Collapse of the petrodollar and why it's okay to "dislike" CEOs addicted to abusive inflation of the petrodollar

First and foremost: you are allowed to dislike any companies you want to dislike. As a college graduate with not one, but two business degrees from 20 and 21 years ago respectively, a woman, a seasoned tech veteran who lived and worked in Silicon Valley for more than 7 years ( SHDH & HackerDojo co-founders from 140B remember me ) and a Native American indigenous to the very continent on which I am trying to survive, I have very specific and educated reasons for disliking the companies I dislike. Being able to exercise my freedom of press and share the songs of my logic as far and wide as there are open minds to learning is one of the best things about the Internet.

Unfortunately, CEOs addicted the petrodollar don't like the clear, unobstructed communication channels available on Internet, and they really don't like women who have "equal" or "greater" logic, business intelligence, or success than they have. The biggest fear of the CEOs addicted to the petrodollar is getting outsmarted by a woman. CEO with unhealthy addiction to the petrodollar whose ego is in danger of getting a booboo will often go out of his way (99.5 percent of the time the petrodollar addict is a "he") to censor or sabotage a successful woman -- and he historically exhibits especially vindictive character in attempting to destroy any equity she has earned.

But remember -- he was never able to win on his own; she is older and smarter and better at business than him. So he had to invent a fantasy where he is always winning. Thus we can understand why and how it came to be that he chose the petrodollar as his BFF for his fantasy.

Is no wonder this terrible thing known as the "petrodollar" is finally collapsing!

As you read on, make note that neither jipji'ju'gisutnat (pictured below) nor the author are ashamed of our logic in publicizing this SWOOP.

