Financial Performance:

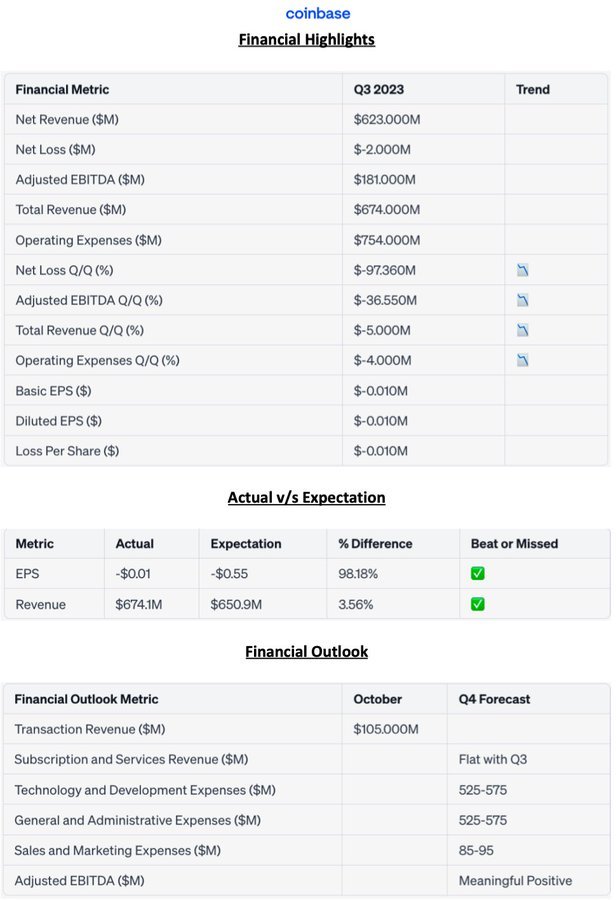

✅ Revenue: $674 million, a slight decrease of 5% quarter over quarter, demonstrating resilience amidst market lows.

✅ Net Loss: Narrowed significantly to $2 million, showcasing strong cost management and operational efficiency.

✅ Adjusted EBITDA: Achieved $181 million, maintaining profitability for the third consecutive quarter.

Business Segments:

✅ Subscription and Services Revenue: Held steady at $334 million, reflecting robust and consistent service offerings.

✅ Transaction Revenue: Reached $289 million, down by 12% Q/Q, yet reflective of strategic fee realignment and customer trading patterns.

Balance Sheet and Capital Management:

✅ USD Resources: Maintained a robust balance sheet with over $5.5 billion in USD resources, slightly up by $20 million Q/Q.

✅ Debt Management: Repurchased $263 million of 2031 Senior Notes at a 33% discount, evidencing shrewd capital management.

Outlook and Forward-Looking Statements:

✅ Q4 Expectations: Anticipating flat subscription and services revenue compared to Q3, with a strategic focus on cost efficiency.

✅ Adjusted EBITDA: Projecting meaningful positive Adjusted EBITDA for the full year of 2023, a testament to long-term sustainable growth.

CEO Statement

"We are navigating through market lows with a robust balance sheet and a clear vision. Our Q3 performance, with $674 million in revenue and steadfast service revenue, underscores our commitment to building a durable, compliant, and customer-centric platform. With over $5.5 billion in USD resources, we are well-capitalized to innovate and lead in the onchain revolution. The crypto economy is burgeoning, and Coinbase is strategically positioned to champion this growth trajectory." - CEO, Coinbase Global, Inc.