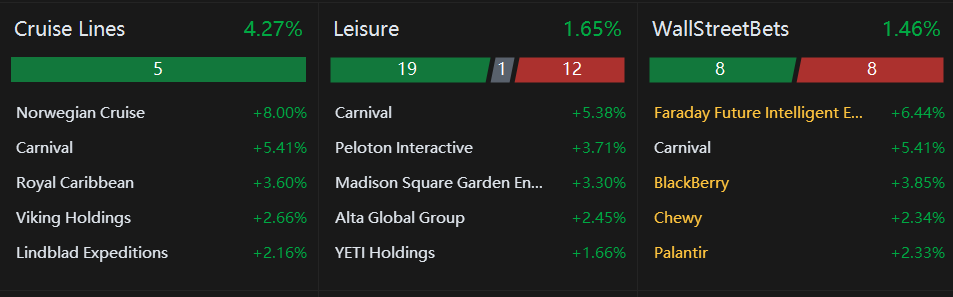

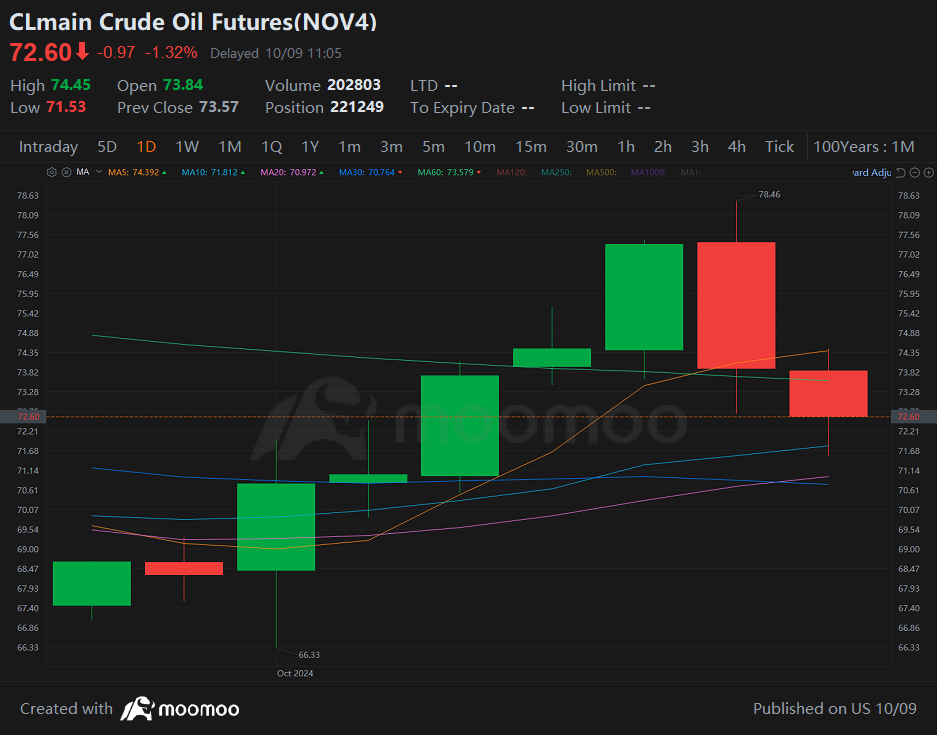

Happy Wednesday, October 9th. The market climbed following a sudden drop in Chinese stocks after no new stimulus was announced Tuesday morning. Four of eleven S&P 500 sectors fell. A second massive hurricane was hurtling toward the American South, due to hit Tampa Bay, Florida, Thursday. Here are Wednesday's mooving stonks.

EZ_money : Chinese stock stanks!!! they are playing head games with the stimulus it's coming

EZ_money : thanks for the update

72486283 : Yes

SPICYDOC辣刀客 : Chinese stocks had a healthy correction. when China had the national day golden week holiday Heng Seng and the Chinese concept stocks in US Market had one more week of growth and had a correction, along with Chinese stocks in US market. the pullback was also because of the good news in US non-farm, that stimulates the climbing of US stocks along with good news with stocks like Nvidia, which attracts funds to sell profits in Hong Kong market and come back to US market. then the next day which is yesterday the A shares was brought down following the Hong Kong and the US market (Chinese stocks) sharp drop. now these factors are gone, these markets with Chinese stocks are going to return to a healthier climbing back to the uptrend, which did not change because of the pullback. the Chinese stocks are still in an uptrend. This time the market will be more sensible, so the growth will be hopefully slower and look more into the fundamentals. however there are many new traders that just signed up for accounts during the national Day Holiday, and could only start trading since yesterday, so it could still be faster going up.

STEVEN CHEE 328 : HI

DreamyLucid : It is not even a proper stimulus. Let’s face it.

102181510 : o.k

Kevin Travers OP SPICYDOC辣刀客 : Do you feel traders returning from holiday contributed to the falling prices?

章允量 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Yani3167 : nice

View more comments...