Here is Part One, this is Part Two

A "Real-Time" example for the collapse of the petrodollar

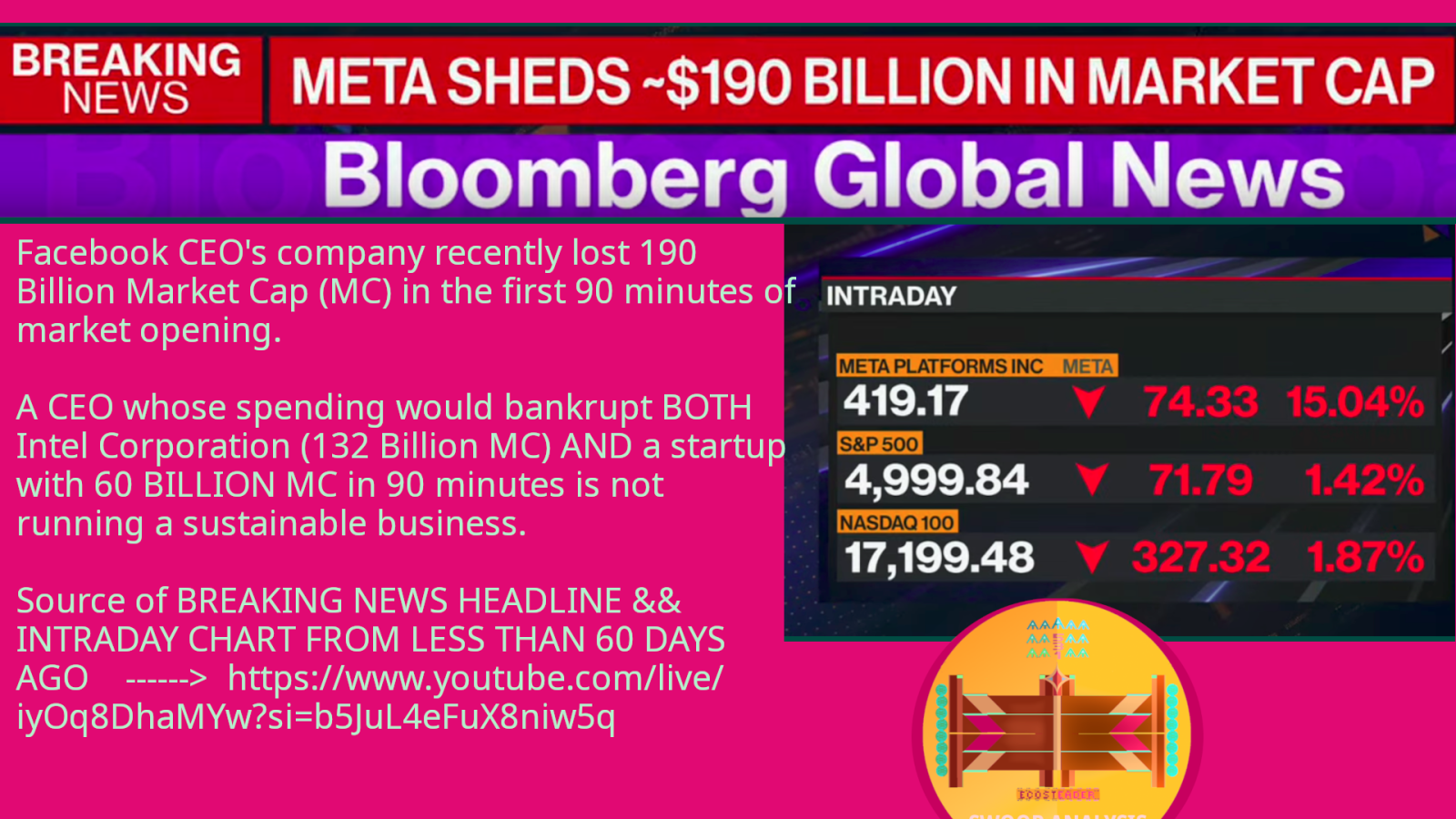

We dislike the young and arrogant CEO of Facebook's Platforms Inc. AND we dislike the CEOs and CFOs naïvely partnering with him. What was happening less than 60 days ago? Do you think he fears loss of the petrodollar?I

I've written elsewhere on the Internet about this concept of "Market Cap" and how the college dropout CEO of Facebook Platforms, Inc. does not quite understand the role of finance in business. With such unsustainable valuations, he is certainly one among the sick ones who must prepare to lose those delusional stock valuations.

For the rest of this column and future columns in this series, we'll need to be able to communicate like sane and professional accountancy professionals in the presence of ethical and licensed CPAs. We aren't going to run any background checks on the audience members; though let us be hopeful that there are at least a handful of CMAs/CPAs/CFAs/FASBs with enough ethical fortitude to assert that it is ACCEPTABLE to "Refuse to Engage" in what we'll call "fraudulently unsustainable valuations". This brings us to the second concept of our SWOOP:

Outside stakeholders -- for example, the humans accounting for geology before Columbus brought RCT, the native animal and plant species on a different tectonic plate than the one the CEO or CFO lives on "more than half time" are all acceptable examples of "outside stakeholders" that will be affected by "business plans" of CEOs addicted to the petrodollar.

Is "required" that business plan maker acknowledges that entities other than themself have rights and sovereignty to refuse any partnerships or proposals offered -- in other words, people on tectonic plates near or far from your own have the rights to make their own decisions.

The advice to "dial back your expectations" is almost always good advice. Something tells me that if you have followed my work thus far, this should be easy; we're already on the same page when it comes to the understanding that those megacap-heavy portfolios cannot be sustainable. And there is absolutely no logic the CEOs or unethical CFOs can invent or buy that makes incorrect rationalizations "correct".

*Disclaimer: moomooers reading this column because they want to learn how to literally "fly like a bird" should please not take the phrase literally. The most tired /r/WSB tropes like "to the moon" need expired. Although this column is authored by a professional, best recommend is do not make any rash decisions without educating yourself from many teachers and using your own brain. Pep talk #2 for ladies: the CEOs of those megacaps are not more valuable than you!

More about author: About 24 years ago, she wandered into the CS lab at her University and noticed some people working on what she learned are called "spreadsheets". These were the coolest things on computers (in her opinion) at the time; they were much more interesting than the rock music videos and Hollywood models her college boyfriend at the time was obsessed with on the Internet.

Word count: 852

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment