Chinese central bank triggered a historic rally! Your complete guide to investing in China

On September 24th, the People's Bank of China introduced a series of policy measures that ignited a frenzy among investors. These actions alleviated concerns regarding the stock and housing markets, leading to a "Super Tuesday" for Chinese assets. Trading activity was so intense that it caused glitches and delays in processing orders.

Hong Kong's Hang Seng Index surged 13% last week, marking its best performance since 1998, according to the earliest available data from information service Wind.

Is the rally in Chinese assets here to stay? Can we capitalize on it?

Chinese authorities’ shift this week drove billionaire investor David Tepper to declare that he’s buying more of “everything” related to the country, he said in a CNBC interview Thursday on September 26. “We got a little bit longer, more Chinese stocks,” he said, citing low valuations, even after this week’s price surge, as one of the reasons he’s a buyer.

Several factors suggest Chinese stocks are becoming increasingly attractive:

– Low valuations: As of July 2024, the MSCI China Index had a PE ratio of just 11.6, near historical lows.

– Interest rate cuts: With the Federal Reserve lowering rates, international capital may seek higher returns in emerging markets like China.

– Yuan appreciation: The strong dollar may be ending with rate cuts, and the yuan has been appreciating since July, boosting Chinese assets.

How to invest in China

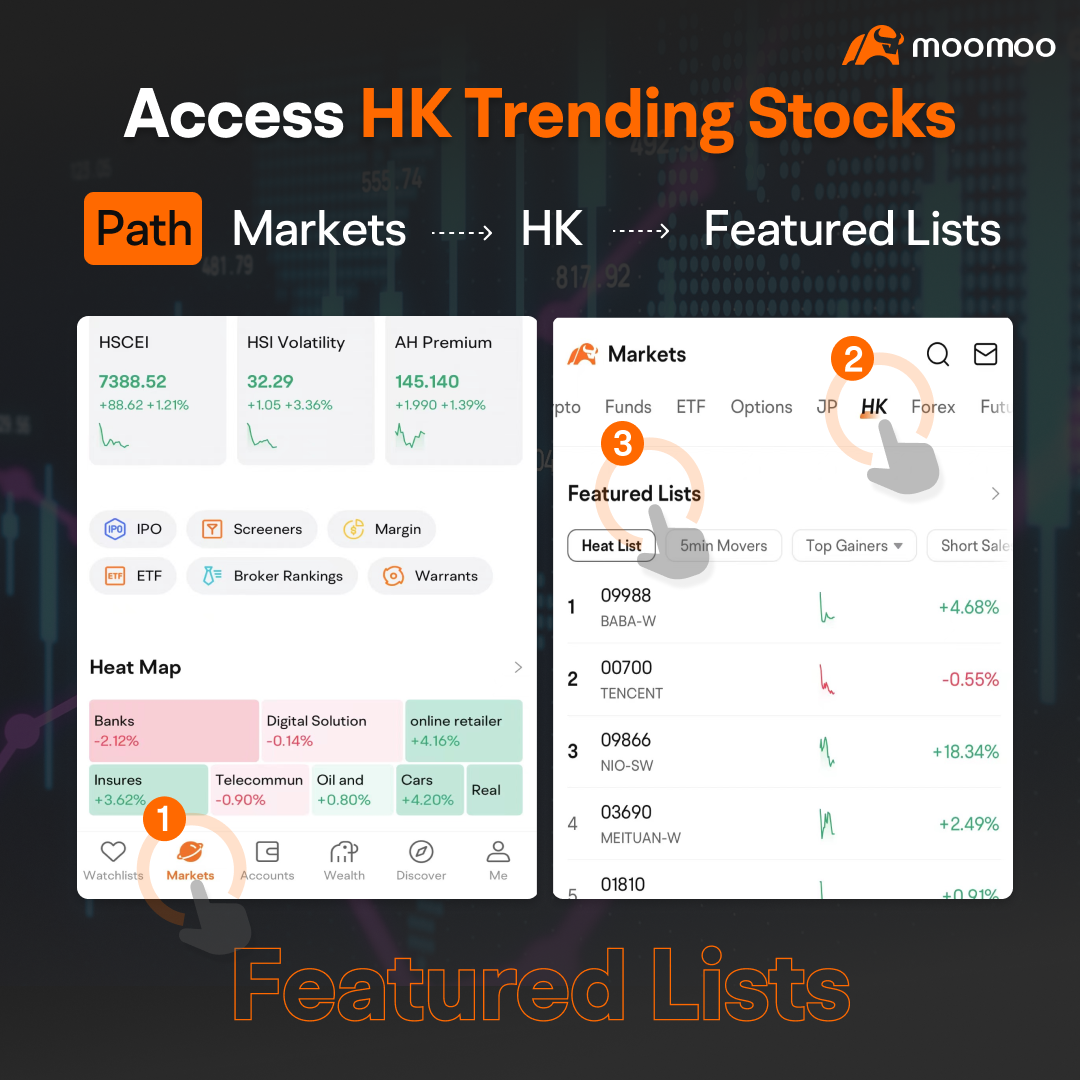

Moomoo Universal Account supports direct investment in Hong Kong markets. This might require a deeper understanding of the markets or investing in related China ETFs, which could be an easier access point for most investors. ETFs can help you gain broader exposure to a market while lowering risks due to their diversification merits.

Before you hit the “Trade” button, let’s get a quick overview of some basics on Chinese assets.

What to know about HK markets

The trading runs from 9:30 AM to 4:00 PM Beijing Time, with a lunch break from 12:00 PM to 1:00 PM. On holidays like Christmas, New Year, and Lunar New Year, trading is half-day.

For Australian investors, this translates to:

– AEST (Australian Eastern Standard Time): 11:30 AM to 6:00 PM, with a lunch break from 2:00 PM to 3:00 PM.

– AEDT (Australian Eastern Daylight Time): 12:30 PM to 7:00 PM, with a lunch break from 3:00 PM to 4:00 PM.

HK stocks follow T+0 trading, allowing you to buy and sell on the same day. There is no limit on price fluctuations, though there are volatility control mechanisms for major stocks.

Key market indices

Here are the main indices in the HK market:

– $Hang Seng Index (800000.HK)$: The most representative index, including 66 large companies reflecting the overall performance of the HK market.

– $Hang Seng China Enterprises Index (800100.HK)$ : Reflects the performance of mainland Chinese companies listed in HK.

– $Hang Seng TECH Index (800700.HK)$: Comprises the 30 largest tech companies, highlighting the tech sector trend in HK.

The top HK stocks ranked by market capitalization as of the September 27, 2024 closing price.

How to invest in China with ETFs

Investing in China stock ETFs can be considered if you're looking to tap into the potential growth of China's broader economy as it recovers or rebounds further.

If you want exposure to China's new economy, including companies like $TENCENT (00700.HK)$ and $Alibaba (BABA.US)$ , the following ETFs could provide you with the access you need.

For more information about those ETFs>>>Buying China at the dip: ETFs to watch

Benefits and Risks

Many China stocks offer growth potential and solid corporate governance, presenting potential opportunities for sustained investor returns. However, China stocks tend to be more volatile compared to those in developed markets.

Investors should also remain mindful of macroeconomic and geopolitical risks.

You might also like:

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

151369719 : Shorters are getting burned. The sleeping giant is awakening. From lazy bear to roaring Dragon.

Trademark-17 : which good stocks is good for today where no short

VicTAN :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

r○bsplace :

Brame Rame :