NVDA

NVIDIA

-- 107.665 TSLA

Tesla

-- 259.245 PLTR

Palantir

-- 84.430 AMZN

Amazon

-- 189.705 GOOG

Alphabet-C

-- 156.020

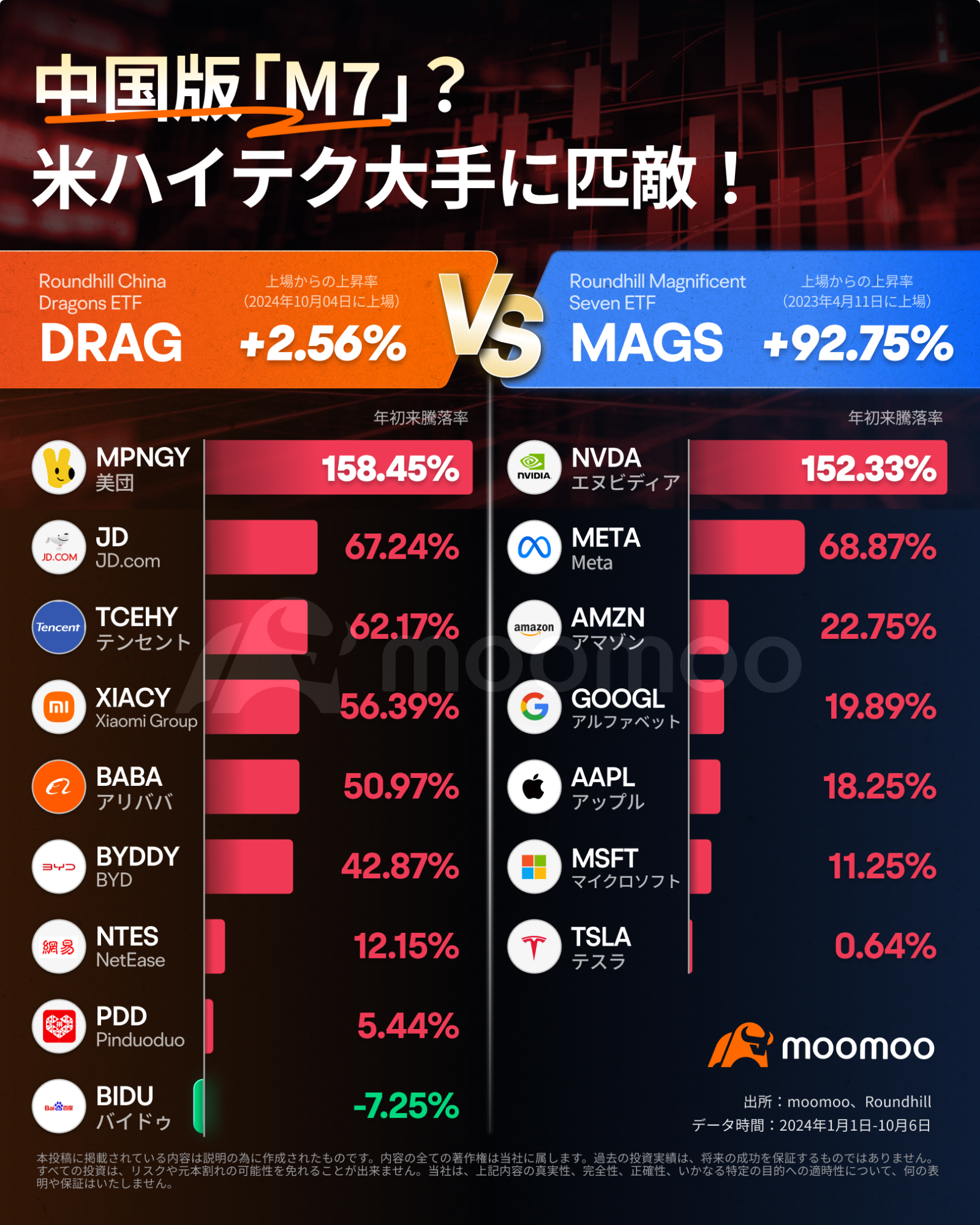

Raised the target stock price of MSCI China from 66 to 84 and the target stock price of CSI300 from 4,000 to 4,600, while "overweight".

Goldman sees the possibility of further increase in the Chinese stock market, estimating about 15-20% upside potential.

Macro issues continue to be challenging, as the scale and details of fiscal policy have not yet been clarified, there is not enough evidence to assert the beginning of a bullish market. However, there are sufficient reasons to believe that the stock market will rise further.

If the economy improves with stimulus measures, there is a possibility that the earnings growth rate will also improve.

Investment trusts are underweight in Chinese assets.

While market sentiment may be overshooting in the short term, it is likely to eventually revert to fundamentals. In this current uptrend, some stocks are becoming overvalued.

Additional easing policies are needed to enhance economic growth and confidence. While the policies announced so far will help smoothen the deleveraging process, there is still a need to continue repairing balance sheets.

恋コイ : The last foot scrape?! Did the Chinese Communist Party come out on bad terms? I'm looking forward to tomorrow's trends. Japan is also affected, so it's no laughing matter, but it could also be the entrance to the Great Depression. Taking into account what if, we secured most of our holdings today. Well, the Nikkei will drop tomorrow. I'll wait and see.

バケツ3杯 : Additional easing measures... and so on...![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) ?

?

I wonder if there are any.