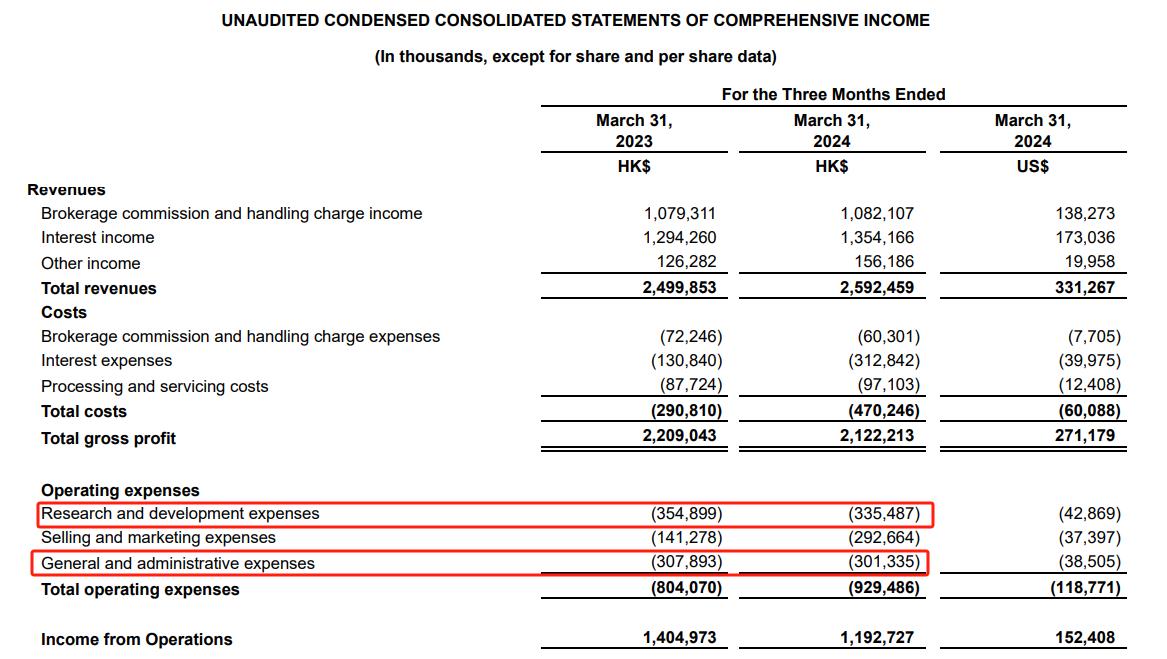

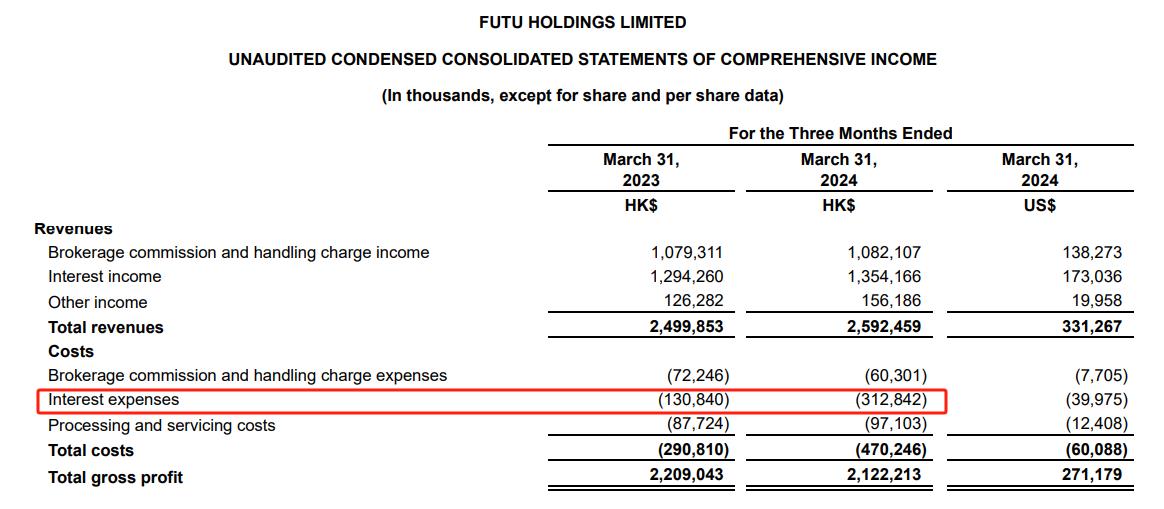

In the entire Hong Kong and US stock markets, the trading volume of the Nasdaq Composite Index and the S&P 500 Index in 2024Q1 is basically the same as that in 2023Q1. At the same time, the trading volume of the Hong Kong stock market has declined by nearly 15%~20%, and the trading volume of the entire Hong Kong stock market has declined by about 12%, but moomoo can guarantee the positive growth of operating income. In 2024Q1, moomoo's total revenue was HK$2.593 billion (about US$331 million), which was basically the same as the same period last year, and there was no significant decline in synchronization with the market. This shows that the quality of moomoo's customers is relatively high. In the context of a year-on-year decline in market trading volume, it can withstand the decline in brokerage income, especially brokerage commissions and handling fees. The income is HK$1.0821 billion (an increase of 0.3% from 2023Q1), which is still good.