Short-sellers sustained around $120 billion in mark-to-market losses in 2023, of which $72 billion occurred in the first half of June, according to a Wall Street Journal report on June 20, citing data from financial data firm S3 Partners.

Bottom-line

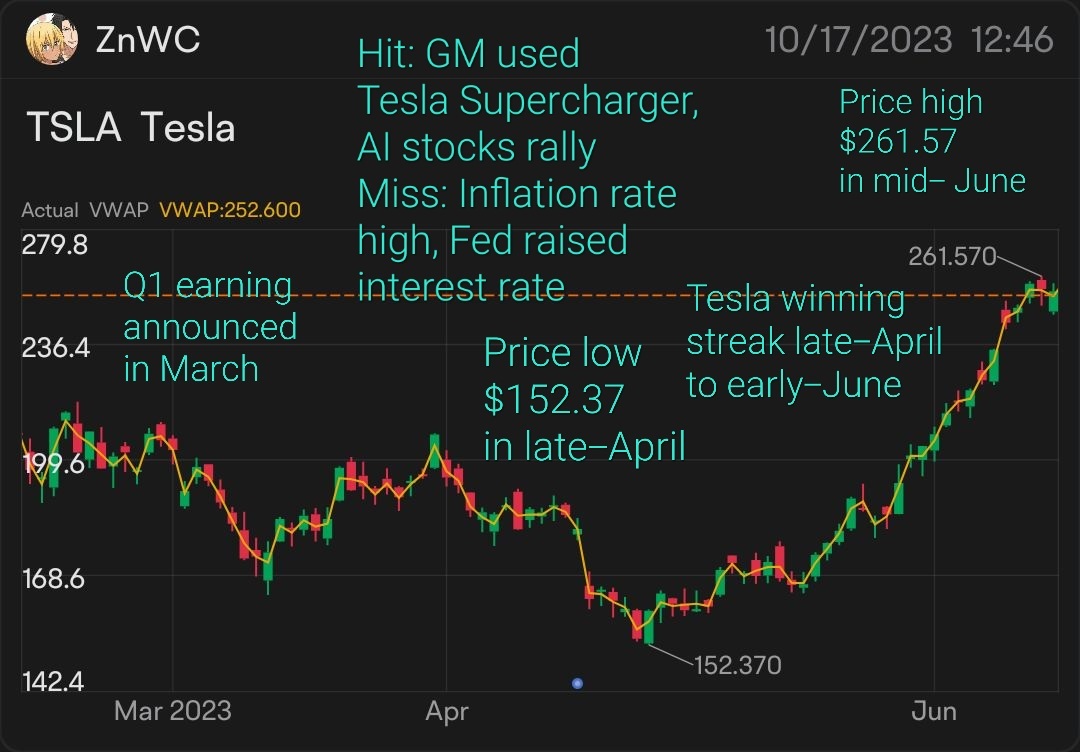

For the coming Q3 2023 earnings, some traders are predicting using chart and indicator that Tesla stock price is bearish and market analysts may further downgrade rating and target price after announcement.