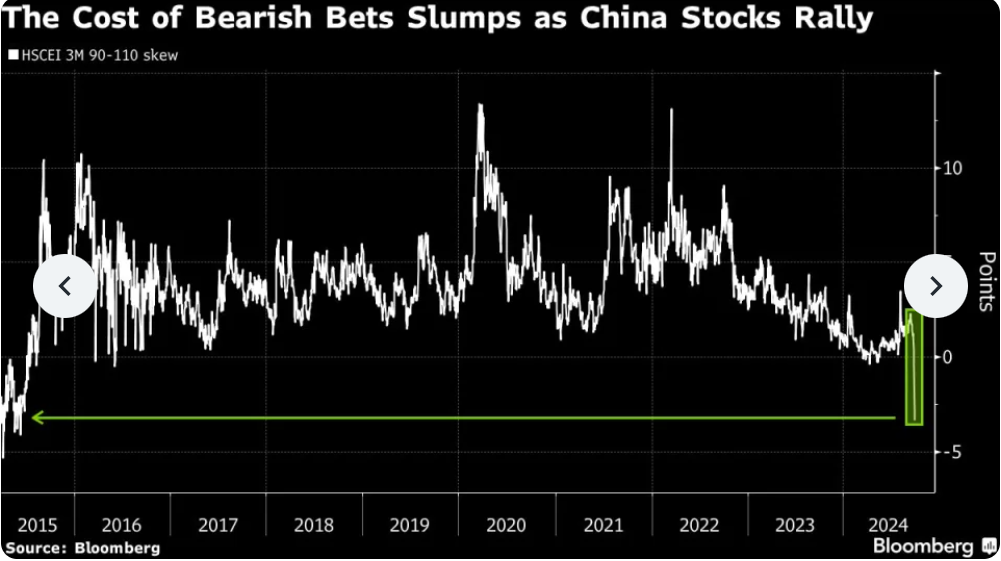

As stocks rallied, protecting against declines in the China Enterprises gauge became the cheapest since 2015, the year the gauge reached a multiyear high. Meanwhile, the number of bullish contracts hit its highest level since June relative to bearish ones.

In the US, investors, including billionaire David Tepper, have been buying Chinese securities. Trading of options on exchange-traded funds tracking Chinese stocks surged, with bullish bets dominating. Some early call buyers took profits later in the week, while others rolled their positions through call spreads. Trading of short-term contracts on American depositary receipts of Chinese companies was also bullish.

However, it’s worth noting that if the rally loses steam, the sudden spike in volatility could reverse. In such a scenario, investors looking to hedge via buying puts should be cautious of a situation where prices retreat but implied volatility levels also drop, severely limiting gains on long puts even if the underlying stock drops. Instead, buying put spreads, protective collars, or overwriting to reduce exposure might be more prudent.

Even though longer-term concerns about the mainland’s economy persist, optimism currently reigns supreme. We anticipate a significant short-term rally in Hong Kong and Chinese stock markets due to investors’ cautious positioning, which creates the potential for a sharp bounce led by short-covering.

All in all, the China stock euphoria is in full swing, and it’s clear that optimism has taken the helm as hedging fades away. $KraneShares CSI China Internet ETF (KWEB.US)$ $iShares China Large-Cap ETF (FXI.US)$ $HSI (LIST91331.HK)$ $NIO Inc (NIO.US)$ $Li Auto (LI.US)$

As stocks rallied, protecting against declines in the China Enterprises gauge became the cheapest since 2015, the year the gauge reached a multiyear high. Meanwhile, the number of bullish contracts hit its highest level since June relative to bearish ones.

In the US, investors, including billionaire David Tepper, have been buying Chinese securities. Trading of options on exchange-traded funds tracking Chinese stocks surged, with bullish bets dominating. Some early call buyers took profits later in the week, while others rolled their positions through call spreads. Trading of short-term contracts on American depositary receipts of Chinese companies was also bullish.

However, it’s worth noting that if the rally loses steam, the sudden spike in volatility could reverse. In such a scenario, investors looking to hedge via buying puts should be cautious of a situation where prices retreat but implied volatility levels also drop, severely limiting gains on long puts even if the underlying stock drops. Instead, buying put spreads, protective collars, or overwriting to reduce exposure might be more prudent.

Even though longer-term concerns about the mainland’s economy persist, optimism currently reigns supreme. We anticipate a significant short-term rally in Hong Kong and Chinese stock markets due to investors’ cautious positioning, which creates the potential for a sharp bounce led by short-covering.

All in all, the China stock euphoria is in full swing, and it’s clear that optimism has taken the helm as hedging fades away. $KraneShares CSI China Internet ETF (KWEB.US)$ $iShares China Large-Cap ETF (FXI.US)$ $HSI (LIST91331.HK)$ $NIO Inc (NIO.US)$ $Li Auto (LI.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment