Cisco (CSCO) Hyperscaler Sales and Revenue Contribution To Watch

Another DJIA component $Cisco (CSCO.US)$ will be releasing their fiscal first-quarter results after market close on Wednesday (13 Nov).

Investors would be focusing on Cisco's ability to gain traction with the hyperscalers, specifically in artificial intelligence (AI), using routing and switching products, silicon and optical components. But for the near term, while Cisco would be seeing "solid AI momentum", the contribution to its revenue might not be seen in this reporting quarter.

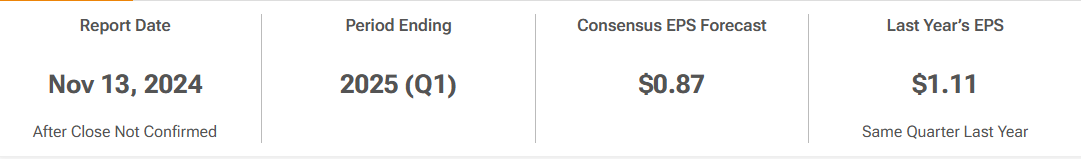

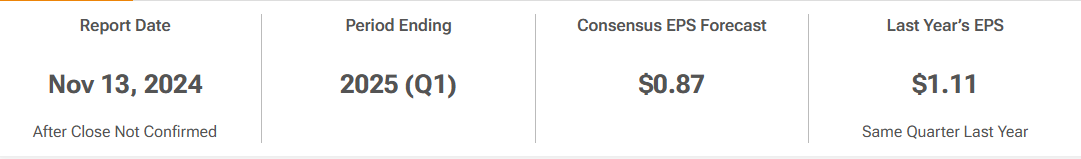

As for Cisco's fiscal first quarter, market expect the company to report earnings of 87 cents per share (-21.6% YoY) on revenue of $13.8 billion (-6.1% YoY).

Cisco (CSCO) Hyperscaler Sales With Major Cloud Provider Revenue Contributor

Enterprise software sales through hyperscaler cloud marketplaces – led by AWS, Microsoft and Google Cloud – are projected to reach US$85 billion by 2028, rising from US$16 billion in 2023. The availability of cloud credits for third-party purchases through the hyperscalers’ marketplaces and the emergence of new digital-first buyers are reshaping enterprise customer procurement behavior, vendor sales strategies and channel models.

While most vendor sales via these marketplaces are today “direct” to end customers, channel partners are playing an increasingly important role. By 2027, Canalys expects more than 50% of marketplace sales to flow through the channel.

Enterprise customers have committed to spend over US$360 billion on the top three hyperscalers’ cloud services on a multi-year basis. Spend is shifting to the hyperscalers’ marketplaces as customers seek to burn down a portion of their cloud credits on third-party software and SaaS.

As we are seeing enterprises facing IT budget pressure, the opportunity to use pre-approved cloud budgets to source a wide array of software and cybersecurity products while taking advantage of simplified billing and consolidated purchasing can be highly compelling.

As we are already seeing $CrowdStrike (CRWD.US)$ and $Snowflake (SNOW.US)$ were among the first to publicly claim US$1 billion of total cumulative sales through marketplaces.

There have been a host of the largest software and cybersecurity vendors actively embracing this route to market. Cisco have launched or grown their sales on the hyperscalers’ marketplaces so far in 2024.

While there are also many smaller “digital native” ISVs built on one of the three top hyperscalers’ cloud platforms (AWS, Google, Microsoft) are using their respective marketplaces as their primary routes to market.

I think as investors we should be looking out for how much revenue contribution does this sales channel have towards its fiscal first quarter earnings result?

For now, I do not think Cisco would be able to do US$1 billion total cumulative sales like CrowdStrike and Snowflake.

Cisco (CSCO) Price Target Forecast

Based on 15 Wall Street analysts offering 12 month price targets for Cisco Systems in the last 3 months. The average price target is $58.64 with a high forecast of $78.00 and a low forecast of $49.00. The average price target represents a -0.12% change from the last price of $58.71.

I would think that we might see much price movement post earnings for Cisco, as there are some challenges for Cisco to grow their sales amidst the AI adoption.

Enterprises are cutting down on CAPEX hardware spending and seek to look for OPEX spending, this might affect their earnings from their traditional business segment.

Cisco (CSCO) Earnings EPS History

Cisco have been showing promising EPS beat for all the quarters from Aug 2022, so there is a high chance that Cisco might equal or beat the EPS forecast by slightly better, as there is challenges coming from Enterprise IT spending reduced.

But I would think we need to watch Cisco overall revenue intake.

Technical Analysis - MACD and Multi-timeframe (MTF)

In terms of technical, we are seeing CSCO trading above the short-term and long-term MA since mid-September, and there is a good upside after bullish MACD crossover formed last week.

MTF is also giving a strong uptrend for Cisco, so for the stock price to move higher, there is a high possibility, but if the expectation of higher revenue is not met, investors might go into profit taking.

Summary

I personally think that we need to wait until at least second quarter of 2025 to see Cisco taking the significant gains from hyperscaler sales channel, this might be a good material boost to revenue by then.

So Cisco to me is more for long term investing. I would still be monitoring how the price action goes today (13 Nov) before its earnings.

Appreciate if you could share your thoughts in the comment section whether you think Cisco would be able to beat its EPS estimate with better revenue.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment