Communication Services Sector to Watch as Rate Cuts Draw Near

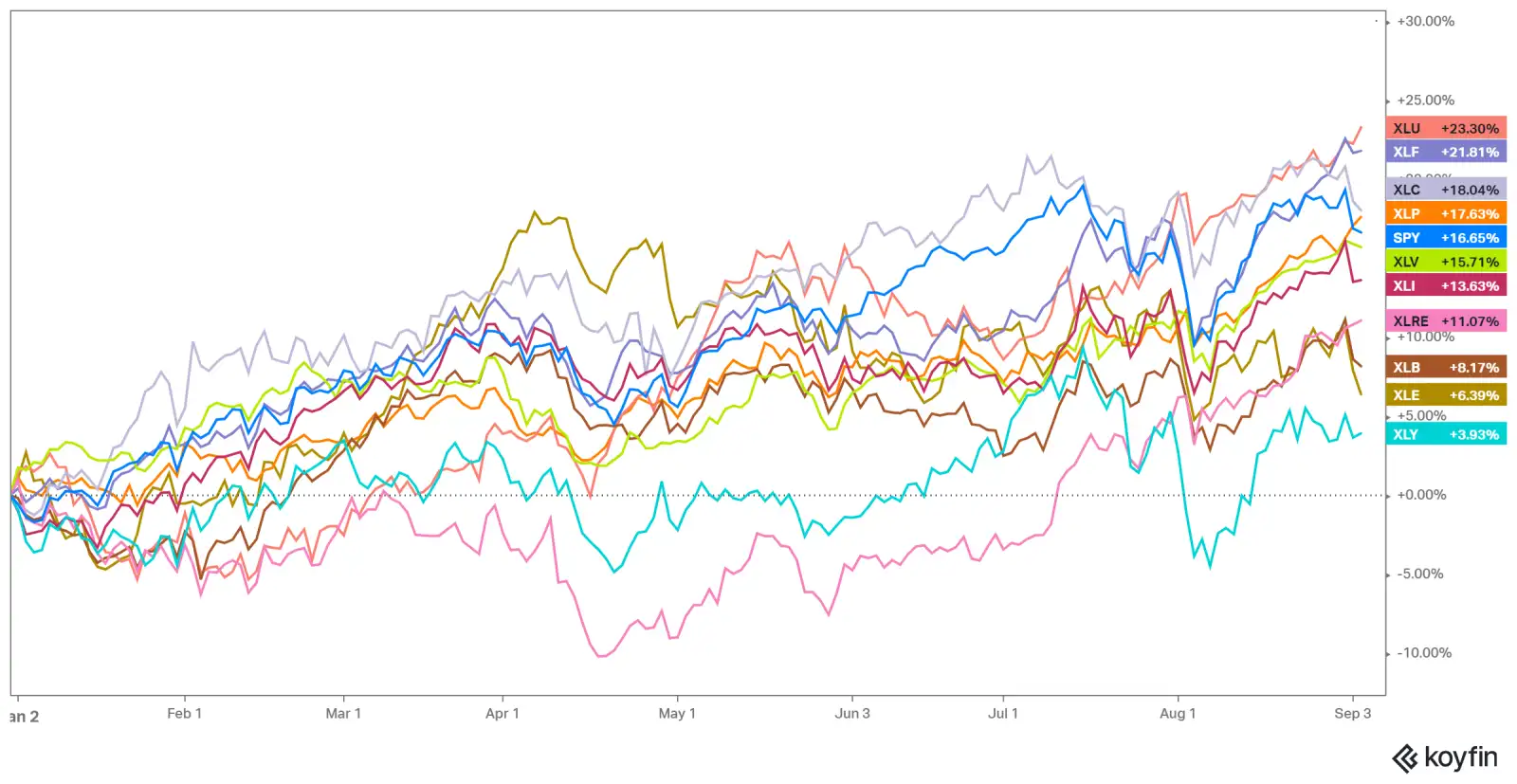

The communication services sector was among the best performers in 2023 and has maintained its growth into 2024. By September 2024, it had surged 28% over the past year, outperforming the broader tech industry. It has risen by 18% yearly, trailing only the utilities and financial sectors.

Thanks to the strong performance of the communications services sector this year, the US stock market faced the potential "September Curse" on Tuesday, but telecom giants $Verizon (VZ.US)$ and $AT&T (T.US)$ defied the trend by hitting new highs.

