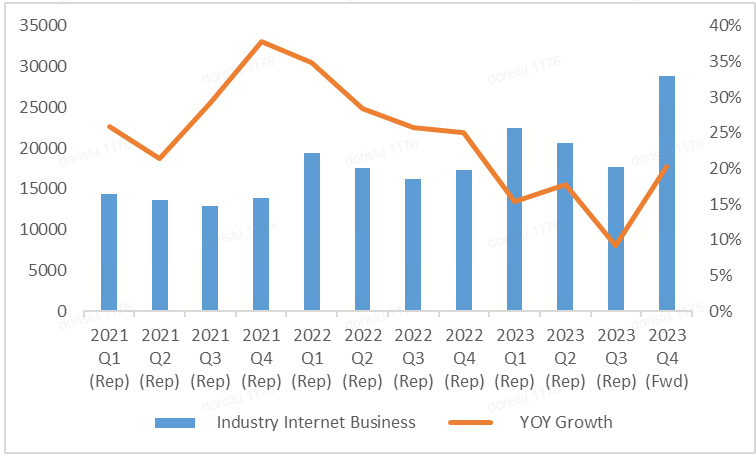

(1) Cloud Services: In 2023, China Unicom focused on transforming into an innovative technology company. Its cloud business has seen rapid development. The company accelerated the construction of industrial internet, promoted ubiquitous interconnection among people, machines, and things, empowered industries with its 'Wu Wu Platform', and participated in industrial internet, digital government, smart city construction, and central enterprise digital transformation. By H1 2023, China Unicom's Big Computing had established a "secure digital intelligent cloud" brand image with self-research capabilities, maintaining over 50% market share in the big data sector; its big data security business revenue grew by 178%.