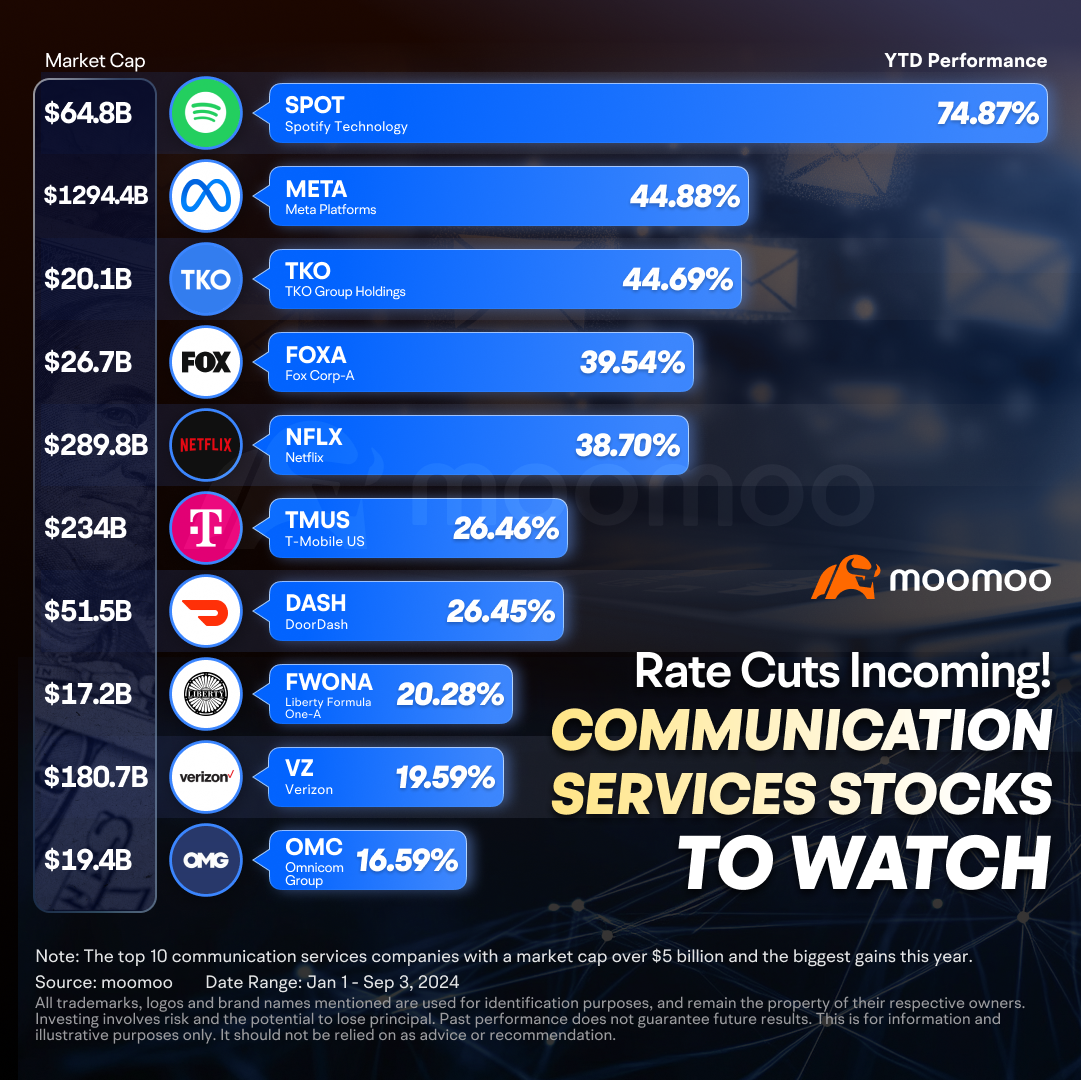

In addition, the communication services sector has seen strong growth this year. Streaming music leader $Spotify Technology (SPOT.US)$ has risen nearly 75% and hit a record high. Advertising giant $Meta Platforms (META.US)$ and new entertainment company $TKO Group Holdings (TKO.US)$ are up around 45%. Media giant $Fox Corp-A (FOXA.US)$ and streaming leader $Netflix (NFLX.US)$ have both increased by about 40%.

In 2018, the Communication Services sector emerged from merging FANG stocks and the telecom sector. This sector is dominated by high-growth, cyclical telecom and media companies.

It's interesting to note that about 40% of the industry now includes growth companies, such as Meta and Alphabet, boosting its appeal in a low-interest-rate environment, as returns on safe investments decrease. Investors may invest more in growth stocks, which tend to perform well during economic expansions, benefiting the sector overall.

From some points of view, these companies' stock prices are still discounted. Meta's price-to-earnings ratio is around 26, and Google's is under 23, both below the S&P 500's ratio of 28. As the AI battle intensifies, many companies have announced plans to increase capital expenditures on AI development. In this context, an interest rate cut would be even more beneficial for overall company profit margins, as it would reduce borrowing costs and support further investment in cutting-edge AI technologies. Lower rates could also stimulate demand, providing an additional boost to revenues and enhancing the long-term profitability of AI-driven projects.

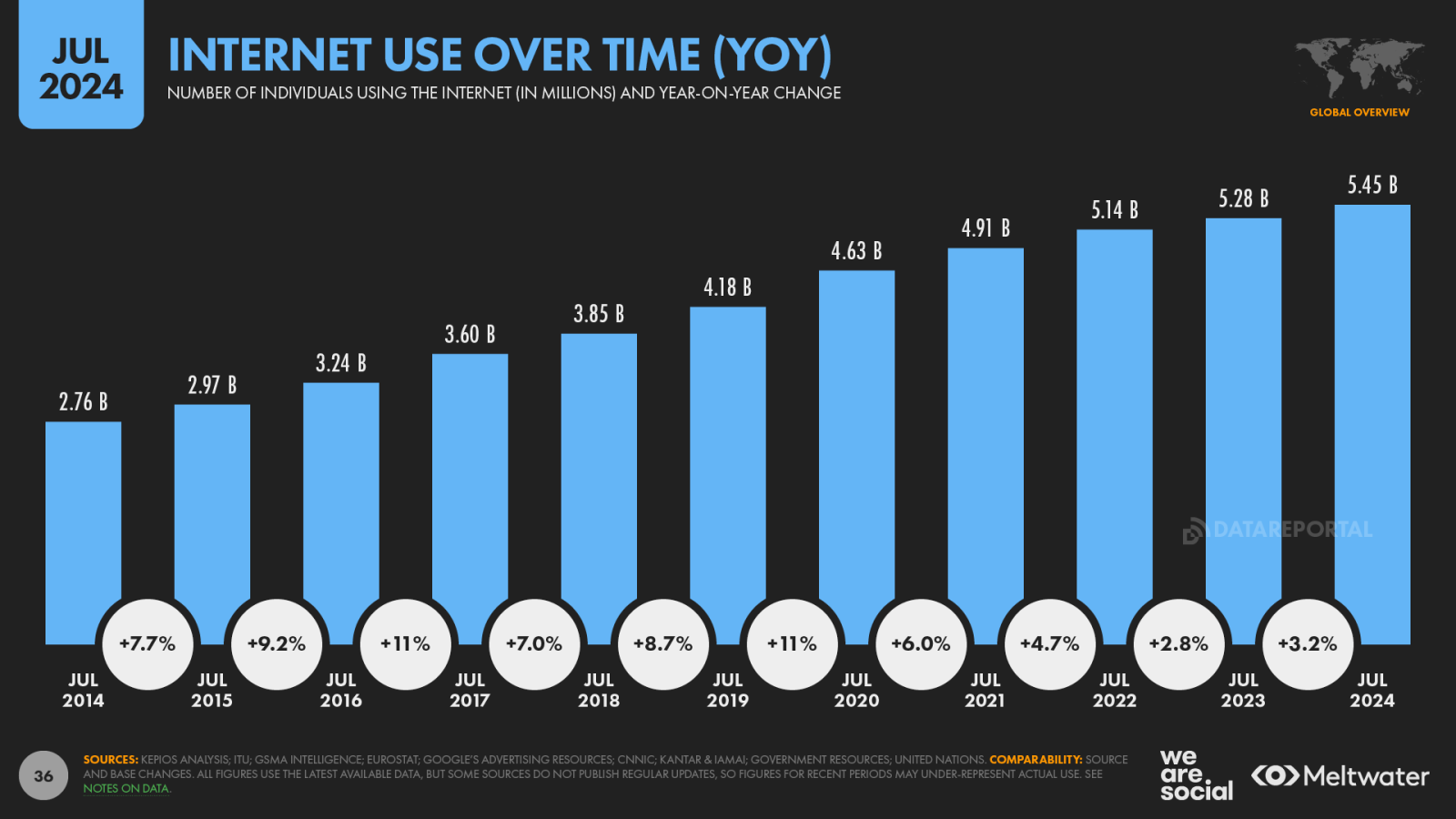

In addition, over the last ten years, the number of internet users around the world has almost doubled from 2.76 billion to 5.45 billion in July. Companies like Meta and Alphabet, which operate all over the world, are likely to benifit more this growth. In comparison, the telecom industry mainly focuses on the U.S., so tech companies have more potential to grow.

For the telecom industry, as a cyclical and highly-leveraged industry, its companies are sensitive to economic changes, whether they are growing or slowing down. When the economy is growing fast, more demand for telecom services could help these companies earn more money.

However, higher interest rates makes it harder for companies to expand their services and meet customer demand through loans. Also, higher interest rates mean it's more expensive for customers to borrow money for things like phones and internet services, which might make them buy less.

Now, investors think the Federal Reserve might start easing its policies sooner than expected, with more rate cuts likely this year beyond the one planned for September. This could help the market, especially if inflation also slows down.

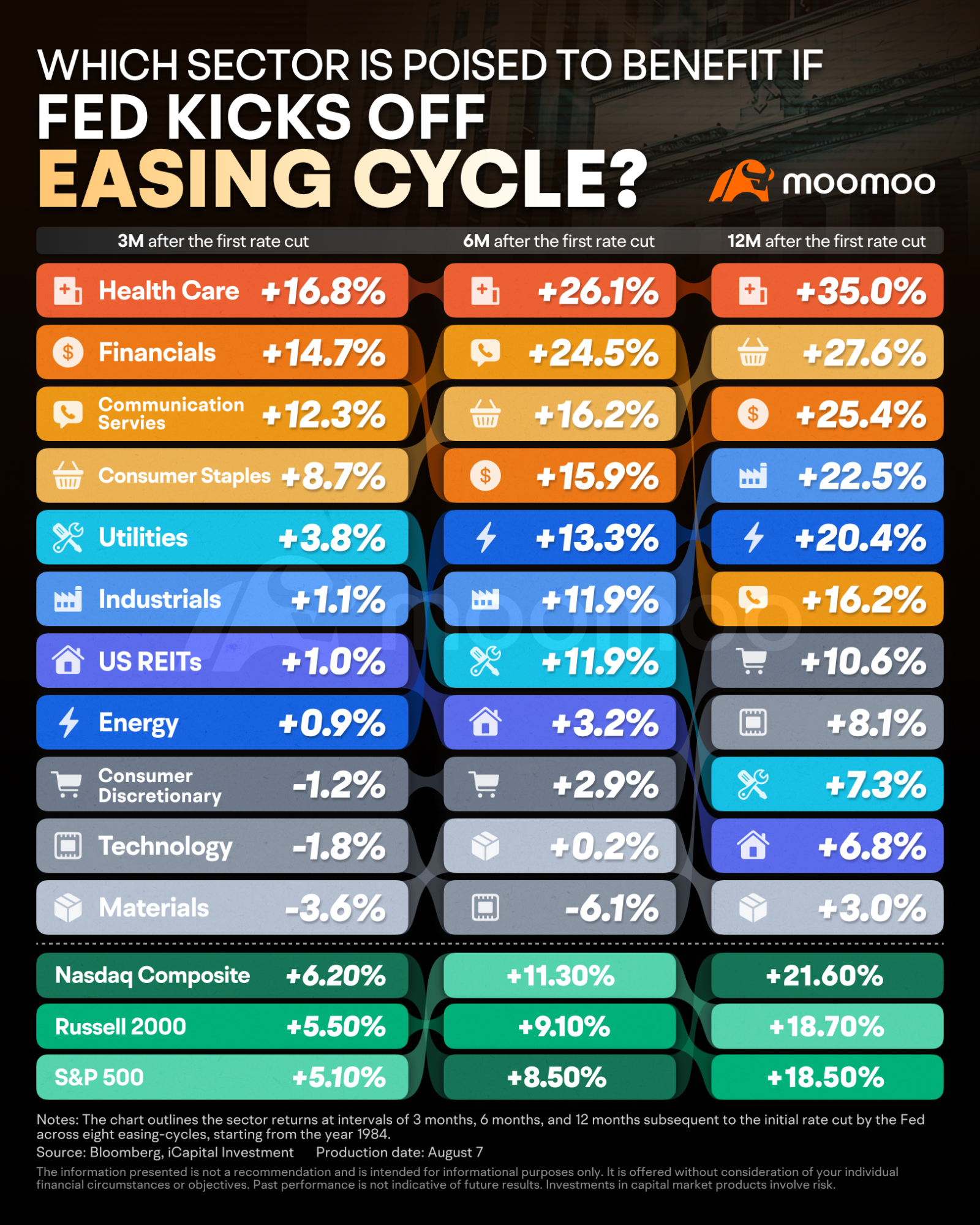

With the likelihood of a loosening cycle increasing, investors are gearing up for market changes. iCapital reviewed the performance of stock indices and sectors three, six, and twelve months after the first rate cut in eight different Fed easing cycles since 1984.

Historically, stocks tend to rise immediately after the first rate cut, may level off or move sideways for one to three months, and then typically resume an upward trend—provided there is no economic recession. In scenarios without a recession, stocks usually perform very well in the six to twelve months following the rate cut.

Among them, The communications services sector has performed very well. After the first rate cut increased by 24.5% over six months and 16.2% over twelve months, it became one of the top performers, just behind the healthcare and financial sectors.

Source: Koyfin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103721817 : thanks

104026079 : I requested this long back, but just now posted :(

webguybob : Time to switch from tech to telecom?